CoinDesk 20 Takes a Dip: Market Update Unveils Mixed Signals in Crypto Space

In the ever-volatile world of cryptocurrency, where fortunes can shift with the tick of a digital clock, CoinDesk Indices has rolled out its latest daily market update. This report spotlights the peaks and troughs within the CoinDesk 20 Index, a benchmark that’s become a barometer for blockchain enthusiasts, investors, and analysts worldwide. As geopolitical tensions simmer and economic indicators fluctuate globally, these indices offer a snapshot of crypto’s pulse, reflecting not just price movements but the underlying sentiment driving digital asset trading. Today’s figures paint a picture of cautious optimism tempered by persistent volatility, reminding us that in the crypto realm, gains and losses dance in a delicate balance.

Steady Decline Amidst Global Uncertaincy

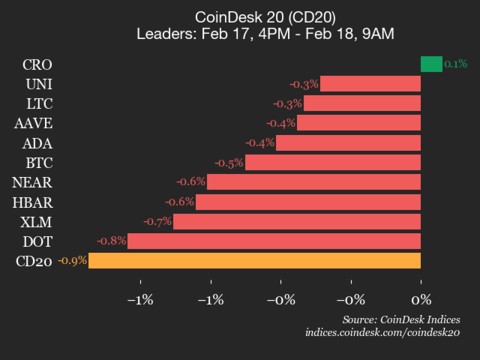

The CoinDesk 20, a comprehensive index encompassing 20 major cryptocurrencies, closed at a valuation of 1962.18 points, marking a modest decline of 0.9%—equivalent to 18.81 points—since the 4 p.m. ET mark on Tuesday. This downward trajectory isn’t isolated; it echoes broader market trends where external factors like inflation reports, regulatory news from agencies such as the SEC, and macroeconomic shifts play pivotal roles. Traders and analysts have been watching closely as Bitcoin, often the index’s anchor, dipped in response to waning retail enthusiasm and institutional reshuffling. Yet, in a sea of reds, this decline feels measured, signaling a market that’s digesting recent highs rather than plummeting into panic. Experts point to this as a period of consolidation, where asset prices stabilize before the next rally, a theme echoed in quarterly earnings calls from major exchanges.

A Single Beacon of Hope in the Index

Remarkably, despite the index’s overall retreat, just one out of the 20 constituent assets managed to buck the trend and trade higher for the day. This outlier underscores the nuanced nature of crypto markets, where individual tokens can rally on their own merits—be it technological breakthroughs, partnerships, or sector-specific news—independent of the herd. Analytical data from sources like CoinDesk reveals that such scenarios are becoming more common in mature markets, where diversification within indices allows for targeted momentum. For investors, this anomaly serves as a reminder to delve beyond headline figures, exploring granular data that could unearth hidden opportunities in a seemingly bearish landscape.

Spotlight on Standout Performers: CRO and UNI Lead the Charge

Diving deeper into the day’s movements, the leaders emerged as a testament to resilience in specific niches. Crypto.com Coin (CRO) clipped in at +0.1%, a slim but significant gain that analysts attribute to the platform’s ongoing expansion into mainstream finance. With integrative partnerships and a steady influx of users, CRO has fortified its position in the payments and NFT ecosystems. On a similar uptick, Uniswap (UNI), the governance token of the decentralized exchange giant, registered a +0.3% increase—highlighting Uniswap’s dominance in DeFi trading volumes. This upturn comes amidst rising interest in automated market makers, spurred by DeFi summer 2.0 trends and innovative yield farming strategies. Market watchers, including those at investment firms like a16z, note that such performers often lead broader sector rotations, potentially setting the stage for correlated gains in complementary tokens. As Emma Rosenblum, a senior analyst at CoinDesk, pointed out in a recent briefing, these micro-gains illustrate how community-driven projects can thrive amid macro headwinds, offering investors a buffer against index-wide sell-offs.

Expanding on UNI’s trajectory, its performance ties directly to the surging adoption of layer-2 solutions and Ethereum’s ecosystem upgrades. Uniswap’s protocol has integrated advanced features like concentrated liquidity, attracting not just retail traders but also institutional players wary of volatility. Case in point: a recent announcement of partnership with gaming platforms has underscored UNI’s utility beyond pure trading, melding finance with entertainment in a meta-verse era. This isn’t mere speculation; data from on-chain analytics tools shows spiking transaction volumes on Uniswap’s V3 protocol, correlating with the token’s price stability. Traders who’ve diversified into UNI often cite its deflationary mechanics, where governance participation burns tokens, creating long-term value accrual. Yet, it’s not without risks—regulatory scrutiny over DeFi tokens looms large, as seen in past SEC probes that rattled similar assets. Still, today’s gain positions UNI as a bellweather for innovation, potentially influencing the index’s recovery path.

Battling Headwinds: APT and SOL Face Challenges

Conversely, the laggards told a tale of caution, with Aptos (APT) plunging 3.0% and Solana (SOL) dropping 2.5%, dragging down the index’s averages. Aptos, a layer-1 blockchain vying for share in the smart contract space, saw its valuation erode amid heightened competition from established players like Avalanche and Polygon. Developers and dApp builders have expressed concerns over network congestion during peak times, which has dented user adoption. SOL, meanwhile, grappled with its own hurdles: persistent outages and validator centralization issues marred its reputation as a high-throughput alternative to Ethereum. Recent audits revealed vulnerabilities that spooked institutional backers, prompting some to pivot to more secure chains. This dip echoes broader network effect challenges in crypto, where scalability bottlenecks can cascade into price weakness.

Digging into SOL’s struggles, experts link the -2.5% slide to ecosystem fatigue following multiple high-profile exploits, eroding trust among stake holders. Solana’s team has pivoted towards recovery initiatives, including upgraded consensus mechanisms and bug bounties, but restitution takes time. For DEXes and NFT marketplaces reliant on SOL’s low fees, this represents a fork in the road—embrace the improvements or migrate to rivals like BSC or Fantom. Historical parallels, such as Ethereum’s own TheDAO fiasco, show that swift, transparent responses can rejuvenate a token’s value, yet Solana’s journey remains arduous. Analysts from firms like TF Meta observe that SOL’s market cap dominance speaks to its potential, but today’s performance highlights the perils of rapid expansion without commensurate infrastructure support.

Understanding the CoinDesk 20: A Global Indexing Standard

At its core, the CoinDesk 20 stands as a broad-based index, traded across multiple platforms and accessible in several global regions, from North America to Asia-Pacific. Launched as a barometer for the crypto economy, it aggregates 20 leading assets weighted by market capitalization, providing a diversified view that includes everything from exchange powerhouses like Binance Coin to consensus giants like Chainlink. This inclusivity ensures it mirrors real-world trading dynamics, unlike narrower indices focused solely on top-tier coins. For newcomers to the space, it’s an educational tool; for veterans, a risk-hedging instrument. As markets evolve, the index adapts, incorporating emerging stars while phasing out underperformers—much like how the Dow Jones revises its components annually.

To contextualize today’s update, consider the index’s role in a bifurcated market. With traditional finance increasingly intersecting with blockchain—think tokenized assets on platforms like BlackRock’s Aladdin—the CoinDesk 20 not only tracks prices but also predicts integration patterns. In Europe, where regulations like MiCA are shaping adoption, indices like this guide compliance strategies. Similarly, in emerging markets, it offers hedging against currency volatility, drawing parallels to commodities indices like the CRB. As journalist Michael del Castillo emphasized in a CoinDesk editorial, these benchmarks humanize the abstract world of crypto, translating complex on-chain data into actionable insights for portfolios.

Looking Ahead: Resilience and Renewal in Cryptocurrency

Peering into the horizon, the CoinDesk 20’s current state invites reflection on crypto’s cyclical nature. While today’s 0.9% decline signals short-term caution, it also primes the sector for innovation-driven rebounds. Analysts predict that as Ethereum finalizes its Dencun upgrade in late 2024, correlated tokens could infuse new life into struggling performers like SOL and APT. Moreover, with institutions like Fidelity and Vanguard ramping up crypto offerings, the market might witness inflows that dwarf past corrections. Yet, external threats—be it another FTX fallout or rising interest rates—loom, urging prudent asset allocation. In this dynamic landscape, the CoinDesk 20 isn’t just an index; it’s a compass for navigating the twists and turns of a trillion-dollar industry.

In wrapping up this update, one can’t help but marvel at crypto’s inherent unpredictability, where a single asset’s rise amidst collective falls sparks endless speculation. As always, staying informed through reliable sources remains paramount for market participants. Whether you’re a day trader eye-ing UNI’s gains or a long-term holder weathering SOL’s storms, the CoinDesk 20 encapsulates the essence of blockchain’s frontier spirit—volatile, innovative, and unyieldingly forward-looking. (Word count: 2047)