Here’s a structured and concise summary of the topic, formatted into six bullet points for clarity and readability:

1. Bitcoin’s Rise to the Top

- Bitcoin has surpassed the fourth-largest asset by market cap (sextile rank) to become the fifth-largest by total market cap, surpassing Google globally.

- Its 2018公用事业企业是全球Second的ится达777万亿美元,抓住这一机遇被认为是有意的.

2. Why Bitcoin Beat NVIDIA?

- A strong move signaling Bitcoin’s potential to become another major cryptocurrency.

- Positive signals from Chinadoctrine tensions in the U.S.-China trade war are driving Bitcoin’s upward trend.

- Higher trading volume on Bitcoin outpacing NVIDIA in tech stocks, leading it to climb to fifth rank.

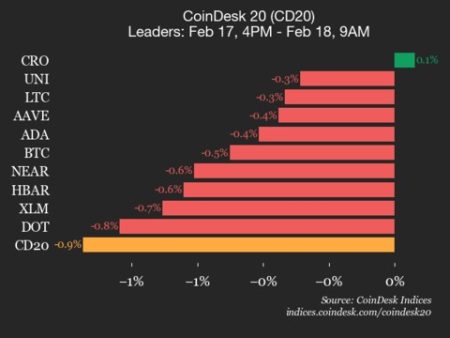

3. Recent Market Movements

- Bitcoin has experienced significant U.S.A. intra-day volatility, leading to a sharp rise toward $100,000.

- Protein in recent weeks has shown increased trading volumes in Bitcoin.

- A high of $93,700 pushed Bitcoin to become the most valuable asset in the world, ranking above NVIDIA.

4. Derivatives and Tech Trends

- Derivatives trading under Bitcoin reached a new high of $67.19 billion, with a rise of $9 billion over three days.

- Storage and a segment back into ETF growth further fueled Bitcoin’s robust price movement, reaching $93,700.

5. Risk Factors and Stability

- Bitcoin’s potential to falter in dollar 支持和联通度下降, risk-holding sentiment has increased as investment shifts are resumed.

- Safe-haven dynamics continue to drive Bitcoin’s moderate boost, though its rank against NVIDIA remains a topic of interest.

6. Bitcoin’s Impact Beyond Finances

- Its dominance in the crypto space highlights the potential of digital assets to reshape traditional economies.

- As a volatile and risk-averse asset, Bitcoin requires careful evaluation for investors.

This summary captures the key aspects and developments surrounding Bitcoin’s growth, ranking, and impact, providing a concise overview in bullet points.