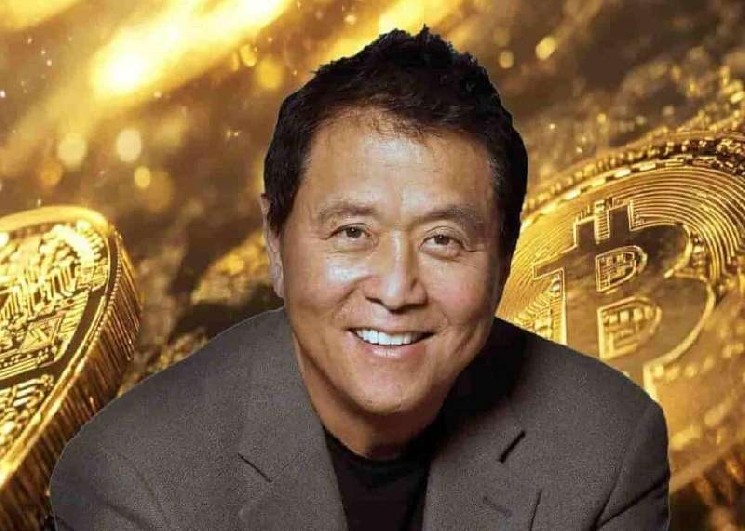

Robert Kiyosaki Champions Bitcoin as “First Truly Scarce Money” Amid Market Fluctuations

Financial Guru Urges Followers Not to Miss Bitcoin Investment Opportunity

In an increasingly volatile financial landscape, renowned financial author Robert Kiyosaki is making headlines once again with his unwavering advocacy for Bitcoin (BTC). The “Rich Dad Poor Dad” author has taken to social media to emphasize what he believes is a critical investment opportunity, pointing to Bitcoin’s finite supply as its most compelling feature. His recent statements come at a time when digital currencies continue to face market scrutiny and fluctuating valuations, highlighting the ongoing debate about cryptocurrency’s role in modern investment portfolios.

“Bitcoin is first truly scarce money… Only 21 million ever to be mined. World close 20 million now. Buying will accelerate. FOMO real. Please do not be late. Take care,” Kiyosaki wrote in an October 22 post on X, formerly known as Twitter. His message underscores the fundamental principle of supply and demand that drives much of Bitcoin’s perceived value proposition. With approximately 20 million of the total 21 million Bitcoins already mined, Kiyosaki suggests the remaining supply will become increasingly valuable as more investors recognize this scarcity. This perspective aligns with traditional economic theories about limited resources appreciating in value as demand grows, a principle Kiyosaki has applied throughout his financial education career.

Distinguishing Substance from Hype in Cryptocurrency Discourse

In a follow-up post just hours later, Kiyosaki expanded his commentary by addressing what he perceives as problematic media coverage in the cryptocurrency space. “I now see ‘click bait’ titles screaming ‘gold, silver, Bitcoin crashing’ or Bitcoin to $2 million this month. Then the podcaster then says ‘To support my channel click and subscribe.’ Give me a break,” he remarked, expressing frustration with sensationalist headlines that either predict Bitcoin’s collapse or project unrealistic gains. This criticism reflects broader concerns within investment communities about the quality of financial information available to consumers, particularly in the relatively young and still-evolving cryptocurrency sector where misinformation can spread rapidly.

Kiyosaki’s comments highlight the tension between genuine investment analysis and attention-grabbing content that may not serve investors’ best interests. By calling out these practices, he positions himself as an advocate for thoughtful, substantive investment education rather than reactive, emotion-driven financial decisions. This stance resonates with his long-standing approach to financial literacy that emphasizes fundamentals over fads and long-term thinking over short-term gains. For cryptocurrency investors navigating an often confusing information landscape, such perspective may provide valuable context for making more informed decisions.

Traditional Economic Concerns Drive Interest in Alternative Assets

The financial writer’s cryptocurrency advocacy appears deeply connected to his concerns about traditional economic indicators, particularly the United States’ growing national debt. Pointing to the staggering $37 trillion figure, Kiyosaki frames his interest in hard assets as a logical response to potential monetary instability. What distinguishes his current position from his previous investment advice is the inclusion of cryptocurrencies alongside traditional safe-haven assets. “Bitcoin and Ethereum (ETH) are likewise the ‘real money’ today,” he stated, placing these digital assets in the same category as precious metals that have historically served as stores of value during economic uncertainty.

This perspective represents a significant evolution in how alternative investments are being conceptualized by financial thought leaders. By positioning Bitcoin and Ethereum as “real money” rather than speculative assets, Kiyosaki suggests a fundamental shift in how we might understand value storage and exchange in the digital age. This framing moves beyond the early cryptocurrency narrative focused primarily on technological novelty and begins to integrate these assets into more traditional investment philosophies centered on protection against inflation and currency debasement. For investors following Kiyosaki’s guidance, this represents an important conceptual bridge between conventional financial wisdom and emerging digital economy principles.

Bitcoin Faces Market Headwinds Despite Bullish Long-Term Outlook

Despite Kiyosaki’s enthusiastic endorsement, Bitcoin continues to experience market volatility that challenges short-term investor confidence. At the time of writing, the cryptocurrency trades at approximately $109,665, representing a monthly decline of nearly 4% and a weekly loss exceeding 1%. Daily trading volume has also declined significantly, dropping 27.34% to $74.78 billion. However, not all indicators are negative – Bitcoin’s market capitalization shows signs of recovery with a 1.27% daily gain, maintaining its position at $2.18 trillion according to data from CoinMarketCap.

These mixed signals highlight the complex reality facing cryptocurrency investors who must balance long-term conviction with short-term market dynamics. While Kiyosaki’s investment thesis centers on Bitcoin’s fundamental scarcity and potential as an inflation hedge, day-to-day price action continues to be influenced by a wide range of factors including regulatory developments, technological advancements, institutional adoption rates, and broader macroeconomic conditions. For market participants, this tension between long-term value propositions and short-term price volatility remains one of the defining characteristics of cryptocurrency investment, requiring both conviction and risk management strategies.

Upcoming Economic Data May Influence Cryptocurrency Market Direction

The cryptocurrency market now turns its attention to imminent economic indicators that could significantly impact price action. Investors are anticipating new Consumer Price Index (CPI) reports scheduled for October 24, which represent one of the primary macroeconomic data points that could influence Bitcoin’s price trajectory for the remainder of the month. This focus on inflation metrics underscores the increasingly close relationship between traditional economic indicators and cryptocurrency markets, reflecting Bitcoin’s evolution from a purely technological experiment to an asset class responsive to broader economic conditions.

The attention paid to CPI figures demonstrates how Bitcoin’s market narrative has expanded beyond its internal supply mechanisms to include its potential role as an inflation hedge. As central banks worldwide continue to navigate complex monetary policy challenges, inflation concerns remain central to many investment decisions. For cryptocurrency advocates like Kiyosaki, these economic data points may either validate or challenge their thesis about Bitcoin’s role as “hard money” in an era of substantial government debt and monetary expansion. As markets await these figures, Kiyosaki’s advice to avoid being “late” to Bitcoin investment reflects his conviction that regardless of short-term fluctuations, the cryptocurrency’s limited supply will ultimately drive significant value appreciation in a world of increasing financial uncertainty.

This article provides market commentary and does not constitute investment advice. Investors should conduct their own research and consider their financial situation before making investment decisions. The featured image in this article is for illustrative purposes only and may not accurately reflect the true likeness of the individuals depicted.