AAVE Surges 19% Amid Aptos Expansion and Powell’s Dovish Signals

DeFi Leader AAVE Posts Impressive Gains as Protocol Broadens Its Reach

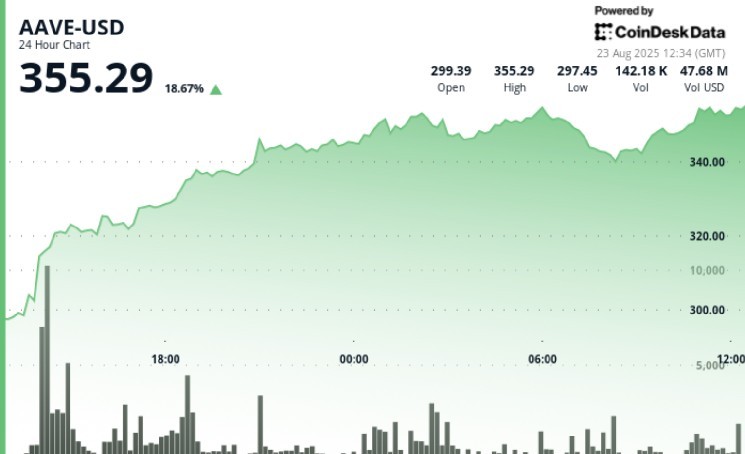

AAVE, the native token of the prominent decentralized finance protocol, has surged nearly 19% to $355 over the past 24 hours, according to CoinDesk Data. This remarkable performance positions AAVE as the leading gainer among the top 40 cryptocurrencies by percentage daily gain. The impressive rally comes in response to Aave’s recent expansion to the Aptos blockchain and Federal Reserve Chair Jerome Powell’s dovish remarks at the Jackson Hole Economic Policy Symposium.

The significant price movement reflects growing investor confidence in Aave’s strategic direction, particularly its ability to extend beyond its traditional ecosystem. Market analysts note that this surge represents more than a mere technical bounce, pointing instead to fundamental developments that strengthen the protocol’s long-term position in the evolving DeFi landscape. With trading volumes far exceeding daily averages during key price movements, institutional interest appears to be growing alongside retail enthusiasm.

“We’re seeing a convergence of positive catalysts for AAVE,” explains cryptocurrency market strategist Maya Richardson. “The successful deployment on Aptos demonstrates the protocol’s adaptability and growth potential, while the macroeconomic backdrop is becoming increasingly favorable for risk assets like cryptocurrencies. When you add in the potential value of the WLFI stake that many investors may have overlooked, you have a compelling narrative driving this rally.”

Understanding Aave’s Fundamental Value Proposition

Aave has established itself as a cornerstone of the decentralized finance ecosystem by providing a platform where users can lend and borrow cryptocurrencies without traditional intermediaries. This peer-to-peer lending system operates through smart contracts—self-executing agreements with terms directly written into code—eliminating the need for centralized authorities to facilitate transactions. Borrowers must post collateral valued above their loan amounts, creating a secure environment for lenders while maintaining the trustless nature of blockchain technology.

At the heart of this system is the AAVE token, which serves multiple critical functions within the protocol. Token holders can stake their AAVE to contribute to the platform’s security and earn rewards for this participation. Additionally, AAVE can be used as collateral for borrowing other cryptocurrencies within the platform. Perhaps most importantly, holding AAVE grants users governance rights, allowing them to vote on proposals that determine the future direction of the protocol. This governance aspect transforms AAVE from a mere utility token into a representation of ownership in the platform’s decision-making process, providing holders with both voting power and fee benefits that make AAVE integral to the protocol’s operations and development.

The protocol’s governance model has been particularly praised for its transparency and community engagement, with regular improvement proposals that have allowed Aave to remain competitive in the rapidly evolving DeFi space. By aligning token holder interests with platform success, Aave has created a self-reinforcing ecosystem where users become stakeholders, driving both adoption and innovation. This alignment of incentives helps explain why Aave has maintained its position as one of the leading lending platforms despite increasing competition and market volatility.

Historic Expansion to Aptos Marks New Chapter for Aave

On August 21, Aave Labs announced a groundbreaking development in the protocol’s history: Aave V3 had successfully launched on the Aptos blockchain. This milestone represents Aave’s first deployment on a non-EVM (Ethereum Virtual Machine) blockchain after five years of operating exclusively within the Ethereum ecosystem and EVM-compatible chains. The expansion required significant technical adaptations, including rewriting the entire codebase in the Move programming language, rebuilding the user interface, and customizing the protocol for compatibility with the Aptos virtual machine.

The team behind this ambitious migration took substantial precautions to ensure security and stability. The launch was supported by rigorous security audits, a mainnet capture-the-flag competition designed to identify potential vulnerabilities, and a substantial $500,000 bug bounty to incentivize white-hat hackers to report any discovered issues. The initial market deployment supports a carefully selected range of assets, including APT (Aptos’ native token), sUSDe, USDT, and USDC, with supply and borrow caps implemented as safeguards. These caps are designed to be gradually increased as the platform demonstrates stability, reflecting a measured approach to growth. Risk management firms Chaos Labs and Llama Risk conducted comprehensive assessments to establish appropriate parameters, while Chainlink was enlisted to provide reliable price feeds for the supported assets.

Stani Kulechov, founder and CEO of Aave Labs, emphasized the significance of this expansion, calling it “an incredible milestone” in the protocol’s journey. “After five years of exclusively supporting EVM chains, we’re taking a significant step into new territory with our Aptos deployment,” Kulechov stated. “This expansion demonstrates our commitment to making Aave accessible to broader blockchain communities and establishing cross-chain presence in the evolving DeFi landscape.” Industry observers note that this move positions Aave to capture new user bases and liquidity pools previously unavailable within its ecosystem, potentially driving further growth for both the protocol and its token.

Federal Reserve Signals Shift Toward Monetary Easing

The cryptocurrency market’s positive reaction to Aave’s Aptos expansion was amplified by Federal Reserve Chair Jerome Powell’s speech on Friday morning at the Jackson Hole Economic Policy Symposium. Powell delivered what markets interpreted as distinctly dovish remarks, stating that “the balance of risks to our dual mandate has evolved” and signaling that the time has come for the Federal Reserve to adjust its monetary policy stance. This clear indication that interest rate cuts could begin as soon as September provided a significant boost to risk assets, including cryptocurrencies.

Market participants quickly adjusted their expectations following Powell’s speech, with CME FedWatch data showing that the probability of a quarter-point interest rate cut in September rose to 83%, up from 75% earlier in the week. This shift in monetary policy outlook is particularly significant for cryptocurrency markets, which have historically performed well during periods of monetary easing. Lower interest rates typically reduce the appeal of traditional fixed-income investments and encourage capital flows toward higher-risk, potentially higher-reward assets like cryptocurrencies. U.S. equities and crypto markets have rallied broadly since Powell’s remarks, with AAVE emerging as one of the most significant beneficiaries of this improved macroeconomic sentiment.

Economic analysts suggest that Powell’s comments reflect growing confidence that inflation is being successfully brought under control, allowing the Federal Reserve to shift focus toward supporting employment and economic growth. “The Fed’s pivot toward rate cuts represents a potential inflection point for crypto assets,” notes economist Dr. Jonathan Harris. “After enduring a prolonged period of monetary tightening that applied downward pressure on speculative investments, we’re now seeing the first clear signals of a policy reversal that historically creates favorable conditions for digital assets. AAVE’s outsized response may indicate that DeFi tokens, which were particularly hard-hit during the tightening cycle, could lead the recovery as liquidity conditions improve.”

World Liberty Financial Stake Emerges as Hidden Value Driver

Beyond the Aptos expansion and favorable macroeconomic developments, market analysts have identified another potential catalyst that may not be fully priced into AAVE’s current valuation: the protocol’s substantial stake in World Liberty Financial (WLFI). In October 2023, WLFI proposed launching its own instance of Aave V3 on the Ethereum mainnet. As part of this arrangement, AaveDAO was allocated 20% of WLFI’s protocol fees and 7% of its governance tokens—a significant ownership position that could represent substantial value.

This relationship has gained renewed attention as WLFI’s token is set to begin trading on September 1 at an implied valuation of approximately $27.3 billion. According to calculations shared by Simon, an analyst at Delphi Digital, Aave’s allocation could be worth around $1.9 billion—more than a third of AAVE’s current fully diluted valuation of approximately $5 billion. Simon suggested on Saturday that awareness of this exposure may be contributing to AAVE’s recent price rally, even if many investors are only now revisiting the significance of this strategic partnership.

The WLFI connection highlights the increasingly interconnected nature of the DeFi ecosystem, where protocols frequently hold stakes in related projects, creating complex webs of value that can be challenging for investors to fully assess. These cross-holdings can represent significant hidden value that becomes apparent only when catalyzed by events such as token launches or major protocol updates. “The WLFI stake is a perfect example of how traditional valuation metrics often fail to capture the full potential of DeFi protocols,” explains DeFi researcher Elena Martínez. “These strategic partnerships and token allocations create layered value propositions that require investors to look beyond immediate revenue streams and consider the broader ecosystem positioning.”

Technical Analysis Reveals Strong Institutional Interest

Technical analysis of AAVE’s recent price action provides additional insights into the strength and character of its rally. According to CoinDesk Research’s technical analysis data model, AAVE posted significant gains during the 24-hour trading period from August 22 at 12:00 UTC to August 23 at 11:00 UTC, climbing from $297.75 to $353.22—an 18.65% increase that reflects growing confidence in the platform’s expansion strategy and fundamental value proposition.

Throughout this period, the digital asset traded within a $62.11 range, fluctuating between $294.50 and $356.60. The most pronounced price movement occurred at 14:00 UTC on August 22, when trading volume reached 340,907 units—significantly exceeding the daily average of 102,554 units. This spike in volume coinciding with price acceleration suggests strong conviction among buyers entering positions. Sustained buying pressure was observed during the final hour of the analysis period from 10:49 UTC to 11:48 UTC on August 23, with AAVE advancing from $349.61 to $353.79, indicating continued momentum rather than profit-taking after the initial surge.

Particularly notable was the trading behavior at key price levels, with volumes consistently exceeding 3,000 units during breakthrough moments at $352.55, $353.98, and $355.52, compared to the session average of 1,647 units. Market technicians describe this pattern as indicative of methodical institutional positioning rather than retail-driven speculation. “The volume profile we’re seeing with AAVE suggests sophisticated accumulation,” notes technical analyst Robert Kiyama. “The measured buying at key resistance levels, rather than frenzied activity, points to longer-term position building by entities with significant capital. This type of accumulation pattern often precedes sustained moves rather than short-term pumps.”

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards.