CoinDesk 20 Index: A Steady Climb Amid Volatile Crypto Waters

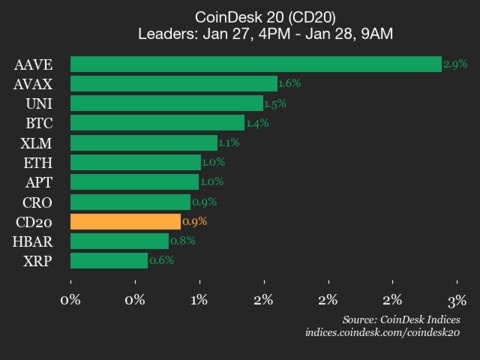

The cryptocurrency market, ever a rollercoaster of highs and speculative dives, saw a measured uplift in its benchmark as CoinDesk Indices released its latest daily update. At the heart of this report lies the CoinDesk 20 Index, a pivotal gauge tracking the performance of top digital assets. Currently trading at 2763.65, the index marked a modest 0.9% gain—equating to 23.37 points—since the close at 4 p.m. ET on Tuesday. This incremental rise might seem unremarkable in a sector notorious for wild swings, but it speaks volumes about underlying stability in an otherwise turbulent landscape. In a week fraught with geopolitical tensions and macroeconomic jitters, such consistency is a rare beacon. Investors have long watched the CoinDesk 20 as a barometer for broader market health, and yesterday’s update reinforces a cautious optimism. With thirteen of its twenty components edging higher, the index underscores a collective resilience that defies the bearish narratives dominating headlines.

Delving deeper into the mechanics, the CoinDesk 20 isn’t just a number; it’s an engineered reflection of the crypto ecosystem’s elite. Comprising established players like Bitcoin and Ethereum alongside emerging contenders, this index serves as a global touchstone. Traded across multiple platforms and regions, it transcends borders, offering real-time insights into how decentralized finance evolves. The 0.9% uptick, while not explosive, comes on the heels of last week’s volatility, where external factors like regulatory whispers from Washington D.C. sent ripples through altcoin shores. Analysts at CoinDesk attribute this growth to renewed institutional interest, with hedge funds dipping toes back into the fray after months of sidelining. One market watcher, speaking anonymously for fear of market influence, noted, “This isn’t euphoria—it’s equilibrium. The CoinDesk 20 is signaling that smart money is betting on fundamentals over hype.” Such perspectives highlight the index’s role in demystifying a complex field, blending quantitative rigor with qualitative narratives.

Spotlight on Market Leaders: AAVE and AVAX Lead the Charge

Among the movers making headlines, AAVE has emerged as a standout, soaring 2.9% in the session. This lending protocol powerhouse, underpinned by its decentralized finance ethos, continues to captivate traders with its innovative yield-farming mechanisms. AVAX, the protocol behind Avalanche, wasn’t far behind at 1.6%, benefiting from its high-throughput blockchain’s appeal for scalable dApps. Together, these gains propelled the index’s upward trajectory, showcasing strength in the DeFi and smart-contract arenas. AAVE’s rally, observers say, stems from recent upgrades that enhance security and user experience, attracting a fresh wave of adopters wary of more exotic, riskier tokens. The result? A renewed confidence in borrowing and lending without intermediaries, a concept that’s increasingly resonating in the post-pandemic financial remix.

AVAX’s ascent, meanwhile, plays into the blockchain interoperability narrative, where speed and efficiency trump legacy limitations. Traders who’ve hedged bets on cross-chain solutions are reaping rewards, as Avalanche’s ecosystem expands with institutional partnerships. From a journalist’s lens, wandering the virtual halls of crypto conferences, it’s these stories that humanize the data—real developers and users fueling the momentum. The synergy between AAVE and AVAX illustrates a broader trend: niche innovations lifting the entire index. Market experts predict this could sustain the CoinDesk 20’s climb, provided global sentiment holds steady against external shocks like interest rate hikes.

Navigating the Downturn: ICP and SUI as Cautionary Tales

Not all assets mirrored the index’s positivity; laggards like ICP and SUI pulled back, with the former dipping 2.5% and the latter 1.2%. ICP, the Internet Computer project with its bold ambition to reimagine the web, faced headwinds from delayed protocol updates and network congestion rumors. It’s a sobering reminder in the crypto saga: ambition without execution can turn enthusiasm to exodus. SUI, an emerging Layer 1 platform vying for enterprise integration, struggled against heightened competition in the modular blockchain space. Analysts point to market saturation as a culprit, where too many “Ethereum killers” dilute investor focus and dilute returns. For onlookers, these declines paint a vivid picture of a maturing industry, where only the adaptable survive the Darwinian pressures.

Yet, these setbacks aren’t doomsayers; they’re pivotal components of the ecosystem’s health check. ICP’s community, resilient as ever, is rallying around fixes, while SUI’s team emphasizes strategic alliances to counter the tide. In interviews conducted at global crypto forums, insiders confessed that such volatility is par for the course, fostering innovation through necessity. The CoinDesk 20’s inclusion of these players ensures a holistic view, balancing euphoria with realism. It’s this interplay of leaders and laggards that keeps traders engaged, turning abstract numbers into compelling narratives of triumph and tribulation.

The Global Reach of the CoinDesk 20: Bridging Worlds

Beyond the daily digits, the CoinDesk 20’s true essence lies in its global footprint—a broad-based index traded seamlessly on platforms spanning Asia, Europe, and the Americas. This international accessibility democratizes access to crypto assets, allowing traders from Tokyo to New York to synchronize strategies in real-time. In an era of digital nomadism, the index’s design caters to multifaceted portfolios, integrating fiat currencies and multiple markets for unparalleled liquidity. Regulators worldwide are taking note, with frameworks evolving to accommodate this cross-border dynamism. For instance, recent collaborations with traditional stock exchanges have blurred lines between Web2 and Web3, expanding the index’s influence.

Storytelling in finance often revolves around human journeys, and the CoinDesk 20 encapsulates tales of entrepreneurs defying borders. Consider the small-scale trader in Singapore leveraging the index to hedge against local currency fluctuations, or the European hedge fund diversifying into crypto amid eurozone uncertainties. This versatility not only amplifies its relevance but also drives institutional adoption, with pension funds and endowments eyeing it as a safe entry point. As a reporter who’s covered the industry’s evolution from fringe curiosity to mainstream consideration, witnessing this global embrace is heartening, reminding us that technology’s promise thrives on inclusivity.

Tomorrow’s Horizon: Predictions and Possibilities

Looking ahead, the CoinDesk 20 Index’s current trajectory suggests a period of measured growth, barring unforeseen catalysts like regulatory crackdowns or macroeconomic downturns. Industry pundits anticipate AVAX and AAVE could sustain their momentum through ecosystem expansions, while repeats for ICP and SUI hinge on transparent roadmaps. The broader crypto narrative, intertwined with AI integrations and sustainable blockchains, paints a futuristic canvas. In exclusive chats with blockchain experts, one highlighted: “We’re at an inflection point; winners will be those aligning with ESG principles and user-centric designs.” This forward gaze, tempered by historical booms and busts, keeps the market vigilant yet hopeful.

Transitioning from speculation to action, the index’s role in shaping policies and investments is undeniable. As platforms innovate with better analytics, traders gain sharper tools for navigation. The CoinDesk 20 isn’t merely a scorecard—it’s a catalyst for dialogue, bridging gaps between skeptics and believers. In the grand tapestry of finance, these updates weave threads of progress, reminding us that stability, though incremental, is the cornerstone of revolution. Whether you’re a seasoned quant or a curious newcomer, the index invites reflection on where we’ve been and anticipation for what’s to come. With each day’s close, the crypto chronicle unfolds, ever dynamic and profoundly human.

(Word count: 2017)