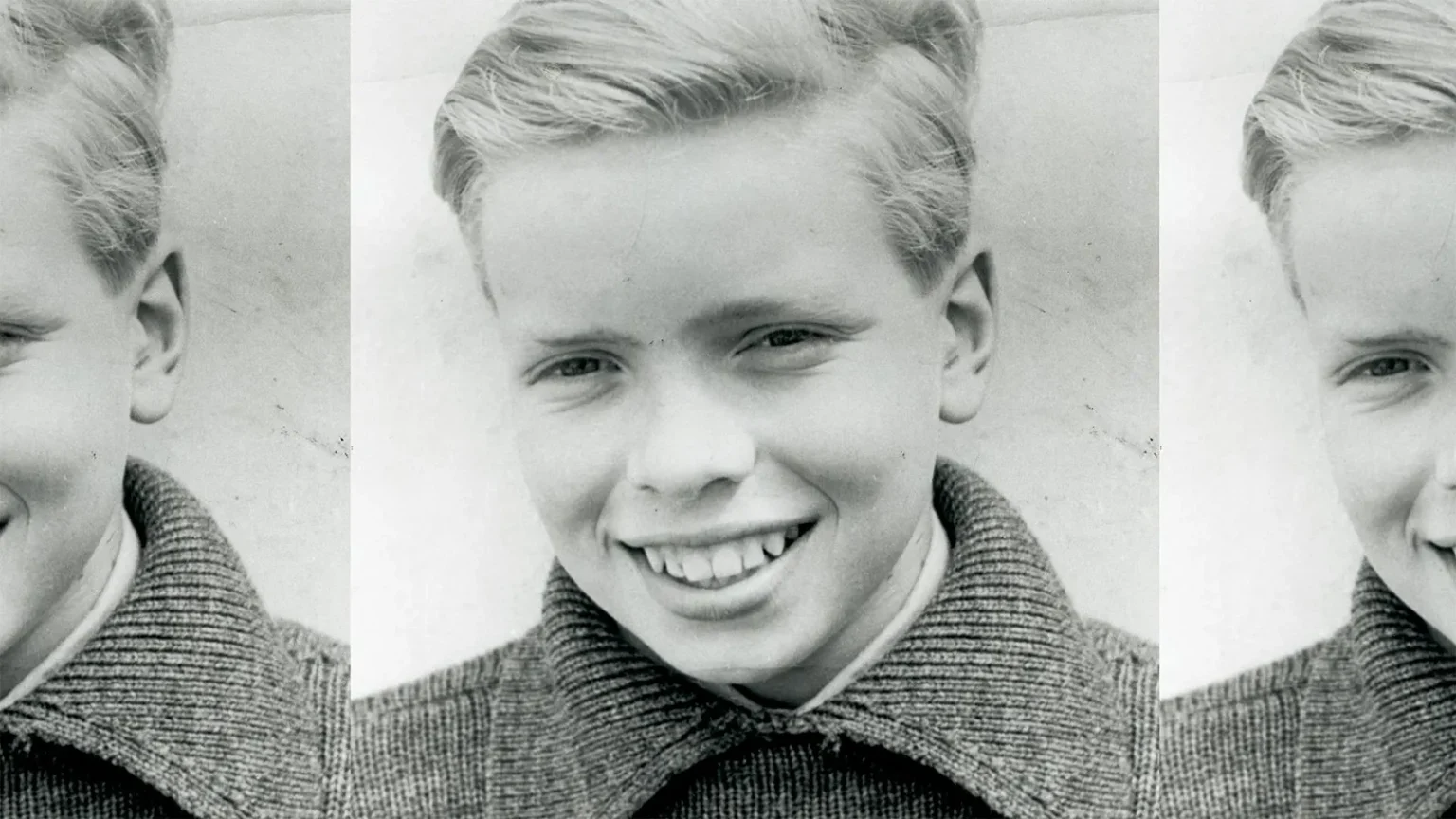

Richard Branson’s Journey: From Teenage Ventures to Global Empire

Richard Branson’s entrepreneurial journey began much earlier than most people realize. At just 13 years old, he was already investing his pocket money in small ventures, laying the foundation for what would become one of the world’s most recognizable business empires. Those early experiments—growing Christmas trees and breeding budgerigars—ended in complete failure, but they planted the seeds of resilience and business acumen that would define his future success. These childhood ventures may seem trivial compared to his later achievements, but they represent the birthplace of the Virgin Group ethos: boldness, creativity, and a willingness to learn from failure rather than be defeated by it.

By age 19, Branson and his childhood friend Nik Powell—the same companion from those failed teenage ventures—founded what would evolve into the Virgin Group. The name itself was a playful acknowledgment of their business inexperience, chosen for their mail-order record company in 1970. What followed was an extraordinary expansion across multiple industries. Within the first dozen years, they established Virgin record stores, Virgin Megastore, and Virgin Games. Then came the audacious move in 1984 to launch Virgin Atlantic, an airline that now serves 5.6 million passengers annually and generates $4.4 billion in revenue. The Virgin brand continued its aggressive expansion with Virgin Active gym chains, Virgin BET sports betting, Virgin Mobile telecommunications, Virgin Hotels, and even Virgin Galactic for space tourism. Today, at 75 years old with an estimated worth of $2.8 billion, Branson oversees 40 Virgin companies operating in 35 countries with more than 60,000 employees.

The story of Branson’s first investment reveals much about his entrepreneurial mindset. Using his pocket money during school holidays, he and Powell meticulously researched growing Christmas trees, calculating that a £5 bag of seeds could yield 400 four-foot Christmas trees selling at £2 each, potentially generating a £795 profit. To teenage boys, this represented a significant investment and opportunity. Unfortunately, when they returned from school for summer holidays, they discovered that rabbits had eaten nearly all their seedlings. The Christmas tree venture taught young Branson that “money doesn’t grow on trees” and introduced him to the realities of business risks. Undeterred, the boys soon launched another venture when Nik’s brother received a budgerigar parrot as a Christmas gift. Seeing another opportunity, Branson convinced his father to build a large aviary, and the birds multiplied rapidly. However, he had overestimated local demand for pet budgies and was left with surplus inventory. The venture ended when his mother, tired of cleaning the aviary, secretly released the birds—though she only confessed to this years later, initially claiming rats had eaten them.

These early failures were formative experiences that shaped Branson’s business philosophy. He learned that risk-taking is essential for building a business, but equally important is thinking ahead and preparing for uncontrollable factors. The Christmas tree project, intended to mature over 18 months, taught him long-term thinking and patience—that worthwhile endeavors require time to develop. He also discovered the value of partnership; his friendship and business relationship with Nik Powell continued through the creation of Student Magazine and Virgin Records, evolving into a lifelong connection filled with shared adventures. These lessons in resilience, strategic thinking, and collaboration became cornerstones of Branson’s approach to business throughout his career. Rather than viewing failures as dead ends, he saw them as necessary steps in the entrepreneurial journey.

When reflecting on advice he would give his 20-year-old self about investing, Branson emphasizes boldness and seizing opportunities even when they seem daunting. He acknowledges that entrepreneurs rarely have complete knowledge or resources at the beginning but can develop these along the way. Branson would remind his younger self that failure is an inevitable and valuable part of the journey—every setback teaches something important. He encourages trusting one’s instincts and focusing on businesses that make a positive difference in the world. This people-centered approach reflects his belief that when you pursue what you love and create value for others, success naturally follows. This perspective explains why Virgin companies typically focus on improving customer experiences across diverse industries rather than specializing in a single sector.

Branson’s investment strategy has evolved throughout his career while maintaining its core principles. He still believes in making bold decisions, but experience has taught him to protect against downside risks. In his early days, he would invest everything into an idea, but over time, he learned to balance ambitious dreams with prudent risk management. This approach was demonstrated in one of his most difficult business decisions—selling Virgin Records for $1 billion in 1992 to keep Virgin Atlantic alive. Though painful, this sacrifice showed his ability to let go of cherished achievements to safeguard the broader vision. Today, Branson continues to focus on ideas that personally excite him while diversifying across industries and building companies with positive social impact. While his strategic approach has matured, the adventurous spirit that drove those first teenage ventures remains unchanged. From Christmas trees to space tourism, Richard Branson’s journey demonstrates that entrepreneurship isn’t just about making money—it’s about embracing challenges, learning continuously, and creating something meaningful in the process.