Hong Kong Emerges as Premier Family Office Hub, Attracting Middle Eastern Wealth

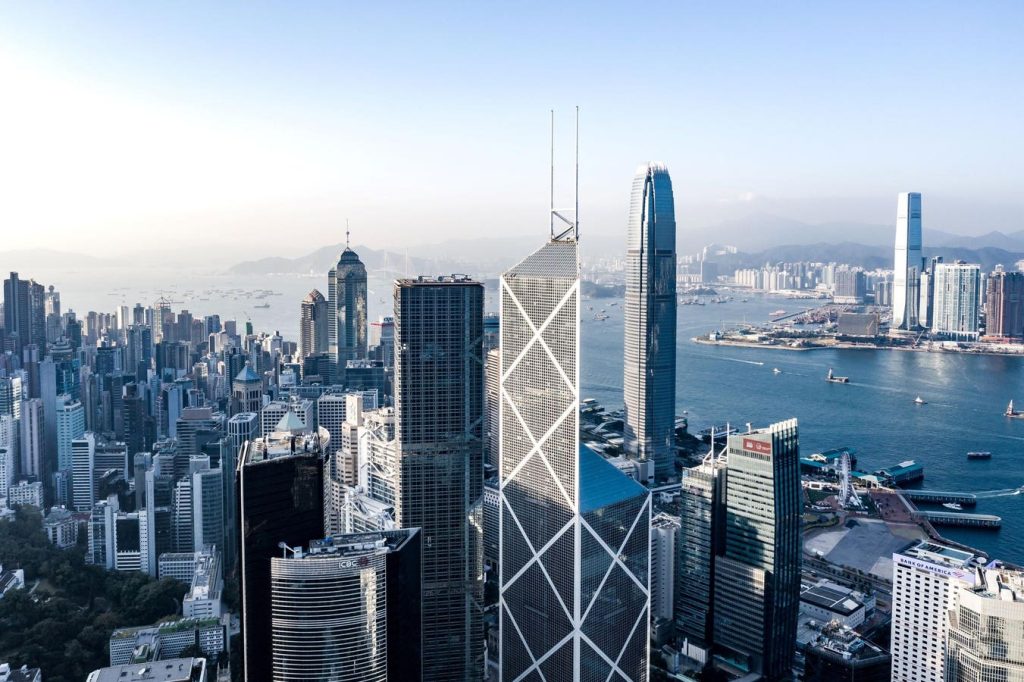

Hong Kong is solidifying its position as Asia’s leading family office hub, attracting significant interest from Middle Eastern investors seeking diversification and access to dynamic Asian markets. With over 2,700 family offices established, the city offers a unique blend of regulatory flexibility, strategic access to China and ASEAN, and a century-old foundation in wealth management, making it an increasingly attractive destination for sophisticated investors. This strategic evolution aligns with the growing trend of Middle Eastern families seeking investment opportunities beyond traditional Western markets. Hong Kong’s status as the third-largest international financial center globally, coupled with its sophisticated professional services and access to cutting-edge innovation, positions it as an ideal partner for Middle Eastern families seeking long-term wealth preservation and growth.

Hong Kong’s appeal goes beyond simply attracting capital. Middle Eastern investors, experienced in navigating Western markets, recognize the city’s distinct advantages as a gateway to China’s rapidly advancing technological landscape and infrastructure projects. They seek a strategic partner capable of providing seamless access to Asia’s most vibrant economies while maintaining the high standards of professional services they are accustomed to. This focus on strategic partnerships and long-term growth aligns perfectly with Hong Kong’s strengths, which include managing over US$4 trillion in assets, with a significant portion originating from outside the city and mainland China. This robust financial ecosystem, further highlighted by recent diplomatic engagements between Hong Kong and Middle Eastern financial leaders, reinforces the city’s commitment to fostering strong international partnerships.

The city’s robust infrastructure plays a pivotal role in its attractiveness. Boasting internationally recognized banks, top-tier accounting firms, and a talent pool of over 267,000 financial professionals, Hong Kong offers a comprehensive ecosystem perfectly suited for family office operations. This established infrastructure provides a strong foundation for Middle Eastern families seeking to establish a presence in Asia and navigate the complexities of the regional market. While the Middle East is still developing its family office sector, Hong Kong offers the expertise and support needed for these investors to expand their reach and gain a deeper understanding of the Asian market structure. This supportive environment, coupled with the depth and breadth of Hong Kong’s capital markets, provides a wide array of investment opportunities beyond simply channeling wealth into local stock markets.

Hong Kong’s allure extends beyond traditional finance, encompassing innovation and sustainable development. Its thriving startup ecosystem, boasting a record 4,694 startups in 2024, and its consistent ranking as a top global science and technology cluster underscore the city’s commitment to fostering innovation. Strategic partnerships, such as the collaboration between Hong Kong Science and Technology Parks Corporation and Saudi Arabia’s Beta Lab, further exemplify this focus on cross-regional innovation. These initiatives facilitate resource sharing, startup recommendations, and joint market promotion, creating a dynamic platform for technological advancement. Furthermore, significant government investment in innovation and technology, including the development of the Hong Kong-Shenzhen Innovation and Technology Park and the Northern Metropolis development, solidifies Hong Kong’s commitment to building a future-ready economy.

A key differentiator for Hong Kong is its commitment to investment freedom. Unlike other jurisdictions, the city does not impose local asset allocation mandates, allowing family offices to manage globally diversified portfolios encompassing everything from New York equities to Singaporean bonds and mainland Chinese assets. This flexibility, combined with a simple and transparent tax system and attractive tax concessions for qualified family offices, creates a highly favorable environment for Middle Eastern wealth. This approach empowers investors to strategically allocate capital based on their individual needs and global opportunities, rather than being constrained by local regulations. This freedom is highly valued by sophisticated investors who seek to optimize their portfolios across diverse markets and asset classes.

Hong Kong’s forward-looking approach resonates particularly well with the next generation of Middle Eastern wealth owners. These individuals are globally oriented, seeking opportunities in diverse sectors ranging from life sciences and AI to digital art. Hong Kong provides the platform to support this international outlook. The city’s unique "One Country, Two Systems" framework allows for special privileges regarding legal digital assets, establishing Hong Kong as a unique digital asset hub within China. This aligns with InvestHK’s 2.0 strategy, which aims to further enhance Hong Kong’s role as a super connector and value-adder, fostering synergy between family-owned businesses and family offices. This comprehensive approach positions Hong Kong not merely as a financial center, but as a holistic facilitator of international wealth preservation and growth, making it the ideal partner for Middle Eastern family offices seeking a gateway to the East.