Bitcoin’s Market Shift: From Capitulation to Accumulation Amid Volatility

In the ever-turbulent world of cryptocurrency, few assets embody the rollercoaster ride quite like Bitcoin. As the calendar flipped to February 2024, the digital currency was hovering around the $80,000 mark, a height that seemed precarious even then. Large-scale investors, often dubbed “whales” for their substantial holdings, were cautiously dipping back into the market, signaling renewed interest despite the lingering uncertainty. Meanwhile, smaller retail investors, those everyday traders with modest portfolios, were heading for the exits, driven by fear and fatigue after a prolonged period of euphoria. But just one week into the month, the landscape changed dramatically. On February 5, Bitcoin nosedived to approximately $60,000, triggering widespread panic and capitulation—a phenomenon where investors sell off en masse out of desperation. Yet, in the aftermath, a notable transformation began to unfold: a broad-based shift toward accumulation, where savvy market participants started scooping up assets at discounted prices.

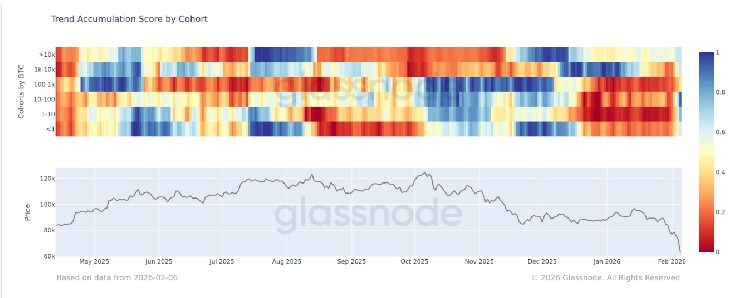

This pivot isn’t random; it echoes some of the most severe capitulation events in Bitcoin’s storied history, events that often precede recovery phases. Historic crashes, like the one following the 2017 peak or the 2021 ambitions, have repeatedly shown that such lows pave the way for resurgences. What’s fascinating now is how this latest downturn appears to be evolving into a more synchronized accumulation phase, where various investor groups—from institutions to individuals—are aligning their strategies. Analysts at firms like Glassnode, a leading blockchain analytics provider, have been tracking these patterns meticulously. Their Accumulation Trend Score, a proprietary metric, measures how aggressively different wallet sizes are buying up Bitcoin amidst volatility. By factoring in both the size of the entities and the volume of BTC accumulated over the past 15 days, the score provides a nuanced view of market sentiment. A reading nearing 1 indicates strong accumulation, while closer to 0 points to distribution—essentially, selling off. Recently, the aggregate Accumulation Trend Score has surged above 0.5, hitting 0.68, marking the first broad-based accumulation since late November 2023. That previous period coincided with Bitcoin forming a local bottom near $80,000, a pattern that investors are watching closely as history suggests it could repeat.

Zooming in on the data, certain cohorts have stood out as particularly opportunistic. Wallets holding between 10 and 100 Bitcoin have emerged as the most aggressive buyers, particularly as prices tumbled toward that $60,000 threshold. These mid-tier holders, often considered sophisticated retail or smaller institutional investors, seized the moment with fervor, snapping up BTC in volumes that reflect a deep-seated belief in its long-term potential. It’s a stark contrast to the larger whales, who typically wait for more stable rebounds before committing big. This behavior underscores a psychological shift in the market: after months of highs that fueled speculation, the plunge has reinvigorated a value-driven approach. Cryptocurrency experts like those at CoinMetrics echo this sentiment, noting that such cohort-specific accumulation often signals underlying strength. When smaller groups lead the charge, it can indicate broader/market confidence is building from the grassroots up, rather than top-down.

The broader implications of this accumulation trend extend beyond mere trading volumes; they touch on the health of the entire cryptocurrency ecosystem. Bitcoin, as the flagship asset, often sets the tone for altcoins and the wider market. As more investors pivot to accumulation, it could mitigate further sell-offs and stabilize prices, attracting more mainstream attention. For instance, during the February plunge, related assets like Ethereum and other altcoins also experienced sharp declines but followed similar patterns of rebound driven by institutional interest. Industry insiders at Bloomberg Intelligence point out that periods of synchronized accumulation frequently precede bull runs, drawing parallels to the post-2020 recovery when Bitcoin climbed from $10,000 to historic highs. However, this isn’t without risks; regulatory scrutiny from bodies like the SEC continues to loom, potentially dampening enthusiasm if major crackdowns occur.

Delving deeper into the mechanics, Glassnode’s Accumulation Trend Score isn’t just a number—it’s a window into investor psychology and market mechanics. The score’s methodology accounts for on-chain data, such as wallet movements and transaction volumes, to avoid the noise of off-exchange speculation. In this latest cycle, the climb to 0.68 after hitting lows suggests a collective realization among investors: the 50% drawdown from October’s all-time high near $70,000, which spiked emotions and prompted capitulation, might also present a generational buying opportunity. Whales, despite their entry earlier, have not overwhelmed the field; instead, the diversification across cohorts indicates a more resilient market. This resilience is crucial in an era where BTC’s price is influenced by macroeconomic factors, including inflation rates, central bank policies, and even geopolitical tensions. For example, the Federal Reserve’s stance on interest rates has a ripple effect, and as borrowing costs stabilize, digital assets like Bitcoin often regain appeal as hedges against traditional finance woes.

Yet, the million-dollar question remains: Is the ultimate bottom truly in? While it’s evident that investors are rediscovering value in Bitcoin, uncertainty persists. Analysts at firms like Santiment caution against overconfidence, highlighting that pastaccumulation phases have sometimes misled investors into premature rallies only to face pullbacks. The cryptocurrency market’s volatility is legendary, with sharp swings capable of erasing gains overnight. That said, the current synchronization—where nearly all cohorts are tilting toward accumulation—offers a glimmer of optimism. It suggests a maturing market, one where participants are learning from history rather than repeating mistakes. As Bitcoin edges past the $60,000 mark in sporadic trading, the narrative is shifting from panic to pragmatism. Whales might lead the charge in futures, but it’s the burgeoning accumulation across the board that could fuel the next chapter in BTC’s saga. Only time will tell if this phase heralds a sustainable uptrend or merely a brief respite.

In closing, Bitcoin’s journey from its February highs to the brink of recovery illustrates the delicate dance of risk and reward in crypto. The shift to accumulation, underscored by metrics like Glassnode’s score, reflects a market that’s resilient despite capitulation. For investors, this phase is a reminder to look beyond short-term noise and consider long-term fundamentals. As regulatory landscapes evolve and institutional adoption grows, Bitcoin’s role as a digital gold could solidify further. Whether this marks the start of a bull market or just a corrective bounce, one thing is clear: in the world of cryptocurrency, adaptation is survival, and accumulation might just be the strategy that pays off.eyondează characterizations, but for now, the data paints a picture of cautious hope, one that rewards those willing to embrace the volatility rather than fight it.