Bitcoin Network Hashrate Decline Signals Miner Stress as Market Dynamics Shift

Computational Power Behind Bitcoin Shows Signs of Strain Amid Profitability Concerns

Bitcoin’s network hashrate, the crucial computational power that maintains blockchain integrity, has experienced a significant 15% decline from its October peak, revealing growing challenges in the mining sector. This downturn highlights a fundamental shift in the cryptocurrency mining landscape as operators face increasingly difficult economic conditions despite Bitcoin’s relatively strong market position.

The average computing power securing the world’s leading cryptocurrency network has fallen from approximately 1.1 zettahashes per second (ZH/s) in October to roughly 977 exahashes per second (EH/s) in recent weeks. This substantial reduction indicates that mining operations across the globe are powering down equipment—a process industry insiders refer to as “capitulation”—as profit margins continue to narrow in the highly competitive mining environment. The trend represents a notable inflection point for the network that has consistently seen hashrate growth throughout most of Bitcoin’s history.

Hashrate Metrics Reveal Deeper Market Dynamics at Play

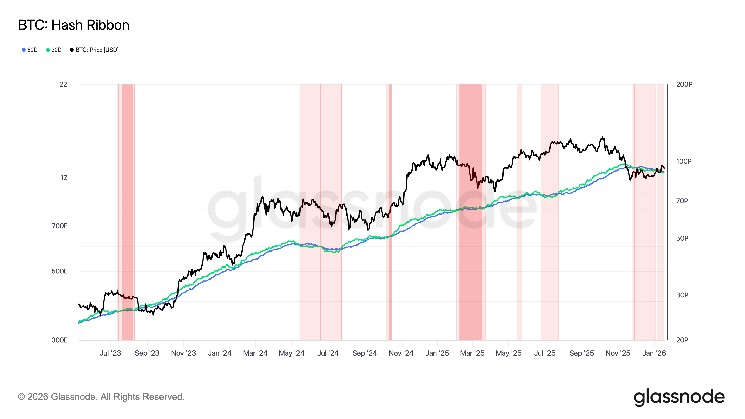

The decline in computational power is clearly captured by Glassnode’s Hash Ribbon indicator, a sophisticated metric designed to track miner capitulation by analyzing and comparing short- and long-term hashrate trends across the network. This technical indicator inverted on November 29, shortly after Bitcoin experienced a market correction that brought its value down to approximately $80,000. The inversion of the Hash Ribbon carries particular significance in market analysis, as it typically signals a period where mining operations face financial pressure that forces them to liquidate Bitcoin holdings to maintain operational viability.

When miners collectively enter such capitulation phases, they often introduce additional supply to the market, creating temporary selling pressure that can influence Bitcoin’s price trajectory. This dynamic highlights the interconnected nature of Bitcoin’s economic system, where the health of mining operations directly affects market supply and demand equilibrium. The current Hash Ribbon inversion suggests that we’re in the midst of such a capitulation phase, with miners acting as reluctant sellers in order to sustain their operations through challenging market conditions.

Historical Context Suggests Potential Silver Lining

Despite the seemingly negative implications of miner capitulation, investment firm VanEck and other market analysts point to historical patterns suggesting these periods often function as contrarian indicators for Bitcoin’s price performance. Data shows that sustained periods of miner stress have typically preceded renewed bullish momentum for Bitcoin as inefficient mining operations exit the market and selling pressure gradually diminishes. This perspective frames the current situation as a potential market-cleansing mechanism rather than simply a bearish signal.

The Hash Ribbon metric provides additional insight into potential turning points, suggesting that capitulation phases typically approach conclusion when the 30-day moving average of network hashrate crosses back above the 60-day moving average. Market observers note that such technical realignments have historically correlated with improving price action for Bitcoin. This pattern reflects the cyclical nature of the mining ecosystem, where periods of contraction and consolidation often lead to stronger, more efficient network conditions that ultimately support price appreciation once excess inventory has been absorbed by the market.

Network Difficulty Adjustments Reflect Operational Challenges

The pressure on mining operations is further evidenced by Bitcoin’s upcoming difficulty adjustment, scheduled for January 22, which is expected to reduce mining difficulty by approximately 4% to around 139 trillion (T). This downward adjustment, designed to maintain Bitcoin’s 10-minute block time target regardless of network hashrate fluctuations, will mark the seventh negative adjustment in the past eight periods—an unusual sequence that underscores the persistent challenges facing mining operators.

Bitcoin’s difficulty adjustment mechanism represents one of the network’s most elegant self-regulation features, automatically calibrating mining difficulty every 2,016 blocks (approximately two weeks) to maintain consistent block production regardless of fluctuations in total network hashrate. The recent series of negative adjustments reflects a prolonged period of hashrate contraction, confirming that many mining operations are struggling to maintain profitability despite Bitcoin’s relatively strong market position compared to historical averages. These adjustments, while providing some relief to remaining miners, also serve as a clear indicator of the economic pressures reverberating throughout the mining ecosystem.

Industry Evolution: Miners Diversify Beyond Cryptocurrency

Adding further complexity to the current market dynamics is the emergence of strategic pivots among established mining companies, with several major players redirecting resources toward artificial intelligence and high-performance computing applications. Companies such as Riot Platforms (RIOT) exemplify this trend, selling Bitcoin holdings to fund capital-intensive investments in AI and HPC infrastructure—ventures that potentially offer more stable or lucrative returns than pure cryptocurrency mining in the current environment.

This diversification strategy represents a significant evolution in the business models of companies that initially built their operations exclusively around Bitcoin mining. By leveraging existing data center capabilities and expertise in managing computational resources, these companies are positioning themselves at the intersection of cryptocurrency and emerging technologies like artificial intelligence. While this strategic shift may contribute to near-term selling pressure as companies liquidate Bitcoin assets to fund these initiatives, it also reflects the maturation of the cryptocurrency mining industry and its growing integration with broader technology sectors. The trend highlights how Bitcoin mining has evolved from a specialized cryptocurrency activity into a component of more diversified computational resource management—a transformation that could ultimately strengthen the industry’s resilience through economic cycles while continuing to support Bitcoin’s underlying network security.

As the Bitcoin network navigates this period of miner stress and adaptation, market participants are closely monitoring hashrate metrics, difficulty adjustments, and miner behavior for signs of stabilization or further capitulation. The current dynamics represent both challenges and potential opportunities within the Bitcoin ecosystem, illustrating the complex interplay between network security, miner economics, and market valuation that continues to define this maturing digital asset class.