Bitcoin, the pioneering cryptocurrency, has historically exhibited a cyclical pattern characterized by three years of bullish growth followed by a year of correction. This cycle, often linked to the Bitcoin halving event, a programmed reduction in the rate at which new Bitcoins are created, has been a defining feature of its market behavior. However, Matt Hougan, Chief Investment Officer at Bitwise, a leading cryptocurrency asset manager, argues that this traditional cycle may be losing its relevance. He posits that macroeconomic factors, particularly regulatory developments and institutional adoption, are now the dominant drivers of Bitcoin’s price trajectory.

Hougan’s perspective challenges the conventional understanding of Bitcoin’s market dynamics. Historically, significant events like the collapse of Mt. Gox in 2014 and the SEC crackdown on Initial Coin Offerings (ICOs) in 2018 marked turning points in the Bitcoin cycle, leading to market corrections. These events, while impacting the market sentiment, were often seen as part of the broader four-year cycle tied to the halving. However, Hougan suggests that the current market is less influenced by the halving and more responsive to broader economic and regulatory shifts. He points to the recent legal victory of Grayscale Investments against the SEC as a pivotal moment, paving the way for the launch of Bitcoin Exchange-Traded Funds (ETFs) and sparking renewed institutional interest.

The introduction of Bitcoin ETFs represents a watershed moment in the cryptocurrency’s journey towards mainstream acceptance. ETFs provide a regulated and accessible avenue for institutional investors, such as pension funds and asset management companies, to gain exposure to Bitcoin without directly owning the underlying asset. This influx of institutional capital has the potential to significantly bolster Bitcoin’s price and overall market stability. Hougan cites the surge in Bitcoin’s price following Grayscale’s legal victory as evidence of the transformative impact of institutional adoption. He also notes the influence of former President Trump’s executive orders on digital assets, further underscoring the growing importance of regulatory clarity in shaping the cryptocurrency market.

While acknowledging the potential for a strong 2025, driven by continued ETF inflows and institutional buying, Hougan cautions against complacency. He recognizes that the increasing use of leverage in the Bitcoin market, with investors borrowing funds to amplify their exposure, introduces a degree of risk. Excessive leverage can exacerbate market volatility and potentially lead to significant corrections. However, Hougan believes that the growing institutional involvement and supportive regulatory environment will mitigate the risk of a severe downturn, marking a departure from the traditional cycle.

This shift away from the halving-driven cycle represents a maturation of the Bitcoin market. Early Bitcoin cycles were largely characterized by retail investor speculation and a lack of regulatory clarity. The current market environment, however, is increasingly shaped by institutional participation, regulatory frameworks, and macroeconomic considerations. This institutionalization of Bitcoin is likely to contribute to greater price stability and reduce the impact of speculative bubbles. While volatility remains a characteristic of the cryptocurrency market, the growing influence of institutional investors and regulatory bodies is expected to temper extreme price swings.

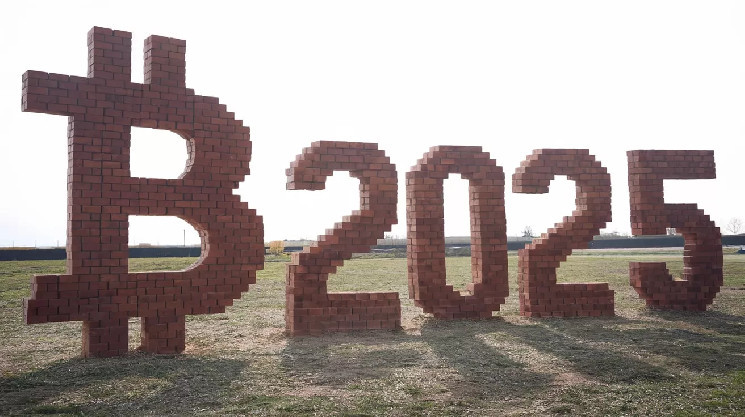

Looking ahead, Hougan anticipates that Bitcoin could reach $200,000 by 2025, driven by continued institutional adoption and positive regulatory developments. However, the outlook for 2026 remains uncertain, potentially deviating from the historical pattern of a corrective year. The increasing interplay between macroeconomic factors, regulatory landscape, and institutional investment suggests that Bitcoin’s future price trajectory will be influenced by a more complex set of drivers than the traditional halving cycle. While the halving event will likely continue to play a role, its influence may be overshadowed by the broader forces shaping the evolving cryptocurrency market. This evolving landscape presents both opportunities and challenges for investors, requiring a more nuanced understanding of the factors driving Bitcoin’s price dynamics.