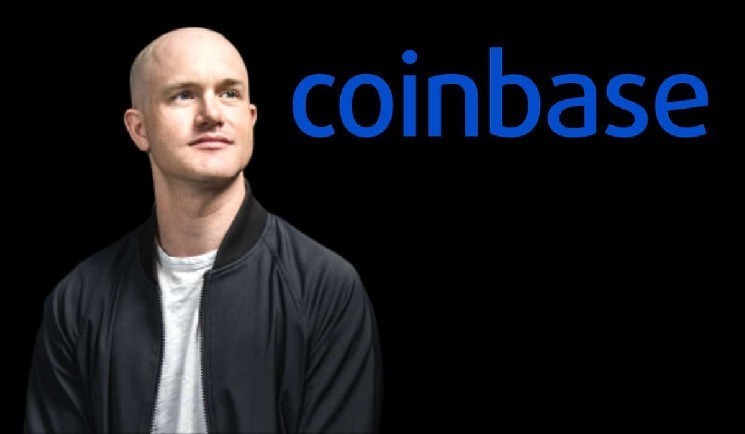

Coinbase Reinforces Bitcoin Commitment as CEO Armstrong Announces Major BTC Acquisition

Coinbase Demonstrates Unwavering Faith in Bitcoin’s Future with Strategic 2,772 BTC Addition in Q3

In a bold affirmation of Bitcoin’s enduring value proposition, Coinbase CEO Brian Armstrong has announced a substantial increase to the company’s Bitcoin holdings, acquiring an additional 2,772 BTC during the third quarter of 2023. The announcement, made via Armstrong’s official X (formerly Twitter) account, underscores the cryptocurrency exchange giant’s continued confidence in Bitcoin’s long-term trajectory despite market volatility and evolving regulatory landscapes.

“We’ve added 2,772 Bitcoin to our corporate treasury this quarter,” Armstrong stated in his social media post. “Coinbase remains committed to systematically accumulating BTC in the coming quarters regardless of short-term market conditions.” This strategic acquisition represents not merely a financial investment but a philosophical stance for the publicly-traded exchange, which has increasingly positioned itself as an institutional champion of Bitcoin’s fundamental value proposition.

Armstrong elaborated on the reasoning behind this significant treasury expansion, explaining that Coinbase views Bitcoin as having “become the most reliable store of value in the global financial system.” This characterization represents a powerful endorsement from one of the cryptocurrency industry’s most recognized executives. The statement carries particular weight given Coinbase’s status as the largest regulated cryptocurrency exchange in the United States, with its actions closely watched by investors, regulators, and market participants worldwide as potential indicators of broader institutional sentiment.

Strategic Accumulation Reflects Long-Term Vision Amid Evolving Market Dynamics

Coinbase’s systematic Bitcoin acquisition strategy appears designed to achieve multiple objectives simultaneously. Financial analysts note that by regularly purchasing Bitcoin irrespective of market conditions, the company is implementing a sophisticated dollar-cost averaging approach at an institutional scale. This methodical accumulation strategy allows Coinbase to potentially minimize the impact of Bitcoin’s notorious price volatility while building a substantial position in an asset the company clearly believes will appreciate considerably over time.

The company’s approach to Bitcoin accumulation seems deliberately uncoupled from short-term market fluctuations, instead focusing on what Armstrong characterized as “strengthening Coinbase’s financial foundation while positioning us to generate substantial long-term returns for our shareholders.” This perspective aligns with increasingly mainstream institutional views of Bitcoin as a legitimate alternative asset class with unique properties that may serve as a hedge against monetary inflation and currency debasement.

Industry observers point to several macroeconomic factors potentially influencing Coinbase’s Bitcoin accumulation strategy. Recent inflationary pressures across major economies, continued expansion of central bank balance sheets, and persistent uncertainty in traditional financial markets have all contributed to an environment where Bitcoin’s fixed supply cap and programmatic monetary policy appear increasingly attractive to sophisticated institutional investors. Coinbase’s systematic accumulation approach suggests the company anticipates these conditions will persist and potentially intensify, further enhancing Bitcoin’s appeal as a store of value.

Institutional Bitcoin Adoption Accelerates as ETF Demand Surges

Coinbase’s substantial Bitcoin acquisition comes amid growing evidence of accelerating institutional adoption of the cryptocurrency. The rising popularity of spot Bitcoin ETFs, particularly in the United States market, has created new channels for institutional capital to gain exposure to Bitcoin through regulated investment vehicles. This trend appears to be gathering momentum, with several major asset managers reporting significant inflows into their Bitcoin-focused investment products.

“Coinbase’s Bitcoin accumulation strategy appears perfectly timed to capitalize on shifting institutional attitudes toward digital assets,” explained Dr. Elena Rodriguez, Chief Economist at Digital Asset Research Institute. “We’re witnessing a fundamental reassessment of Bitcoin’s role in institutional portfolios, driven by both macroeconomic concerns and the increasing regulatory clarity around cryptocurrency investments in major markets.”

This reassessment is evidenced by the growing number of publicly-traded companies adding Bitcoin to their corporate treasuries. While early corporate adopters like MicroStrategy and Tesla initially faced skepticism, the practice has become increasingly mainstream as companies seek alternatives to holding cash reserves in an environment of persistent inflation and negative real interest rates. Coinbase’s status as both a Bitcoin holder and a key infrastructure provider for the cryptocurrency ecosystem places it in a unique position to benefit from and contribute to this broader adoption trend.

Market Impact and Competitive Positioning: Coinbase Strengthens Its Industry Leadership

The announcement of Coinbase’s Bitcoin acquisition has been interpreted by market analysts as a significant vote of confidence in the cryptocurrency’s fundamentals at a time when digital asset markets continue to mature. The move potentially signals a new phase in the evolution of cryptocurrency exchanges, with leading platforms increasingly functioning as strategic holders of digital assets rather than merely facilitating their trading.

“By substantially increasing its Bitcoin position, Coinbase is sending a powerful message to the market about its long-term outlook for the asset,” noted Marcus Chen, Director of Digital Asset Strategy at Global Investment Partners. “This approach differentiates Coinbase from exchanges that remain asset-neutral and positions the company to benefit directly from Bitcoin appreciation while demonstrating deep conviction to institutional clients considering similar allocations.”

The strategic accumulation of Bitcoin may also provide Coinbase with enhanced financial stability in an industry known for its cyclical nature. By building substantial reserves of what many consider to be cryptocurrency’s foundational asset, Coinbase potentially insulates itself from market downturns while positioning to capture upside during bull market cycles. This approach represents a sophisticated evolution of treasury management practices in the cryptocurrency sector, potentially establishing a model for other industry participants.

Future Outlook: Coinbase’s Bitcoin Strategy Signals New Era for Cryptocurrency Ecosystem

Industry experts suggest that Coinbase’s Bitcoin acquisition strategy could have far-reaching implications for the broader cryptocurrency ecosystem. As one of the sector’s most regulated and compliance-focused entities, Coinbase’s actions carry particular significance for institutional investors still cautiously approaching digital asset markets. The company’s methodical Bitcoin accumulation may serve as a template for other publicly-traded companies considering cryptocurrency allocations.

“What we’re witnessing is the normalization of Bitcoin as a treasury asset for forward-thinking corporations,” explained Sarah Washington, Principal at Blockchain Capital Advisors. “Coinbase’s approach demonstrates how companies can implement structured Bitcoin acquisition programs that satisfy both regulatory requirements and fiduciary responsibilities to shareholders. This model could accelerate institutional adoption significantly in coming quarters.”

Armstrong’s announcement included indications that Coinbase would continue its Bitcoin accumulation strategy in future quarters, suggesting the company views its current acquisitions as part of a long-term strategic initiative rather than a one-time portfolio adjustment. This persistent accumulation approach, if maintained, could contribute to Bitcoin’s overall supply dynamics by effectively removing additional units from circulation as they are secured in Coinbase’s long-term treasury holdings.

As cryptocurrency markets continue to mature and institutional participation increases, Coinbase’s Bitcoin strategy appears positioned at the intersection of several powerful trends shaping the future of digital assets. By committing substantial resources to Bitcoin accumulation while articulating a clear long-term vision, Armstrong and Coinbase have reinforced their leadership position in an industry still defining its relationship with traditional finance and institutional investors.

This article is for informational purposes only and should not be construed as investment advice.