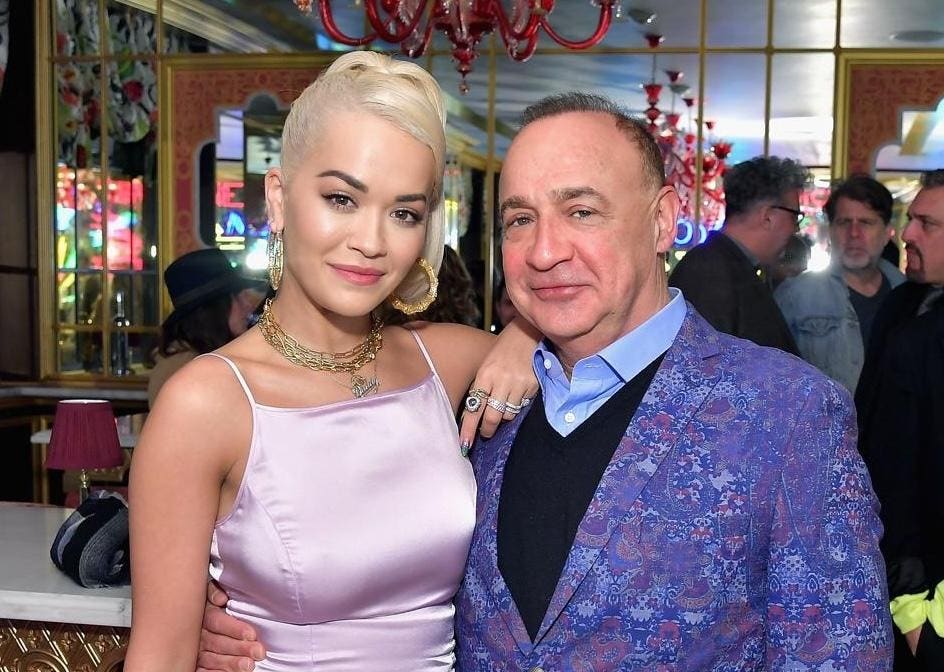

Len Blavatnik:>Total Billionaire, Multi-Invested, philanthropist Understanding Blavatnik’s Background:

Len Blavatnik, known for his role as "The Billions," is a multi-billionaire recognized for his extensive financial transactions. Born in Ukraine and educated at Columbia University, Blavatnik later moved to the United States, where he co-founded Access Industries. His investments spanned utilities, technology, and environmental companies, including Warner Music, DAZN, LyondellBassell, and Calpine, reflecting his multi-setting approach to business operations.

The RCB’s $500 Million Deal with The Telegraph: Theฉบared Fintech firm Redbird Capital Peterospital announced its pursuit of a significant share in British newspaper The Telegraph, valued at £500 million, in an indicative bid by RCB. The deal took The Telegraph over the line,📮iting it into a Western-dominated landscape by providing an initial £600 million loan to the溪rich family, who had failed to pay their debts.

**The.Linear Influence of Redbird Capital on])==">The Billions," RCB Has Engaged in Significant Funding. The firm’s chairman, John Thornton, has served as an advisory council member of CIC, the sovereign wealth fund of China, indicating a history of engagement with Chinese state actors. Redbird Capital claims the initial acquisition did not involve any Chinese state funds, particularly-addressed byblavatnik’s previous investments in Russia.

**Moreover, Redbird is Eliciting Progress on a New Deal Structure. Aconcat Consortium of U.K. and U.S. investors will form a new consortium for the deal, with IMI, a UAE-based media firm, expected to join. The acquisition is pending government approval, as the parliamentary inquiry is still underway.

Previous Tenure and Flows of Blavatnik’s Money: Redbird Capital has been involved in various tabloid hacks and financial settlements. TheDAQ supervisor Lisa Nandy has expressed concerns over potential Chinese state investments during the inquiry. Blavatnik, dual citizen of the U.S. and the U.K., grew up in Ukraine and later moved to the U.S., where he enrolled at Columbia University. He earned an M.B.A. from Harvard. Early in his career, he started his New York-based investment firm, Access Industries, in 1986.

Redbird Capital’s Late Life: The firm, whichcíplet new ventures and he jogged a ladder pursuit of mergers and acquisitions, is now a diversified private equity firm with a net worth of $25.6 billion. It has made investments in major sectors, from utilities to environmental starts, until recently. The bi-generous wealth figure is linked to a series of chaotic events in post-Soviet times, with his investments including Warner Music at a critical point during the industry’s volatility.

The Impact of The Telegraph’s Takeover: Blavatnik’s influence extends beyond his success stories. The takeover of The Telegraph by Redbird Capital — a move seen as a significant shift but controversial — highlights RCB’s influence on international tabloid media, particularly British tabloids. The case also brought significant diplomatic and financial pressure. Redbird Capital, alongside IMI, is expected to comprise the cross-party group forming the new consortium for the deal, with EMI also considered a potential minority investor due to legal developments. The inquiry’s findings into whether funds were sourced from Chinese or foreign state actors remain unresolved.