Historic First: Grayscale’s Multi-Cryptocurrency ETF Set to Launch on NYSE

Groundbreaking Digital Asset Fund Receives SEC Approval for Public Trading

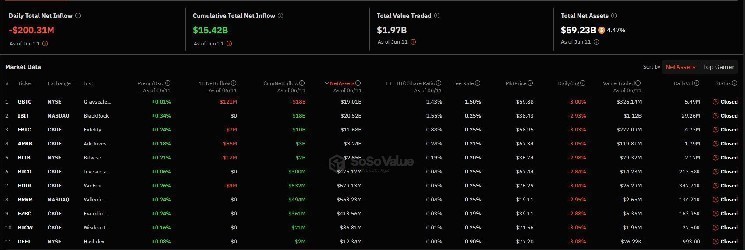

In a watershed moment for cryptocurrency investment vehicles, the digital asset market is poised to witness an unprecedented milestone tomorrow. The Grayscale Digital Large Cap Fund (GDLC) has secured regulatory approval for public listing, marking the first multi-cryptocurrency exchange-traded product (ETP) to trade under the Securities and Exchange Commission’s newly approved Generic Listing Standards. This development represents a significant evolution in how mainstream investors can access diversified cryptocurrency exposure through traditional financial infrastructure.

Peter Mintzberg, Chief Executive Officer of Grayscale Investments, announced the landmark approval that will bring Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA) together in a single investment vehicle. The fund’s structure, comprising five of the most liquid cryptocurrency assets, aims to provide institutional and retail investors with diversified exposure to the digital asset space without the complexities of direct cryptocurrency ownership. “This approval represents years of diligent work with regulators and underscores our commitment to bringing regulated crypto investment products to market,” Mintzberg stated during the announcement. The fund’s conversion to an ETF format signals growing institutional acceptance of digital assets as a legitimate asset class deserving of standardized investment vehicles.

Regulatory Breakthrough Enables New Investment Pathways

Bloomberg analyst James Seyffart highlighted the significance of this development, noting that “Yesterday’s approval of the general listing standards for crypto ETPs was a major development. Grayscale’s GDLC ETF conversion was also approved and the stop order was lifted.” According to Seyffart, GDLC will make its debut on the New York Stock Exchange (NYSE Arca) tomorrow, operating under a newly converted ETF format. This transition from a trust structure to an exchange-traded fund represents a substantial upgrade in accessibility, liquidity, and transparency for investors interested in cryptocurrency exposure. Additionally, the fund will undergo a rebranding to align with a CoinDesk index, further strengthening its position as a benchmark product for multi-cryptocurrency investment.

The SEC’s approval of Generic Listing Standards for cryptocurrency investment products marks a pivotal shift in the regulatory landscape. For years, digital asset investment firms have navigated a complex and often uncertain regulatory environment, with many product applications facing extended delays or outright rejections. This new framework establishes clearer parameters for cryptocurrency investment vehicles, potentially accelerating the approval process for similar products in the future. Market observers suggest this could trigger a wave of new cryptocurrency ETF applications from asset managers eager to participate in the growing digital asset investment space. The standardization of listing requirements may also lead to greater consistency in how these products are structured and regulated, benefiting both issuers and investors.

Diversification Strategy Addresses Market Volatility Concerns

The multi-cryptocurrency approach of the GDLC ETF addresses one of the primary concerns institutional investors have expressed about digital asset investment: volatility. By incorporating five major cryptocurrencies with different technological foundations and market behaviors, the fund offers natural diversification that could potentially reduce overall portfolio volatility compared to single-cryptocurrency investment products. This basket approach may appeal particularly to financial advisors and wealth managers who seek cryptocurrency exposure for clients but remain cautious about concentration risk in any single digital asset. The inclusion of established cryptocurrencies like Bitcoin and Ethereum alongside newer blockchain protocols like Solana and Cardano creates a balance between the more mature digital assets and those with emerging technological capabilities.

The Grayscale team has indicated they are working expeditiously to launch the fund, suggesting strong institutional demand for such a product. Market analysts anticipate significant initial interest from both retail and institutional investors who have been waiting for regulated, diversified cryptocurrency investment vehicles. The ETF structure offers several advantages over existing cryptocurrency investment options, including intraday liquidity, transparent pricing mechanisms, and familiar custody arrangements that align with traditional securities. These features may help overcome adoption barriers that have previously kept certain investor segments from participating in the cryptocurrency market. Financial advisors, in particular, have cited regulatory clarity and familiar investment structures as prerequisites for recommending digital asset exposure to clients.

Market Implications and Future Outlook

The introduction of GDLC as an ETF represents more than just a new investment product—it signals a maturing cryptocurrency market increasingly integrated with traditional financial systems. As the first multi-cryptocurrency ETF to trade on a major U.S. exchange, it establishes a precedent for similar products and potentially accelerates the timeline for additional cryptocurrency ETF approvals. Industry experts suggest this development could catalyze greater institutional participation in the digital asset space, bringing new capital flows and potentially reducing market volatility through more diverse market participation. The ETF’s performance will be closely monitored as a barometer for institutional appetite for diversified cryptocurrency exposure.

Looking forward, market participants will be watching how the fund’s composition evolves in response to the rapidly changing cryptocurrency landscape. The inclusion mechanism for determining which digital assets qualify for the fund will be particularly important as new cryptocurrencies continue to emerge and existing ones evolve. Additionally, the fund’s fee structure, tracking error, and trading volume will be critical metrics in assessing its success as an investment vehicle. While this represents a significant milestone for cryptocurrency investment accessibility, potential investors should conduct thorough due diligence and consider their risk tolerance before participating. As with all investment decisions, particularly those involving emerging asset classes, professional financial advice tailored to individual circumstances remains essential. The launch of this pioneering investment product marks not an endpoint but rather a new beginning in the ongoing integration of digital assets into the broader financial ecosystem.

This article is intended for informational purposes only and does not constitute investment advice.