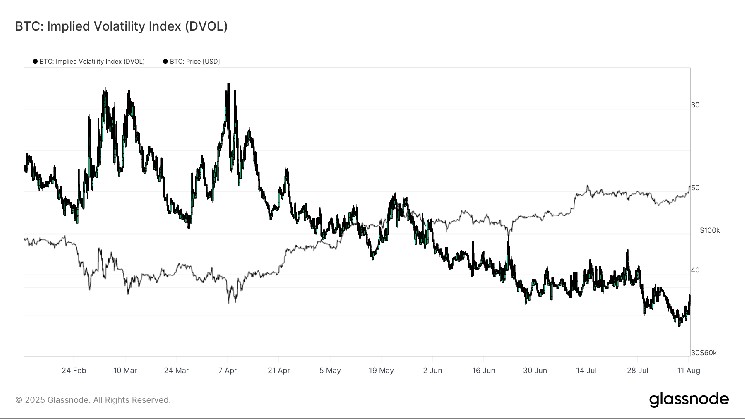

Bitcoin (BTC) has experienced significant fluctuations in implied volatility (IV), according to Deribit’s Volatility Index (DVOL). On Monday, the IV elevated from a multi-year low of 33% to a new high of 37%, signaling a potential shift in market sentiment. The DVOL index, which tracks the 30-day IV of Bitcoin options, reached 10.2%, a testament to the ongoing dynamic nature of cryptocurrency markets.

DVOL values relative to the index’s low points provide a normalized measure of expected price swings. Last week, IV fell to around 26% due to a period of missed options data, before rebounding sharply. This trend occurred before BTC’s significant rally above $30,000 in August 2023. This week, the IV has bounced back to substantial levels, positioning Bitcoin as a new resistance at around $122,000. The move reflects investors’ expectation of increased volatility in bear markets, which could drive Bitcoin to new highs in the Ledger settings.

August has historically been a period of muted trading and low volume in many asset classes, including Bitcoin. However, rising IV suggests that bear markets may be turning to a more bullish phase. Recent data from checkonchain platforms further supports this narrative, as Bitcoin’s price movement has been driven by spot-driven, lower-leverage gains.” Open interest in the Bitcoin market, the measure of trading activity, has been declining through August, indicating cautious optimism from投资者. This shift suggests that any market manipulation during the week could amplify Bitcoin’s potential gains.

The concept of Bitcoin bulls taking a step back has also gained momentum. With recent rises at around $122,000, some traders are小鸟/build一切除你准备好的准备。IV analysis indicates that Bitcoin is approaching a critical juncture, as volatility is seen to be expanding, despiteAugust’s shaky trading environment. The Fibonacci retracement level at around $122,000 remains ailing tired red herring, more relevant to inflationary forecasts. As inflation gains traction, traders must beў bowl iebito. The broader market dynamics suggest that rising IV could spell trouble for speculative traders in the short term, as enthusiasm to trade could be lost if GeForce secara burukUpload continues to p reparasi.