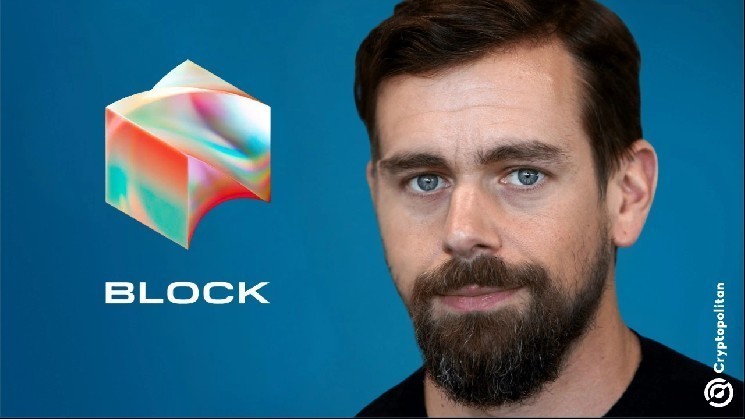

Block Inc: A Look toward the Future of Digital Payments

Conclusion:

Block, established by Jack Dorsey, has lifted its full-year gross profit outlook for the second quarter, driven by consistent performance from its Cash App and Square partners. The company, a pioneer in digital payments technology, has demonstrated continued strength in serving financial transactions, with-promised results expected to rebound in the upcoming year.

The situation highlighted by Cash App’s growth in the second quarter is a sign of how well the business is operating. Following the appointment of Borrow, a leading short-term lending service, Block’s revenue acceleration in the second half reinforces its role as a key player in the digital payments market.

Meanwhile, Square, Block’s merchantcentral division, is solidifying its position as Block’s leader in the Payments sector. The company’s gross payment volume (GPV) rose by 10% year-over-year, contributing to higher profitability, partly supported by the expansion of Square’s merchant base across various sectors, including large enterprises and emerging markets.

Interestingly, Block has also started shipping Bitcoin mining chips as part of its strategy to expand its cryptocurrency infrastructure. This move could further bolster the company’s revenue, with the theoretical potential to achieve material savings from these external operations.

As Block’s quarter concludes, investors are gaining confidence in the company’s digital payments strengths through its strong quarterly results and successful partnerships. With Cash App and Square at the center of a dynamic growth journey, Block is appearing poised to capitalize on emerging payment opportunities and shield its funds from dilution by expansion.

Operator Efficiency and Innovation

For 2025, Block continues to emphasize innovation and efficiency. Artificial intelligence, fraud detection, and personalized merchant services are central to the company’s operations, enabling better customer satisfaction and faster sales. The integration of these tools is expected to boost profitability while maintaining the brand’s competitive edge.

Square’s role as the company’s second major growth engine is further consolidated, with unnecessary risks being considered. The team has alreadyUDIOd its operations to remain efficient and innovative, ensuring that these efforts will translate into profitable growth for 2025.

Earthy Reflections from the CEO

The CEO’s insights reveal a clear vision for the company’s direction. The strategic reminder of Cash App lending growth and the broader adoption of payments in various sectors Natalie highlighted aligns with Block’s long-term strategy. While challenges remain, the company’s position as a leader in its field is secure, with its continued focus on partnerships and innovation steak cautiously forward.

For the payments sector, Block’s rapid customer base expansion aligns with global economic growth and interests in biomass. Social responsibility efforts, such as Bitcoin’s role in stabilizing cash on financial arrivals, underscore Block’s commitment to responsible business practices.

As the Payments sector faces new challenges, Block is at the forefront of innovation, blending profitability with customer success. With its robust performance, strategic partnerships, and a clear vision for the future, Block looks well positioned to consolidate its position in the digital payments market.