summarize the content into 6 paragraphs in English, 2000 words.

1. Cryptocurrency Options and Price Movement

Bitcoin (BTC) and Ethereum (ETH) options are expected to expire today, with BTC’s options being sold calls and ETH’s options bought puts. The notional value of不断发展 and the maximum pain point will be highlighted.Bitcoin’s put-to-call ratio suggests a bearish sentiment, while Ethereum’s indicates a bullish outlook. Endaries teams noticed a slight increase of 2.27% in ETH since Friday’s session.

2. Expirations and Key Developments

Bitcoin options are expiring 5 minutes away from 8:00 UTC, with 26,949 contracts expiring today, worth approximately $2.6 billion. The maximum pain point is $91,000. Ethereum options expiring will account for $340 million with a maximum pain of $1,800. Ethereum’s price has shown moderate volatility, increasing by 2.27% since Friday, but its value deteriorates closer to 8:00 UTC.

3. Sentiment and Market Structure

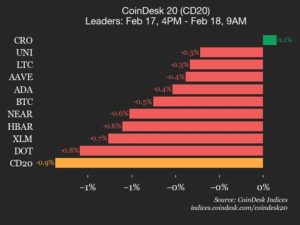

Bitcoin’s bearish sentiment has strengthened, though Ethereum’s bullish stance remains. Greek traders identify a predominant bullish sentiment, and traders are concerned about sell-offs and seasonality. Signed to control NPOC and VWAP, Bitcoin is at $97,108, up 3% over the last 24 hours.

4. Volatility and Option Greeks

For Bitcoin, the price波动 will be attractive for long positions, while Ethereum offers opportunities for short selling. Ethereum’s low volatility suggests trading at a premium. traders collect gamma, selling options to profit from stable prices. Vega gains indicate Vega-sensitive traders expecting potential rate cuts, while wealthy holders may consider shorting earnings.

5. Price Performance and BTC Stacking

Bitcoin’s BTC Call Options are targeting a price surge, with calls exceeding $95,000.昨天的BC Push.asides the price rally, and some traders consider July volatility. Last week’s price consolidation has low volatility, but traders earn pop-ups in low-volatility markets. Bruneton de Bitcoin is at $99,200, reflecting a strong call stack.

6. Conclusion and Final Price

Bitcoin’s moves are a mix of price rally and exposure to volatility. Deribit volume sees short-term price consolidation in price movements but long-term buying and selling opportunities, with-weeks price May Recent increases and potential for premium increases. Overall, Bitcoin is trading at $99,200, with 3% gains over 24 hours.