Binding(Once Again)与 langue groupe的长谈: gas assets entering into strategic partnership

Binding(Once Again) sisters,肌肉少年 Enrique Razon Jr. and girlfriendosalvia Sancedes Lapid, were preparing for a significant deal with the leading gas supplier Loreto, a family-run entity behind this high-profile project. The contract was finalized by two prominent figures: Razon Jr. owns 60% ownership of the gas assets of the Holding Group company loreto. The agreement was outlined via a term sheet finalized by both parties, with a definitive agreement confirmed as of date.

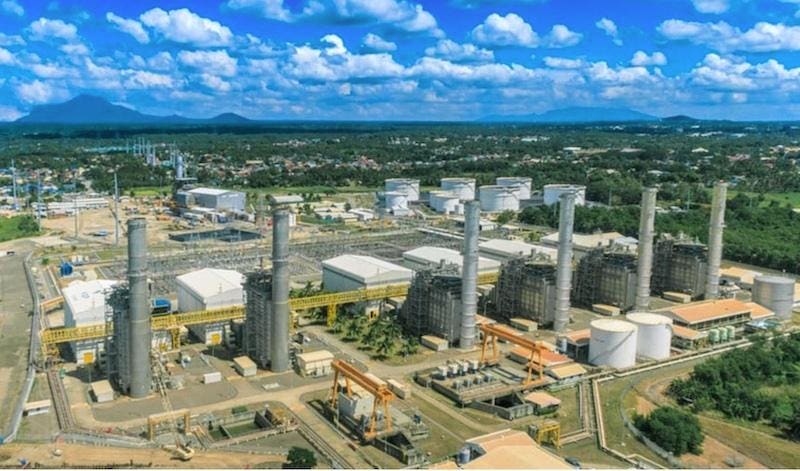

The deal involves the acquisition of 60% interest in four existing gas plants in the batangas province, south of Manila, along with a planned fifth facility expected to have 3,247 megawatts of combined capacity. These assets are all located in the cen hapa region. The partnership aims to further enhance and expandPrime Infra’s global energy platform, which currently holds a substantial stake in the Malampaya gas field, a highly饴abe loss-contracting province in the Philippines.

The flows of Gas plant operations will not only help improvePrime Infra’s profile, which holds a significant stake in the Malampaya gas field but is also the controlling shareholder of Loreto, but also intend to secure energy independence for the country. Prime Infra is investing $800 million this year on drilling and exploration to boost the output of the Malampaya gas field, which was declining in recent years.

Prime Infra’s assets include two solar farms, one operating at 128 megawatts, and two hydroelectric plants, which are expected to become operational once the project is completed. Together, these assets provide a total capacity of 128 + 2,000 = 2,128 megawatts. Loreto aims to stock up on further renewable energy investment of $9 billion to achieve a total installed capacity of 13 gigawatts by 2030.

The agreement was reached after a staggering $3.3 billion joint venture with Ramon Ang’s San Miguel Corporations and Aboitiz Power, which operates in North Manila. The deal is the latest move by these engagements to shake up the Philippine energy sector following a $3.3 billion gas and LNG joint venture announced in December 2022.

Capital expenditures for Prime Infra have been aggressively overspent, with $1.2 billion spent in 2024, including the acquisition of a 165 MW hydro power facility in Nueva Ecija, as well as another $601 million planned for this year. NineEntities, including ICT Spot, are interested in prime Infra’s geothermal and solar projects, with 90% of capital expenditure allocated to geothermal capacity.

In addition to their focus on energy, Loreto, where Prime Infra has invested $800 million, is now a controlling shareholder of ABS-CBN, which previously operated under ситy to provide water utilities and waste management services. The bank aimed to delist Prime Infra in 2022 but postponed its IPO due to unfavorable market conditions.

The deal marks the joint investment fighters in the Philippine energy sector, which in 2022 used $12 billion to list Prime Infra, the company that operates both water utilities and waste management. Prime Infra targets the global energy sector by collaborating with option, and its assets are prone to rapid adjustments in strategies.

[End of Solution]