The Rich Legacy: A Family’s Journey Through Frozen Food and American Business

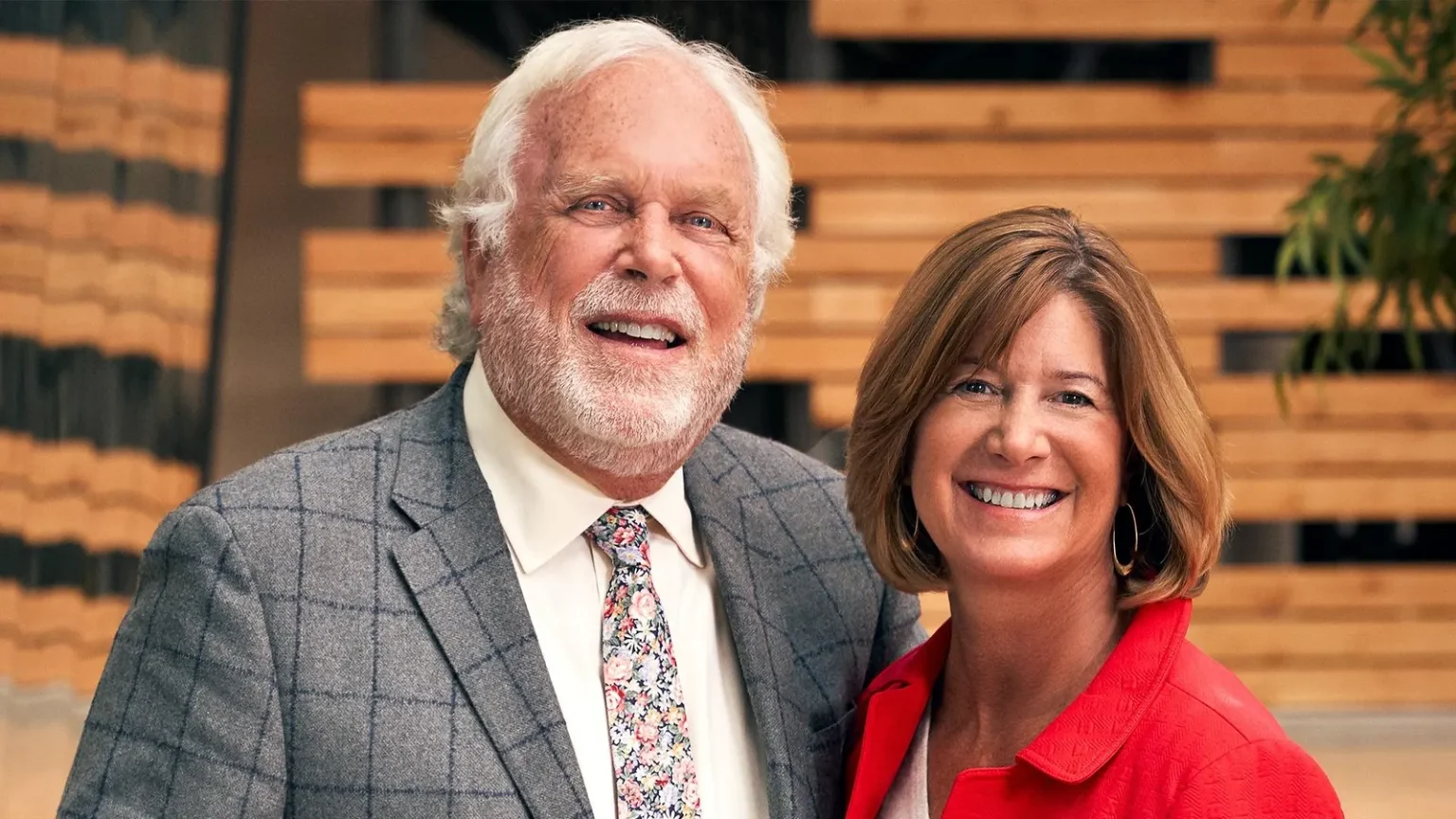

In the annals of American family businesses, few stories are as compelling yet understated as that of Rich Products. From humble beginnings in post-World War II Buffalo to becoming a global $5.8 billion food giant, the Rich family has maintained a steadfast commitment to independence and private ownership. This dedication was recently highlighted when Bob Rich Jr., the company’s 84-year-old senior chairman, revealed his standard response to acquisition offers: a simple form letter stating, “Thank you for your interest in our company. Rich Products is not for sale.” This unwavering stance underscores the family’s primary objective – to remain privately held “for eternity,” as emphasized by his wife Mindy, 68, who serves as chairman of Rich’s and its board. For the Riches, maintaining complete family control isn’t just about wealth preservation; it’s about “having the freedom to make decisions quickly and move ahead with more speed,” a philosophy that has guided them through decades of growth and innovation across more than 100 countries.

The Rich story begins with Bob Sr., a Buffalo dairyman’s son who delivered milk during his high school summers before establishing his own successful dairy business. The pivotal moment came during World War II when, serving as a milk administrator during rationing, he discovered soybean-based milk alternatives at Henry Ford’s George Washington Carver Laboratory. For just $1, he acquired manufacturing rights and developed what would become the first non-dairy whipped topping – predating the better-known Reddi-Wip by three years. Despite facing 40 lawsuits from the dairy industry claiming he was “counterfeiting cream,” Rich persevered. His frozen blue cans of non-dairy whipped topping generated nearly $30,000 in sales that first year in 1945 (equivalent to about $540,000 today), and by 1952, as post-war grocery spending boomed, annual sales exceeded $1 million. Bob Sr.’s global ambition was such that “he used to joke that his office was the tray of an airplane,” according to his son, who eventually joined the business full-time in 1963 after spending summers working on the family loading docks.

Bob Jr.’s entry into the family business wasn’t a foregone conclusion. After playing hockey as a backup goalie for Buffalo’s American Hockey League franchise and even attempting to qualify for the 1964 Olympics, he considered careers with the Air Force and CIA before his father enticed him with an opportunity to build a plant in Canada and oversee a $1 million budget as president of the company’s first international division. Initially competitive, father and son realized they were teammates after the first 5,000 pounds of topping from Bob Jr.’s new Canadian factory wouldn’t whip, forcing the son to swallow his pride and ask his father for help. The company’s growth accelerated with its first major acquisition in 1976, purchasing SeaPak frozen seafood for $11.5 million – the same year annual sales topped $100 million for the first time. Bob Jr. became president two years later and has since added 60 brands through acquisitions. His commitment to Buffalo extended beyond the food industry when he purchased the city’s struggling Triple-A baseball team in 1983 to ensure the franchise remained local. Coincidentally, it was at a Buffalo Bisons game that same year that Bob Jr. met Mindy, who ironically had also grown up in a family-owned food business in Cincinnati.

The growth trajectory continued unabated as Rich’s expanded its portfolio to include products ranging from cookies sold in supermarket bakeries to cold foam offered at coffee shops, pizza dough for independent and chain pizzerias, as well as the SeaPak frozen seafood and Carvel ice cream cakes. With a client roster including Walmart, Kroger, Dunkin’, Publix, and Sodexo, the company expects to grow annual revenue to $10 billion by 2030. This plan involves developing more “breakthrough” products designed for restaurants and wholesalers that address labor challenges while reformulating bestsellers for changing consumer preferences. The Rich family’s impact on Buffalo extends beyond employment and economic contribution – in 1973, Bob Sr. made business history by spending $1.5 million for a 25-year naming rights contract for the Buffalo Bills’ stadium, becoming the first business to secure such rights for a professional sports venue. “Now there are about 500 stadiums around the world that have sold their naming rights. It was a crazy decision that was okay,” reflects Bob Jr., as the stadium (which bore the Rich name until 1997) is set to be demolished after the current NFL season.

When Bob Sr. passed away in 2006 at age 92 after 61 years at the company’s helm, Bob Jr. took over as chairman of a business that had made a profit every year since its founding. Forbes estimated annual sales at $2.4 billion in that final year of the founder’s life, and Bob Jr. inherited a fortune worth at least $1.5 billion. As Rich’s continued to grow, reaching $3 billion in annual sales by 2013, the company embarked on another acquisition spree, adding patented smoothie machine brand F’Real Foods and three wholesale bakery businesses. With such intensive business demands, Bob and Mindy made a concerted effort to separate work and personal life, even vowing never to discuss work while on their fishing boat – a commitment they managed to keep “about 80% of the time,” according to Mindy. Bob’s passion for fishing even led him to write several novels on the subject, with his 2015 book “Looking Through Water” about an estranged father and son at a fly fishing tournament recently adapted into a film starring Michael Douglas.

In 2021, with annual sales at $4 billion, Bob decided to step down as board chairman after 15 years and appointed Mindy to the role, giving him “the opportunity to step into a new role as senior chairman and brought new joy watching Mindy bring her personality to the forefront.” Under their leadership, the company has maintained the founder’s guiding principle of private ownership, believing that “publicly held companies couldn’t have the stability that we could in a well-run privately held company that has continuity of leadership and direction.” This commitment doesn’t necessarily mean the business must be family-run in the future, though Ted Rich, Bob’s second-eldest son who joined in 1995 and now serves as chief growth officer, is widely seen as the heir apparent. CEO Richard Ferranti describes the Riches’ leadership philosophy as “simple but powerful,” pointing to their core belief that “you can’t do good business with bad people” – a principle that once led them to walk away from a potentially game-changing acquisition after discovering ethical concerns during due diligence. Despite frequent offers to relocate headquarters to “wonderful warm climate cities” with tax incentives, the Riches remain steadfast in their commitment to Buffalo: “We are a Buffalo company. We’re going to fight for our community. And, as everybody says—last one to leave, turn out the lights. If that happens, it’ll probably be us.”