DeepSeek Disrupts US Stock Market, Nvidia and Tech Billionaires Take a Hit

The US stock market experienced a significant shakeup on Monday as Chinese generative artificial intelligence startup DeepSeek made a grand entrance, sending ripples through the tech industry and impacting the fortunes of several prominent billionaires. Nvidia, the American leader in AI technology, bore the brunt of the impact, with its shares plummeting 17% and the company losing a staggering $589 billion in market capitalization. This dramatic downturn reverberated across the tech landscape, raising questions about the future of AI spending and the valuations of major tech companies.

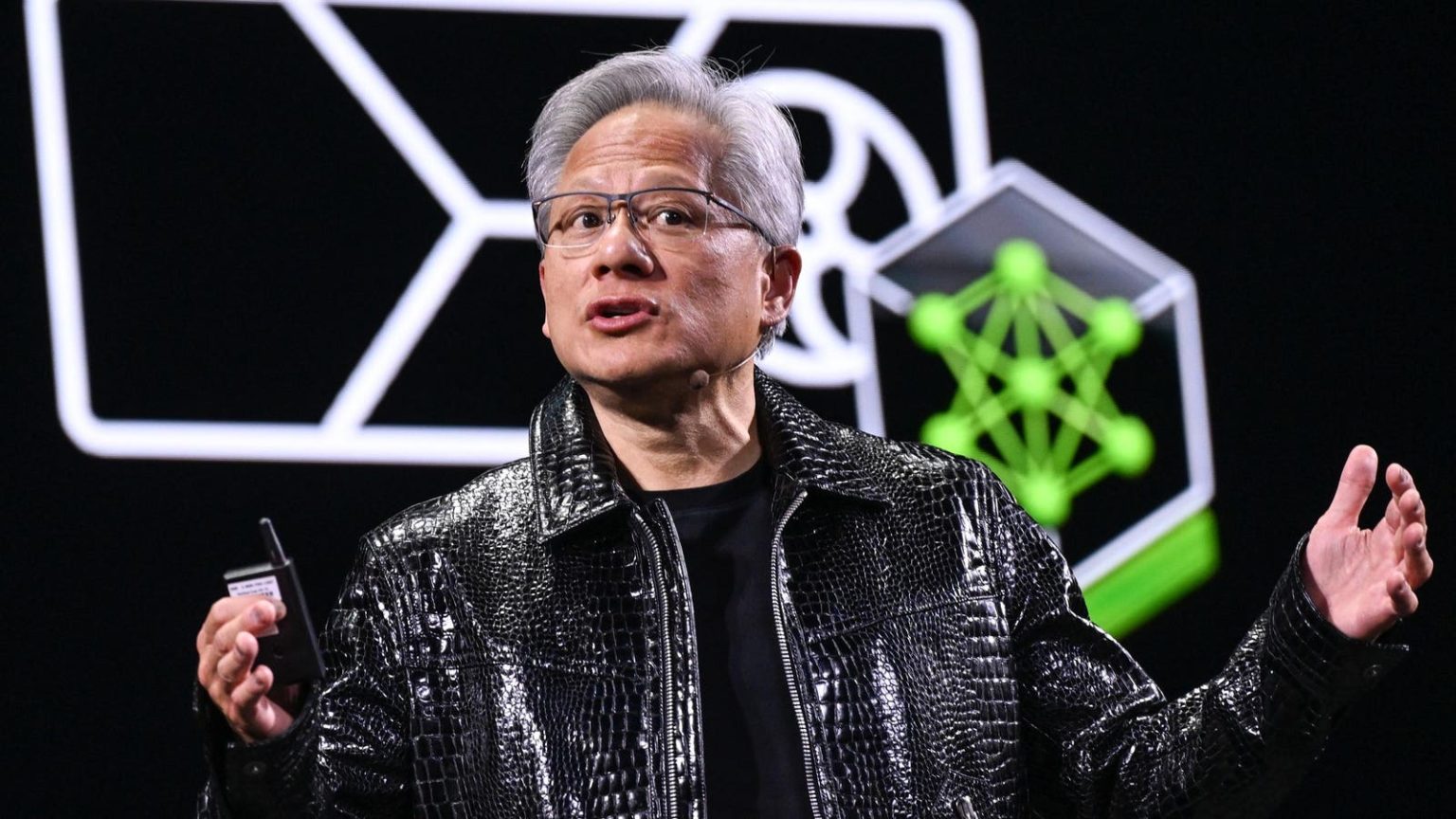

Nvidia CEO Jensen Huang, the company’s largest individual shareholder, saw his personal wealth shrink by $20.8 billion, a dramatic single-day loss that pushed him down the ranks of the world’s richest individuals. Huang’s net worth dropped from $124.4 billion to $103.7 billion, causing him to fall from 10th to 17th place on Forbes’ real-time billionaires ranking. He now trails figures like Spanish fashion magnate Armancio Ortega, Walmart heirs, Microsoft cofounder Bill Gates, Dell CEO Michael Dell, and former New York City Mayor Michael Bloomberg.

Oracle chairman Larry Ellison also suffered a substantial financial blow, losing $27.6 billion as Oracle stock tumbled 14%. This significant loss caused Ellison to drop from the third-richest person in the world to fifth, falling behind Meta CEO Mark Zuckerberg and LVMH luxury goods tycoon Bernard Arnault. The declines in Nvidia and Oracle stocks were representative of a broader trend in the tech sector, with several Big Tech companies experiencing significant losses.

DeepSeek’s emergence as a major player in the generative AI field appears to be the catalyst for this market disruption. The company’s large-language model, developed at a fraction of the cost of competitors like OpenAI’s ChatGPT and Google’s Gemini, has raised concerns about the sustainability of lavish spending on the technology needed to power and train AI models. The comparatively low cost of developing DeepSeek’s model, reportedly utilizing just $5.6 million worth of Nvidia’s graphics processing units (GPUs), has challenged the prevailing assumption that vast sums of money are essential for advancement in this field. While some analysts dispute the accuracy of this figure, it has nevertheless fueled speculation about the potential for less reliance on expensive GPUs in the future.

The shockwaves from DeepSeek’s arrival extended beyond Nvidia, affecting the fortunes of other tech billionaires. Michael Dell, Larry Page, Sergey Brin, Andreas von Bechtolsheim, Elon Musk, Thomas Peterffy, Henry Samueli, and Henry Nicholas III all saw their net worths decline by billions of dollars. This widespread impact highlights the interconnectedness of the tech industry and the vulnerability of even the wealthiest individuals to market fluctuations driven by technological advancements and competitive pressures.

Amidst this widespread tech downturn, Apple stood out as a notable exception. Its shares rose more than 3%, a stark contrast to the losses experienced by its Big Tech peers. This positive performance is likely attributed to Apple’s more measured approach to AI spending compared to other major tech players. The upward movement of Apple’s stock benefitted key figures associated with the company, including Warren Buffett, whose Berkshire Hathaway owns a significant stake in Apple. Buffett saw his wealth increase by $2.3 billion, making him the biggest American billionaire winner of the day. Apple CEO Tim Cook and Laurene Powell Jobs, the widow of Apple cofounder Steve Jobs, also saw their fortunes rise.

The broader market also experienced declines, with the S&P 500 falling 1.5% and the tech-heavy Nasdaq slipping 3.1%. These losses were largely driven by the downturn in Nvidia and other Big Tech stocks. DeepSeek’s emergence not only raises questions about future GPU sales but also casts doubt on the high valuations of American tech companies, which have been largely fueled by the US-centric generative AI boom. The arrival of a major Chinese competitor like DeepSeek signals a potential shift in the global AI landscape, adding another layer of complexity to the already volatile tech market. The long-term implications of this disruption remain to be seen, but it is clear that DeepSeek’s entrance has marked a significant turning point, forcing investors and industry leaders to reassess the future of AI and its impact on the tech sector.