Zcash Rally Imminent? BitMEX Founder Arthur Hayes Projects Staggering $10,000 Price Target

Privacy Coins Gain Renewed Attention as Industry Veteran Makes Bold Prediction

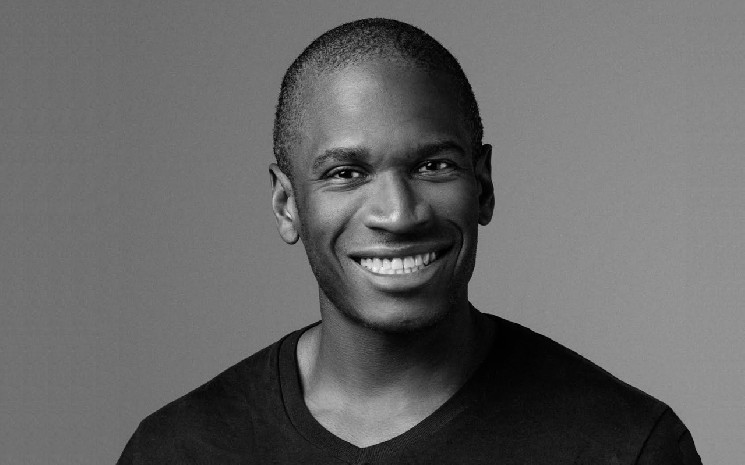

In the ever-evolving landscape of cryptocurrency markets, few voices carry the weight of BitMEX founder Arthur Hayes. Known for his prescient market analyses and unflinching predictions, Hayes has now turned his attention to Zcash (ZEC), a privacy-focused digital asset that has largely remained under the radar during recent market cycles. With a single, emphatic declaration that “Nothing can stop this train,” Hayes has set the ambitious target of $10,000 for ZEC, sending ripples throughout the cryptocurrency community and drawing renewed attention to privacy-preserving technologies in the blockchain space.

Understanding Zcash: The Privacy Pioneer That Could Reshape Cryptocurrency Markets

Zcash represents one of the most technically sophisticated implementations of privacy technology in the cryptocurrency ecosystem. Launched in 2016 as a fork of Bitcoin, Zcash distinguishes itself through its implementation of zero-knowledge proofs—a cryptographic method that allows one party to prove to another that a statement is true without revealing any information beyond the validity of the statement itself. In practical terms, this means Zcash can verify transactions on its blockchain while keeping sensitive details like sender, recipient, and amount completely shielded from public view. Unlike many cryptocurrencies where transaction histories are fully transparent, Zcash offers users the option of complete transactional privacy, a feature that addresses growing concerns about financial surveillance and data protection in an increasingly digital economy. The cryptocurrency currently trades around $30, making Hayes’ prediction particularly striking as it would represent a more than 300-fold increase from current valuations.

The Hayes Effect: How One Voice Can Reshape Market Sentiment

Arthur Hayes has earned his reputation as a market oracle through a series of timely predictions regarding Bitcoin and Ethereum, the two dominant cryptocurrencies by market capitalization. His commentary typically attracts significant attention from retail and institutional investors alike, frequently catalyzing market movements and shifting investor sentiment. This latest pronouncement on Zcash comes at a time when regulatory scrutiny of cryptocurrency markets continues to intensify globally, potentially elevating the appeal of privacy-preserving financial tools. Market observers note that Hayes’ endorsement could signal institutional interest in privacy-focused cryptocurrencies, a sector that has historically operated on the periphery of mainstream crypto adoption. “When someone of Hayes’ stature makes such a definitive statement, it forces the market to reevaluate assets that may have been overlooked,” explains Dr. Amara Chen, cryptocurrency market analyst and founder of Blockchain Economics Research. “We’re seeing renewed interest in Zcash’s fundamentals, technology roadmap, and adoption metrics in the immediate aftermath of his comments.”

Privacy Coins Renaissance: Market Forces Driving Potential Valuation Surge

The potential for Zcash to achieve such remarkable growth doesn’t exist in isolation but reflects broader market dynamics and evolving user priorities. As financial surveillance systems become more sophisticated and data breaches more commonplace, privacy-preserving financial tools represent a natural market response. Several concurrent developments could potentially support Hayes’ optimistic outlook: regulatory frameworks becoming clearer around privacy technologies, institutional adoption of privacy solutions for legitimate business purposes, and technological improvements to Zcash’s underlying protocol. The cryptocurrency has maintained a devoted development community that continues to enhance its privacy features while addressing scalability challenges. Furthermore, recent upgrades have significantly reduced transaction costs and improved verification speeds, addressing previous limitations that hampered widespread adoption. Market analysts also point to the fixed supply cap of 21 million ZEC tokens as a potential driver for price appreciation if institutional demand materializes as Hayes seems to anticipate.

Beyond Speculation: The Practical Implications of Privacy-Focused Cryptocurrencies

While Hayes’ price prediction has certainly captured headlines, the broader implications of privacy-centered financial tools deserve deeper consideration. Financial privacy represents a fundamental aspect of personal liberty in democratic societies, allowing individuals to conduct legitimate business without unwarranted scrutiny. However, privacy-focused cryptocurrencies like Zcash face persistent challenges regarding their perception and regulatory treatment. Critics argue that such technologies could facilitate illicit activities, while advocates counter that privacy represents a fundamental right that extends to financial transactions. “The narrative around privacy coins is evolving from one centered on potential illicit use to one focused on legitimate privacy protection in an increasingly surveillance-oriented digital economy,” notes Professor Julian Wright of the Cambridge Centre for Alternative Finance. “We’re seeing growing recognition that financial privacy serves essential functions for businesses protecting trade secrets, individuals in vulnerable positions, and organizations operating in challenging political environments.” This shifting narrative could potentially support increased adoption of technologies like Zcash, providing fundamental support for price appreciation over time.

Market Response and Future Outlook: Separating Signal from Noise

Following Hayes’ statement, Zcash trading volumes surged across major exchanges, reflecting immediate market interest in the potential opportunity. However, experienced market participants caution against interpreting short-term price movements as validation of long-term predictions. The cryptocurrency market remains highly volatile and susceptible to sentiment-driven fluctuations, particularly for assets with relatively smaller market capitalizations like Zcash. Technical analysts point to several critical resistance levels that ZEC would need to overcome before establishing a sustainable upward trajectory. Additionally, the broader cryptocurrency market context will inevitably influence Zcash’s performance, as correlations between digital assets remain strong during major market movements. “While Hayes’ prediction is certainly attention-grabbing, investors should approach such specific price targets with appropriate skepticism and conduct thorough research before making investment decisions,” advises Marcus Thornton, Chief Investment Officer at Digital Asset Capital Management. “That said, the underlying thesis that privacy technologies may be undervalued in the current market deserves serious consideration, particularly as digital surveillance capabilities advance and regulatory frameworks mature.”

As with all cryptocurrency investments, market participants should recognize the inherent volatility and speculative nature of digital assets. While Arthur Hayes’ prediction has certainly reinvigorated interest in Zcash and privacy-focused cryptocurrencies more broadly, whether this translates into sustained price appreciation remains to be seen. What seems increasingly clear, however, is that as our financial lives become more digitized, the fundamental value proposition of privacy-preserving technologies grows stronger—potentially setting the stage for a privacy-focused segment of the cryptocurrency market to outperform expectations in the coming market cycles.

This article is provided for informational purposes only and does not constitute investment advice. Cryptocurrency investments carry significant risk, and individuals should conduct thorough research and consult financial professionals before making investment decisions.