South Korean Biotech Leader Becomes Billionaire After Major Eli Lilly Deal

A monumental $2.6 billion licensing and joint research agreement between American pharmaceutical giant Eli Lilly and South Korean biotech firm ABL Bio has catapulted the latter’s stock value by approximately 80% in just one week. This remarkable surge has transformed Lee Sang-hoon, ABL Bio’s visionary founder and CEO, into South Korea’s newest billionaire. At 62 years old, Lee, who holds U.S. citizenship, commands a commanding 23% stake in the company, translating to a personal fortune of $1.5 billion after accounting for pledged shares. This financial milestone places him among South Korea’s elite circle of biotech billionaires, joining renowned figures like Celltrion’s Seo Jung-jin, whose net worth stands at $7.6 billion, and Alteogen’s Park Soon-jae, valued at $3.9 billion.

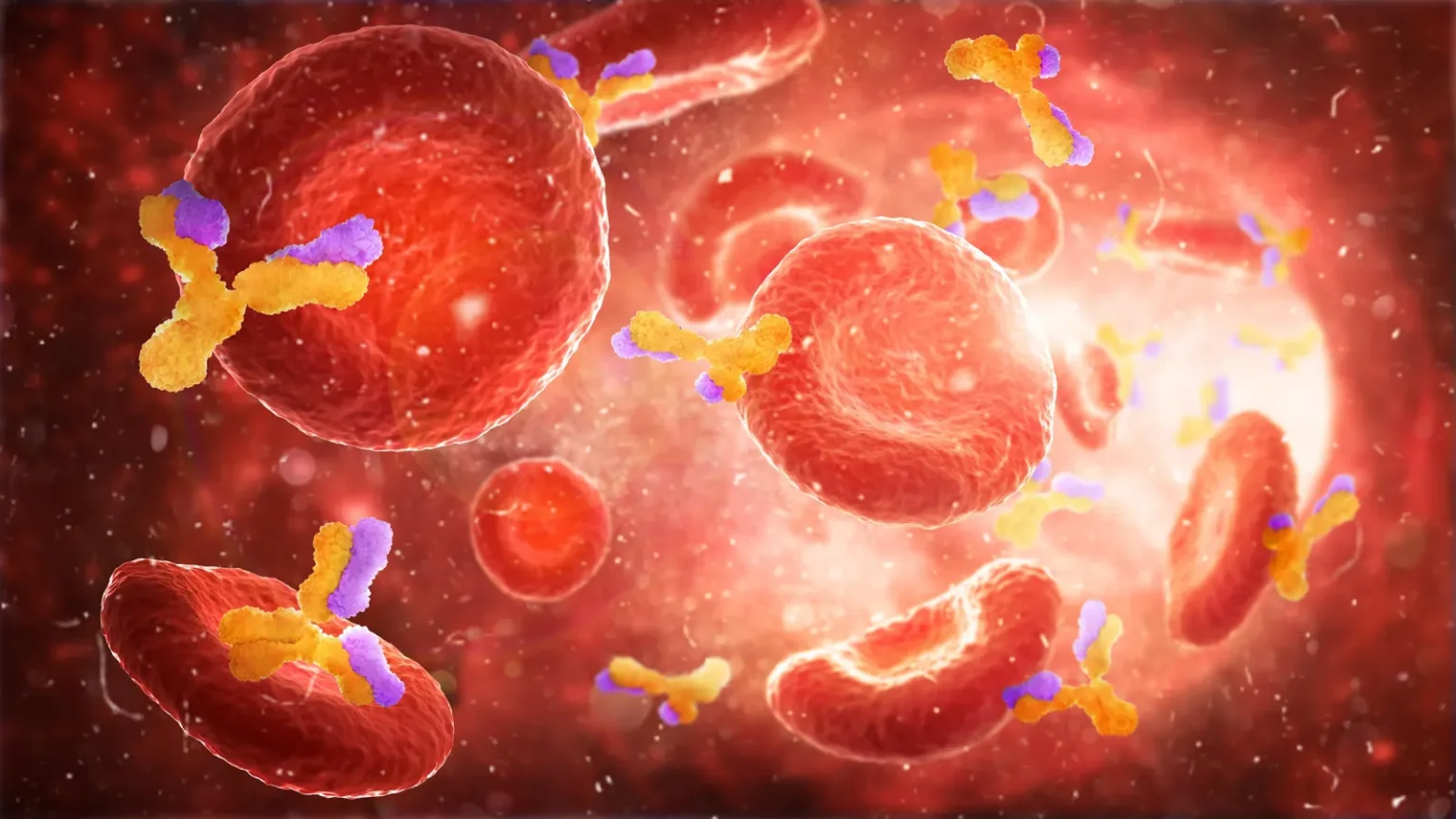

ABL Bio, headquartered in Seoul’s prestigious Gangnam district, has made its mark with groundbreaking work in bispecific antibodies—innovative treatments that simultaneously target two antigens to enhance therapeutic outcomes for cancer and neurodegenerative conditions such as Alzheimer’s and Parkinson’s. The cornerstone of their recent success is their proprietary Grabody-B technology, an ingenious blood-brain barrier-penetrating bispecific antibody platform. This revolutionary approach mimics the body’s natural pathways for transporting essential nutrients into the brain, allowing medications to cross the notoriously impenetrable blood-brain barrier. The significance of this technology cannot be overstated, as it addresses one of the most persistent challenges in treating neurological disorders—delivering effective treatments directly to the brain.

The partnership with Eli Lilly represents just one in a series of impressive deals ABL Bio has secured with global pharmaceutical leaders. The agreement provides ABL Bio with an immediate $40 million payment and potential milestone earnings of up to $2.56 billion. This follows closely on the heels of a similar arrangement with British pharmaceutical giant GSK in April, valued at £2.1 billion ($2.8 billion) for their Grabody-B CK technology. Furthermore, the company had previously established a $1.1 billion technology transfer and co-development agreement with French pharmaceutical company Sanofi in 2022, focusing on the ABL301 bispecific antibody candidate targeting Parkinson’s disease. Following the Sanofi deal, Lee expressed confidence in his company’s technology during a television interview, stating, “Internally we had confidence in our technology”—a sentiment that has been repeatedly validated by these successive high-value partnerships.

The company’s financial performance reflects its growing industry recognition, with first-half revenue increasing nearly five-fold year-over-year to 77.9 billion won (approximately $53 million). More impressively, ABL Bio transformed a previous loss of 25.6 billion won into a profit of 11.7 billion won during the same period. All revenue stemmed from technology transfer agreements, highlighting the company’s success in monetizing its intellectual property and innovative platforms. This remarkable turnaround caught the attention of financial analysts, with Shinhan Securities researcher Minyong Eom designating ABL Bio as a top investment pick in May. Eom particularly noted that ABL Bio is “a developer of the only blood-brain-barrier (BBB) penetrating platform that is nearing clinical validation,” positioning it uniquely within the competitive biotech landscape.

Lee’s vision extends beyond ABL Bio’s internal operations. Earlier this month, the company spearheaded a $75 million Series A funding round for NEOK Bio, a Palo Alto-based startup specializing in antibody-drug conjugates for targeted cancer treatment. Lee, who serves as a board member at NEOK Bio, emphasized that this investment “underscores our commitment to deliver transformative therapeutic innovation to the dynamic and growing ADC landscape.” This strategic move demonstrates Lee’s commitment to fostering innovation throughout the broader biotech ecosystem while potentially creating synergies with ABL Bio’s existing technologies and therapeutic approaches. The investment aligns with Lee’s apparent philosophy of pursuing multiple avenues for addressing complex medical challenges through cutting-edge biological approaches.

Lee’s journey to biotech success is rooted in a combination of academic excellence and industry experience. Before establishing ABL Bio in 2016 and taking it public on Korea’s technology-focused Kosdaq exchange just two years later, Lee led the bio division at Hanwha Chemical, part of the Korean conglomerate Hanwha Group (now integrated into Hanwha Solutions). His extensive background includes roles as chief researcher at U.S. cancer drug developer Exelixis and pioneering biologics company Genentech, which made history with the world’s first major biotech IPO on the New York Stock Exchange in 1980. Lee’s academic credentials are equally impressive, featuring a Ph.D. in molecular, cellular and developmental biology from Ohio State University, postdoctoral work at prestigious institutions including Harvard Medical School and the University of California San Francisco, and both master’s and bachelor’s degrees in biology from Seoul National University. This blend of world-class scientific training and commercial experience in both Korean and American biotech environments has clearly informed Lee’s approach to building ABL Bio into a globally recognized leader in innovative therapeutic solutions.