Bitcoin Rebounds to $93,000 Following Fed Rate Cut as Market Shows Signs of Decoupling

Bitcoin Stabilizes While Altcoins Struggle in Post-Fed Decision Trading

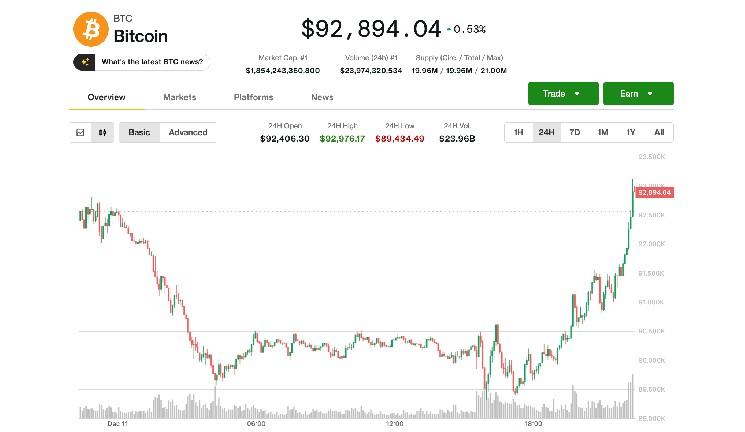

In a notable display of resilience, Bitcoin rebounded to the $93,000 level on Thursday as traders processed the Federal Reserve’s latest interest rate decision. The cryptocurrency market showed interesting divergence patterns, with Bitcoin recovering from an earlier dip while most altcoins failed to participate in the bounce. This movement comes amid shifting market dynamics and growing evidence that cryptocurrency may be increasingly decoupling from traditional equity markets.

Bitcoin, which had slipped to around $89,000 following the Federal Reserve’s Wednesday rate cut announcement and a sharply lower opening for U.S. stocks, managed to climb back to approximately $93,000 by late Thursday. This recovery represented a marginal increase over the previous 24-hour period, suggesting that despite short-term volatility, the leading cryptocurrency maintains underlying strength in the face of broader market uncertainty. The bounce coincided with a late-day recovery in U.S. equities, with the Nasdaq closing down just 0.25% after being as much as 1.5% lower earlier in the session. The S&P 500 ended the day slightly positive, while the Dow Jones Industrial Average posted a more substantial gain of 1.3%.

“What we’re witnessing is increasingly compelling evidence that Bitcoin is developing its own market narrative separate from traditional financial assets,” explained Dr. Eleanor Westfield, chief market analyst at Digital Asset Research. “The cryptocurrency’s ability to recover independently of altcoins demonstrates Bitcoin’s unique position as a potential safe-haven asset during periods of economic uncertainty. This behavior stands in stark contrast to previous market cycles where digital assets typically moved in tandem.”

Altcoins Underperform While Precious Metals Surge to Record Highs

While Bitcoin demonstrated resilience, the broader altcoin market struggled to recover from early losses. Cardano’s ADA and Avalanche’s AVAX led the declines among major altcoins, dropping 6%-7% respectively. Ethereum, the second-largest cryptocurrency by market capitalization, was trading 3% lower, though it managed to maintain support above the $3,200 level. This divergence between Bitcoin and altcoins suggests investors may be showing preference for the market leader during periods of uncertainty.

The day’s most remarkable performance came from precious metals, with silver surging 5% to reach a new all-time high of $64 per ounce. Gold also demonstrated strength, climbing over 1% to approach $4,300. These advances were supported by weakness in the U.S. dollar index (DXY), which fell to its lowest level since mid-October. The robust performance of precious metals alongside Bitcoin’s recovery highlights interesting parallels between traditional safe-haven assets and the leading cryptocurrency, potentially signaling a shift in how institutional investors categorize Bitcoin within their portfolio strategies.

Among crypto-related stocks, exchange platform Gemini stood out with an impressive gain exceeding 30%. This substantial increase followed news that the company had secured regulatory approval to offer prediction markets in the United States, marking a significant advancement for regulated crypto products in the American financial landscape. “Regulatory clarity continues to be a primary driver for institutional confidence in the digital asset space,” noted Marcus Henderson, regulatory affairs director at Blockchain Analytics Institute. “Companies securing clear operational frameworks can expect significant market premiums as the industry matures.”

Crypto’s Growing Independence from Traditional Markets

Thursday’s market activity further reinforced observations about cryptocurrency’s increasing decoupling from equities, particularly around significant macroeconomic catalysts. Jasper De Maere, desk strategist at trading firm Wintermute, provided insightful analysis on this trend: “Only 18% of the past year’s sessions have seen BTC outperform the Nasdaq on macro days. Yesterday fit that pattern: equities rallied while crypto sold off, suggesting the rate cut was fully priced and that marginal easing is no longer providing support.”

This divergence highlights a maturing market where cryptocurrencies respond to their own set of fundamental drivers rather than simply mirroring traditional financial assets. De Maere further elaborated that early indicators of stagflation concerns are emerging for the first half of 2026, and markets appear to be shifting focus from Federal Reserve monetary policy toward potential U.S. cryptocurrency regulation as the next major market driver. This transition in focus reflects the growing significance of regulatory frameworks in determining the long-term trajectory of digital assets.

Industry experts suggest this decoupling represents an important milestone in cryptocurrency’s evolution. “We’re witnessing the maturation of digital assets as an asset class,” explained Dr. Rebecca Chen, cryptocurrency economist at Global Market Research. “Earlier in Bitcoin’s history, correlation with equities was high, particularly during periods of market stress. The current divergence suggests institutional investors are developing more nuanced approaches to cryptocurrency allocation based on fundamentals specific to the digital asset ecosystem rather than broader market sentiment.”

Bitcoin Selling Pressure Diminishing as Market Seeks Direction

Analytics firm Swissblock noted that downward pressure on Bitcoin appears to be losing momentum, with the market showing signs of stabilization though not yet entering a definitive recovery phase. “The second selling wave is weaker than the first, and selling pressure is not intensifying,” the firm stated in a post on social media platform X. “There are signs of stabilization… but not confirmation.”

This technical analysis suggests that while Bitcoin has successfully defended against further significant declines, the market remains at an inflection point awaiting clearer directional signals. On-chain metrics indicate reduced selling from long-term holders, potentially limiting available supply for further price decreases. Concurrently, institutional flow data shows continued accumulation from larger entities, creating a supportive foundation for potential future price appreciation.

Market sentiment indicators have improved from the extreme fear readings registered immediately following the Fed announcement, now hovering in neutral territory as investors reassess positioning. “Bitcoin’s technical structure remains constructive despite recent volatility,” observed Michael Thornton, senior market strategist at Digital Currency Advisors. “The ability to maintain support above key moving averages while defending the $90,000 psychological level demonstrates underlying strength. However, confirmation of a sustained uptrend would require breaking resistance at $96,500 with increased volume.”

As global markets navigate the complex landscape of slowing economic growth, persistent inflation concerns, and evolving monetary policy, Bitcoin’s recent price action suggests the cryptocurrency may be finding its footing as an independent asset class with unique value propositions. Whether this emerging narrative of decoupling continues will depend on multiple factors, including regulatory developments, institutional adoption rates, and Bitcoin’s performance during future periods of market stress. For now, the resilience displayed in Thursday’s session provides cryptocurrency advocates with encouraging evidence that digital assets may be establishing their own distinctive market dynamics separate from traditional financial instruments.