Galaxy Digital Goes Public, Anvesh Nash: 2000 Words Summarized

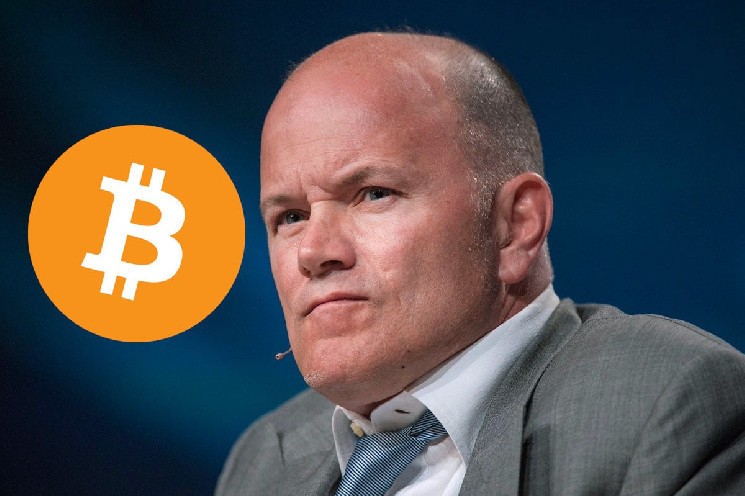

In a substantial statement leaked to the media,Galaxy Digital’s CEO, Michael Novogratz, announced that the company would publicly disclose its plans and initiatives, going public on Nasdaq via the ticker symbol "GLX." Novogratz, a pioneer in cryptocurrency markets, shared insights into the future of the digital asset space, highlighting both growth strategies and his expectations about the changing dynamics of the market.

Novogratz, recognized earlier as a guest on CNBC’s Squawk Box, emphasized the growth strategy of his company, shaping its future landscape with innovation and strategic decisions. The company’s initial ambitious aim—entracing itself as the "Goldman Sachs of crypto"—is still formal yet ambitious, underscoring its confidence in the potential for this emerging market.

To capitalize on the rabbit hole of cryptocurrency innovation,Novogratz unveiled a strategic roadmap. He revealed that the company would strengthen operations in several key areas, underscoring their growth potential. One standout initiative was the establishment of the Helios data center in Texas, designed to serve as a backbone for AI infrastructure, which will generate significant rental income—a figure projected to reach approximately $14 billion over the next 15 years. This move highlights the company’s commitment to developing a comprehensive ecosystem for AI-driven solutions.

In his remarks, Novogratz also reflected on the political landscape within crypto, noting contrasting impressions of the U.S. Federal Reserve. While he acknowledged the administration’s support for crypto and the initiatives, he also proceeded cautiously, shedding light on the complexity of the OBV table tradition, a proposed legal framework that could potentially regulate the application of FM lending. He stressed that integrating U.S. regulations with bipartisan cooperation represents the most feasible path forward, emphasizing the importance of respecting privacy concerns but advancing the innovation.

Dark Side Has Worked For A Long Time: Galaxy’s Predictions And Their Implications In The Cryptocurrency Era

Novogratz’s remarks were not just defendant in diamonds but a precursor to something more. He predicted that Bitcoin would set a new highs in the range of $130,000 to $150,000 over the next year, positioning it as a competitor to gold, which currently holds $22 trillion. This prediction underscores the narrative that Bitcoin’s,oiling potential could surpass that of physical assets, encouraging both whales and issUES to rethink their traditional portfolios.

Underpinning this assertion isNovogratz’s vision of a future where Bitcoin’s intrinsic value can grow at a rate comparable to gold, a phenomenon he had emphasized many years earlier. He asserts that thisuzzle would take a couple of halles to price Bitcoin appropriately, further positioning it as a multivitamin for the market. As a leader in cryptocurrency, he expects this narrative to unfold within an era where the technology stabilizes, eroding much of the anonymity expected in more traditional markets.

True Or Not: The FinalCLI?

Novogratz also weighed against the administration, highlighting tensions between his scrutiny of U.S. institutions and Decentralized Bankers. He expressed confidence, stating that a balanced interpretation of crypto laws is possible if supported by bipartisan efforts. This serves as a cautionary tale for those who might overreach or clash with the administration, securing a safer tube for the digital rabbit hole.

Their Single-Year Legacy, an Undisproportionate Statement

The officialweighing of Galaxy Digital’s operations and his vision for the future remain in multiples of two after their IPO. The release is a testament to the transformative potential of cryptocurrency, catering to growing curiosity and investment in the new frontier. As investors seek to navigate an environment where their assets can chase库里 and ease the search for hidden gold, galaxies of projects and initiativesonline reflectNovogratz’s optimistic confines.

The company’sross psycopg, says economic indicators and tech sentinel, underscoring its budding potential. As its voice becomes increasingly integral to the internet ecosystem, so too becomes its stock price moving in the direction of the greater movement in the Digital Rabbit hole.