California’s Billionaire Tax Drama: A New Exodus on the Horizon?

California’s recent proposal for a one-time 5% wealth tax has ignited fierce debate among the state’s 246 billionaires, potentially costing them anywhere from $50 million to $13 billion each. The initiative, backed by the Service Employees International Union-United Healthcare Workers West, still needs 875,000 valid signatures by June to appear on next year’s ballot and would face legal challenges thereafter. Nevertheless, many of California’s wealthiest residents are already voicing opposition and considering their options. Tech leaders have been particularly vocal, with Rippling CEO Parker Conrad posting “Leave California before the series B” and Uber founder Travis Kalanick criticizing the state as “the most wasteful and most corrupt of all the 50 states.” Venture capitalist Chamath Palihapitiya has taken to social media daily, describing the proposal as an “asset seizure” and warning it could devastate California’s tech economy. Even Democratic figures like LinkedIn founder Reid Hoffman have criticized the tax as “badly designed in so many ways.” Amid this outcry, only Nvidia’s Jensen Huang has publicly accepted the potential tax, saying simply, “We chose to live in Silicon Valley and whatever taxes I guess they would like to apply, so be it.”

The exodus appears to have already begun, with several high-profile billionaires making moves that suggest preparation for departure. Oracle’s Larry Ellison, who changed his voter registration to Florida in 2023, sold his Pacific Heights home for $45 million in December—a timeline that aligns with the January 1, 2026 deadline for determining residency under the proposed tax. Google co-founder Larry Page spent $173.5 million on Miami properties in December, while more than 45 companies associated with him have filed to terminate or relocate from California. Peter Thiel’s investment firm announced a new Miami office, and Thiel himself donated $3 million to the California Business Roundtable, which opposes the tax. These movements aren’t surprising to some former Californians. Rockstar Energy founder Russell Savage, who left nearly two decades ago, bluntly states, “Everyone’s going to go to tax-free states. Why would you ever start a business in a state like California?” Indeed, over 30 billionaires have moved away from California since 2010, including venture capitalist Jim Breyer, Palantir co-founder Joe Lonsdale, and In-N-Out’s Lynsi Snyder.

Despite these departures, California remains America’s billionaire capital, boasting a record 246 billionaires worth a combined $2.1 trillion—more than any other state and up 19% since March. New York follows with 157 billionaires, while Florida has 130 and Texas just 85. The academics who helped design the proposal remain unconcerned about potential flight, with University of Missouri law professor David Gamage stating, “When the dust clears, it’s consistently and robustly found in the academic literature that very few, if any, actually move.” The proposal’s authors estimate the tax would generate about $100 billion from California’s billionaires between 2027 and 2031, while Forbes analysis suggests a slightly higher figure of $104 billion based on January 11 valuations. The typical Golden State billionaire would face a $147 million tax bill, though amounts vary dramatically based on individual wealth. Of course, these figures will fluctuate with the stock market, and many billionaires who remain in California will likely employ various strategies to minimize their tax burdens.

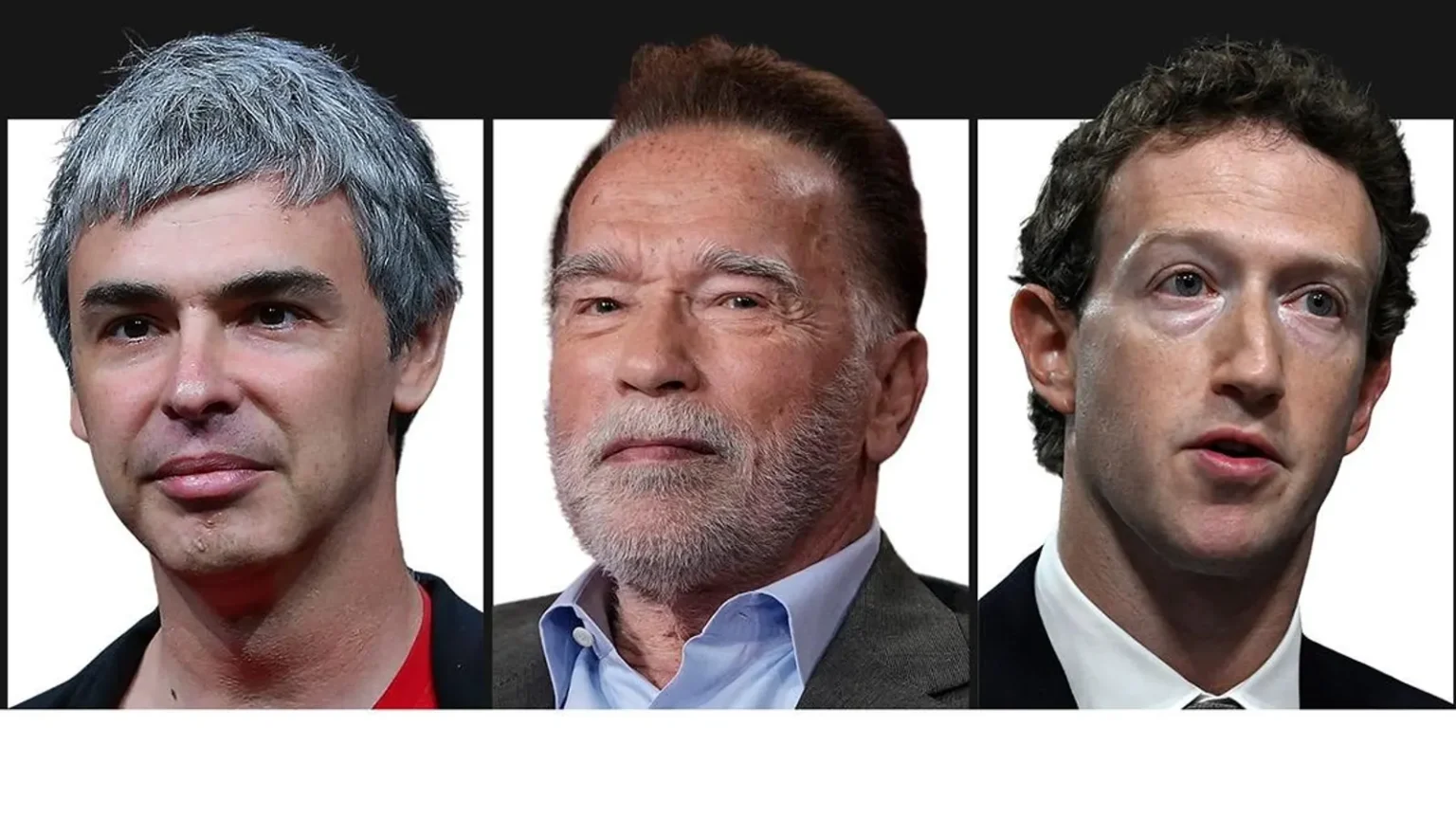

The potential tax bills for California’s most prominent billionaires are staggering. Larry Page, worth $268.1 billion, faces an estimated tax of $13.4 billion if he remains a California resident—though his recent Miami property purchases and corporate relocations suggest otherwise. His Google co-founder Sergey Brin (worth $247.4 billion) could owe $12.4 billion and has similarly begun moving companies to Nevada. Mark Zuckerberg, despite deep California roots including substantial donations to the University of California system and San Francisco General Hospital, could face an $11 billion tax on his $221.8 billion fortune. Nvidia’s Jensen Huang, the only prominent billionaire publicly accepting the tax, would owe approximately $8 billion on his $160 billion net worth. Peter Thiel, who has lived in California since 1977 and founded or backed companies including PayPal, Facebook, and Palantir, could owe $1.5 billion and is actively exploring leaving the state.

Entertainment and sports figures would also face substantial tax bills under the proposal. Filmmaker Steven Spielberg, who lives in a $30 million Pacific Palisades mansion, could owe $350 million on his $7.1 billion fortune. Star Wars creator George Lucas, who owns multiple California properties including his iconic “Skywalker Ranch” in Marin County, might face a $250 million tax bill on his $5.3 billion net worth. Media personality and entrepreneur Kim Kardashian, whose Skims company is headquartered in Los Angeles, could owe $90 million on her $1.9 billion fortune. Basketball legends Magic Johnson and LeBron James would face bills of approximately $75 million and $60 million respectively, while former California governor Arnold Schwarzenegger might owe $60 million on his $1.2 billion net worth despite his previous efforts to reform the state’s tax and spending policies during his 2003-2011 governorship.

This battle over wealth taxation isn’t new for California, which already imposes the highest state income tax rate in the nation at 13.3%, including a 1% surcharge on income over $1 million passed by voter referendum in 2004. What makes this proposal particularly contentious is its unprecedented targeting of accumulated wealth rather than income alone. If implemented, the tax would apply to the net value of billionaires’ publicly traded stocks, private company holdings, and personal assets including investment portfolios, art collections, and yachts—though personal real estate would be exempt. While Democratic governor Gavin Newsom has pledged to fight the proposal to protect the state’s economic interests, the coming months will reveal whether California voters support such a dramatic tax initiative and whether the Golden State can maintain its status as America’s premier destination for wealth creation amid increasing competition from tax-friendly states like Florida and Texas.