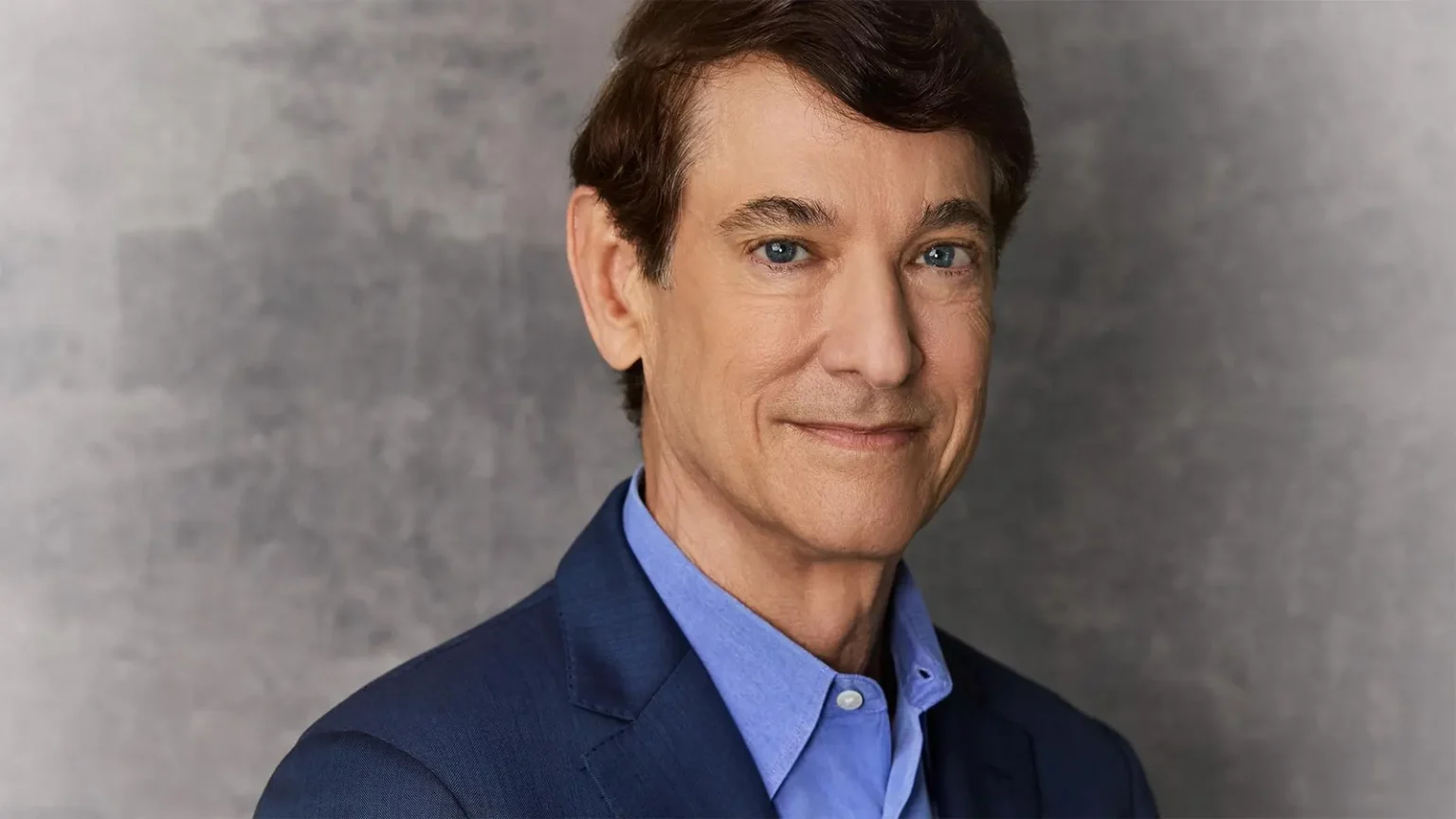

From Facebook to Circle: Jim Breyer’s Billion-Dollar Journey

In the sun-drenched environs of Pebble Beach, California, venture capitalist Jim Breyer moves comfortably among the world’s most prestigious automobiles at the Concours d’Elegance. Despite the luxury surroundings, Breyer isn’t there to show off his car collection—just a BMW and a Land Rover sit in his driveway. His real passion isn’t collecting status symbols but connecting with people and ideas. This people-first approach has served him extraordinarily well, most recently with the June IPO of Circle Internet Group, creator of the USDC stablecoin. When Circle’s market cap surged to $55 billion, Breyer—the second largest individual shareholder—saw his fortune more than double to $5.7 billion. Though Circle’s shares have since cooled by nearly 50%, his 8% stake remains worth over $1.7 billion, helping return him to The Forbes 400 list with an estimated $3.8 billion fortune. His investment philosophy is simple yet powerful: “I want founders to have skin in the game. I love it when investors have significant skin in the game.”

Breyer’s journey with Circle began in 2013, long before stablecoins became part of the financial lexicon. After meeting Circle’s CEO Jeremy Allaire at Harvard Yard and taking a long walk together, they shook hands on a deal that would eventually yield astronomical returns. Breyer paid just 27 cents per share based on his conviction that “crypto infrastructure and the stack would provide phenomenal opportunities.” This foresight has become Breyer’s hallmark—Circle represents one of four investments that have generated at least 100x returns for him, alongside Facebook (which he backed at four cents a share), Foundry Networks, and Redback Networks. Fifteen other investments have returned more than 20x, including Spotify (backed at a $900 million valuation) and the Boston Celtics (purchased with childhood friend Wyc Grousebeck for $360 million in 2002 and sold this year in a deal valuing the franchise at $6.1 billion).

What truly distinguishes Breyer is his ability to recognize potential in people across incredibly diverse backgrounds. This talent has led him to invest in companies like Marvel (sold to Disney for $4 billion), Etsy (which went public in 2015), and Legendary Pictures (acquired by China’s Wanda Group for $3.5 billion). His broad-ranging curiosity is evident in his Instagram feed, which features him at the French Open, with former Led Zeppelin guitarist Jimmy Page, at film galas, art exhibitions, and most frequently, University of Texas Longhorn football games. Since moving from Silicon Valley to Austin five years ago, Breyer has embraced Texas culture wholeheartedly, amassing over 20 pairs of cowboy boots and attending 90% of Longhorn games. As he laughs, “My children would say, ‘Dad, you’re interested in too many things,’ and they’re right!”

Like many American success stories, Breyer’s begins with immigration. Born to Hungarian parents who fled during the 1956 revolution, he became the first in his family born in the United States. His family arrived with just $500, initially living in a funeral home in New Haven before settling in Boston where both parents worked at Honeywell. Breyer studied interdisciplinary computer science and economics at Stanford, spent time in Florence, Italy, worked at McKinsey, and earned an MBA from Harvard before joining Accel Partners in 1987. Initially planning to become an entrepreneur himself, he discovered his true talent lay in investing. His landmark investment came in 2005 when Accel backed Facebook, with Breyer personally investing $1.1 million alongside the firm’s $11.7 million. To win Mark Zuckerberg over, Breyer took the Facebook team to dinner, buying wine for those of age (Zuckerberg, not yet 21, had a Sprite). Within six years, Breyer became a billionaire.

In 2006, Breyer established Breyer Capital as a complementary venture to his Accel work, investing in companies outside Accel’s technology focus. He left Accel in 2014 after nearly three decades to focus entirely on Breyer Capital. The year 2020 brought significant changes as he and his second wife, Angela Chao (CEO of Foremost Group and sister of former U.S. Transportation Secretary Elaine Chao), relocated to Austin at the urging of Michael and Susan Dell. That same year, he brought his two adult sons from his first marriage—Daniel, now 30, and Ted, now 28—into Breyer Capital as partners, transforming it into a family office. The brothers bring complementary strengths: Ted, who became fascinated with money at a young age and began investing in crypto during college, and Daniel, a history major and published novelist whose book “Smokebirds” explores themes of wealth and family dysfunction. Daniel describes working with his father and brother as making them “just the luckiest people on the planet.”

Amid his professional success, Breyer has faced profound personal tragedy. In February 2024, his wife Angela Chao drowned in an accident at their Texas ranch when she accidentally drove her Tesla into a pond. Though Breyer has not spoken publicly about the accident, he acknowledges that his family has been his source of comfort. “So much of it is, I persevere for that little five-year-old, ensuring that I’m the best dad possible and the best dad and partner to the rest of the family,” he says of raising his young son with help from two nannies. Working with his adult sons has reinvigorated Breyer and shifted his investment focus toward the intersection of AI with life sciences and healthcare. In April, he brought in Morgan Cheatham, a promising young venture capitalist and friend of Daniel’s, as a Breyer Capital partner to help with these efforts. One of their most successful bets in this space is OpenEvidence, a ChatGPT-like app for doctors that has already signed up 40% of U.S. physicians. The company recently raised $210 million at a $3.5 billion valuation, making its 42-year-old founder Daniel Nadler a billionaire. Nadler praises Breyer’s unique approach: “He’s much more interested in the founder and what makes them an aberrant exceptional.” This ability to connect with entrepreneurs, understand their motivations, and help them navigate obstacles with straightforward advice continues to be Breyer’s special magic—talking to founders not as an investor, but as a friend.