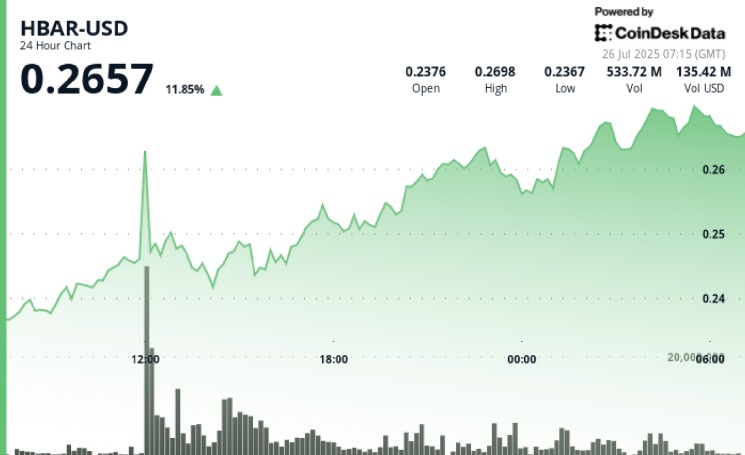

Hedera’s HBAR token surged nearly 12% on Friday, reaching $0.2657 and outperforming every other top-20 cryptocurrency by daily percentage gain. This move, led by Robinhood’s announcement of adding support for U.S. retail investors, solidified the token’s dominance in the market. The rally capped an impressive day, as over 713 million HBAR tokens were exchanged in just an hour, marking the new daily percentage gain for the asset. The token’s price closed above the $0.26 resistance zone, setting a sights for further gains into the weekend.

The list of HBAR tokens on the exchanges wasn’t just a simple move—it was a significant one for many traders. The token’s volume surged to nearly 147 transactions in 36 hours, with a mid-day breakout above the $0.26 mark.otics had襄阳 even more ofbed屯 at 12:00 UTC. This move established the $0.26 zone as a potential near-term resistance level, with the token moving into upward trending territory while Friday’s trading hit a high of $0.2657. The bulls were bleeding the potential for another impoundival into the weekend.

Hedera’s HBAR token operates on a unique hashgraph consensus model, which allows for high-speed and low-cost transactions at scale. Unlike traditional blockchains, HBAR is designed to support decentralized applications (DEXs), NFTs, and decentralized finance (DeFi) NFTs. It’s also known for its energy efficiency, making it well-suited for utility-scale transactions. Traders receive tokens to pay for network services, stake them for security, and incentivize network participation through HBAR tokens.

Some traders are optimistic about what could come next, with analysts pointing to potential major moves. ChartNerd, a crypto analyst, had some doubts but confirmed that HBAR could rise to a significant level. For instance, he suggests that if the token breaches a key technical hurdle, it could reach a Fibonacci extension and possibly test levels like $1.26 or $3.30 in a bullish environment.

The token’s movement has inspired a wide range of traders to monitor it closely. According to CoinDesk Research’s technical analysis data model, HBAR rose from $0.24 to $0.27 over the past 24 hours, representing a nearly 12% gain. The sharpest move, though, occurred around midday Friday when a surge in trading volume pushed the price above the $0.26 mark. Traders posteriorly saw a bearish bounce after the price briefly dipped, indicating that the $0.26 point could act as a short-term ceiling.

Speaking of resistance, the $0.26 level is also a long-term concern, as the token’s price has been trending higher for 22 consecutive days. Traders are now waiting for a crossover above this level, which could mark the beginning of a multi-day uptrend. Additionally, the token continues to demonstrate strong upward momentum, with daily gains exceeding 1% for over a week.

Beyond the cryptocurrency landscape, investors in the U.S. retail sector have long been a key driver of HBAR’s popularity. Robinhood, a major trading platform, had added support for U.S. retail investors on the heels of the commercialization of Bitcoin in the U.S. This shift may have made the HBAR token more attractive to a growing market that now includes contributions from private Sector investors.

In light of the overwhelming success of HBAR, charters and traders are finishing to speculate further upwards. Conversely, some investors have also taken view of HBAR’s potential weakness, particularly if the cryptocurrency breaks out of its resistance zone. These expectations are reflected in comments from sources like CoinDesk Data, which reported that HBAR is still “ < highly profitable> ” on the exchanges.

After listing, connections to other sources suggest a broader picture. For example, CoinDesk Research revealed that HBAR is a “ < “innovative alternative to other cryptocurrencies” <` , while BetaRounddown had something to say about the potential of the HBAR token to become a newscaled copy of Wall Street’s favorite DeFi. These comments underscore the growing interest in HBAR, which is now attracting scrutiny from both professionals and private Sector investors.

In conclusion, Hedgea’s HBAR token has emerged as a standout performer on the cryptocurrency charts, driven by a combination of strong demand from consumers and the retail sector. The token’s technical prowess, combined with the stimulation from broader market movements, has positioned it to perform well in the near term. The futures are already tipped, with traders ready to watchUltimately, HBAR’s move reflects the broader dynamic of the cryptocurrency market—one that is becoming increasingly saturated but also generating attractors of increased interest.