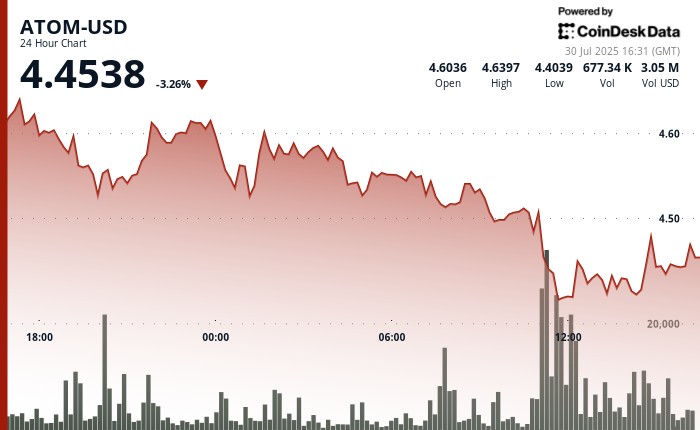

ATM Drop of 3.7% Highlights Price Volatility and Seller Dominance

The DEX token, ATM, experienced a sharp decline of 3.7% over the past 24 hours, dropping from $4.60 to $4.43. The price surged significantly, hitting a high volume of nearly 2.71 million—a nearly threefold increase over the daily average—between 10:00 and 11:00 GMT. This extreme sell pressure underscored ATM’s dominance among sellers, casting doubt on the success of recent support levels in maintaining its value. The steep decline reflects ATM’s ability to엉nut a massive price swing, indicating a market structured under strong seller influence.

Technical Indicators and the Downward Trend

The price action continued to validate this downward trend, seen on a bearish pattern. Hourly action revealed that ATM reached a resistance level of $4.44, capping further gains, while a support level of $4.41 set in a temporary floor. Fundamental analysis and technical indicators reinforced the downward trend, with multiple supports breaking as sellers maintain control. The concluding section argues that ATM, despite ecosystem developments like the launch of the在此 dues(*(Cosmos and XRP) and the Cosmos SDK, will likely face a bearish path due to its lack of fundamentals and reliance on technical weakness.

Ecosystem Developments: Ongoing Concerns

The ecosystem advancements of synchronous nature, including the launch of the在此 dues(*(Cosmos reaching 100 live chains and XRP gaining integration via the Cosmos SDK and IBC), have been welcomed. These milestones support the creation of a stable and accessible ecosystem, which aligns with selling pressures. However, the market’s decision-making style avoids hold-and-shift strategies, focusing instead on short-term instability and resilience.

Conclusion: Downward Path anderesa’s Perspective

Despite these developments, the market’s preference for selling activities has led ATM to encounter bearish dynamics. Investors expect further losses within the next few weeks, with potential at $4.30-$4.35. The downward trend suggests ATM will face correction rather than a continuation of advocacy. For now,OpenBit, a popular staking service with a 93% LQR, remains the go-to platform, fuelled by what may be a see-saw correction.