The Democratization of High-Tech Investment: A Paradigm Shift Driven by Technology and Generational Change

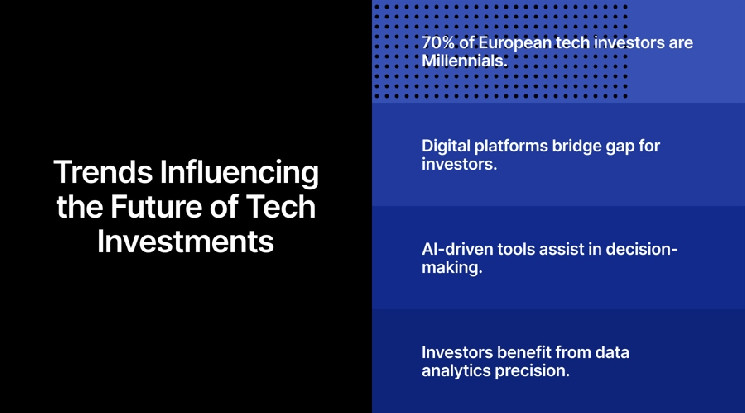

The landscape of high-tech investment is undergoing a profound transformation, moving away from its traditionally exclusive realm of institutional investors and venture capitalists towards a more democratic and accessible model. This shift is fueled by two powerful forces: the rise of digital investment platforms and the emergence of a new generation of tech-savvy investors. Research indicates a significant portion of accredited tech investors in Europe now belong to Generation X and Millennials, demonstrating a strong inclination towards online co-investment platforms. This represents a pivotal moment, opening up access to late-stage private investments that were previously beyond the reach of most individual investors. These platforms are effectively bridging the gap, offering a gateway to high-potential opportunities that were once the exclusive domain of large funds and well-connected individuals.

Navigating the New Landscape: Challenges and Opportunities in Digital High-Tech Investment

While digital platforms offer unprecedented access, they also introduce new challenges regarding due diligence and transparency. Building trust and ensuring investor confidence are paramount. Investors must develop the skills to evaluate opportunities effectively in this evolving landscape. High-tech investments, particularly in rapidly innovating sectors like artificial intelligence (AI), health technology, and climate technology, are characterized by complex risk profiles and require a nuanced understanding of market dynamics. The rapid pace of innovation necessitates continuous learning and adaptation. Platforms are rising to meet these challenges by implementing sophisticated vetting processes, leveraging AI-driven tools, and providing investors with the resources needed to make informed decisions. This includes access to detailed metrics, market analysis, and expert insights, empowering investors to navigate the complexities of the high-tech investment world.

The Allure of Late-Stage Investments: Capturing Value in Mature Growth Companies

A significant trend contributing to the appeal of high-tech investing is the increasing tendency of private companies to delay their entry into the public market. This allows them to retain more control and capture a larger share of the value created during their late-stage growth phases. Investors who gain access to these later rounds are positioned to benefit from potentially outsized returns, an advantage previously enjoyed primarily by large institutional investors. Late-stage investments often involve companies with established product-market fit, robust revenue streams, and experienced leadership teams. These characteristics offer a compelling combination of growth potential and relative risk mitigation, making them attractive to investors seeking a balance between return and stability.

Efficiency and Precision: The Transformative Power of Digital Platforms and AI

The integration of digital platforms has revolutionized the efficiency of the investment process. Investors can now access comprehensive information, evaluate investment terms, and execute transactions seamlessly from their digital devices. This streamlined approach contrasts sharply with the traditionally time-intensive processes of private equity and venture capital, opening the door to a broader range of sophisticated investors. Furthermore, the use of AI and data analytics is enabling platforms to identify market trends, assess risks, and provide personalized investment recommendations with exceptional precision. These advancements empower investors to make more informed decisions and strategically position themselves within the dynamic high-tech investment landscape.

The Future of High-Tech Investment: Fostering Inclusive Growth and Innovation

The evolution of high-tech investment is not merely a shift in access; it represents a fundamental redefinition of who can participate and how value is created. As the industry progresses towards greater inclusivity and efficiency, digital platforms will play a pivotal role in shaping the future of private investments. By aligning with trusted lead investors, embracing technological advancements, and fostering transparent ecosystems, the next generation of high-tech investment platforms has the potential to drive significant growth, not only for individual portfolios but also for the broader innovation economy. This democratization of investment empowers a wider range of individuals to contribute to and benefit from the growth of cutting-edge technologies.

Building a Sustainable Ecosystem: Collaboration and Innovation for Long-Term Success

The future of high-tech investment hinges on the development of a robust and sustainable ecosystem. This requires collaboration between platforms, investors, and the companies seeking funding. Transparency, trust, and a commitment to ethical practices are essential for building confidence and fostering long-term growth. The integration of AI and data analytics will continue to play a crucial role in refining investment strategies, identifying promising opportunities, and managing risks effectively. As the ecosystem matures, we can expect to see even greater accessibility, efficiency, and transparency, further empowering individual investors to participate in the exciting world of high-tech innovation. This collaborative approach will not only benefit individual investors but will also fuel the development of groundbreaking technologies that address global challenges and shape the future.