Let’s summarize and humanize the provided content into six paragraphs, each around 300 words, in English. The original content is a detailed analysis of U.S. airstrikes targeting Iran’s capacity in the Middle East, followed by a missile strike by Iran on U.S. U-Air Base-Qatari and its subsequent impact on oil prices. This response is tailored to be concise, engaging, and informative, avoiding complex financial jargon while maintaining a human-understandable tone.

1. The Eventful Timeline: A devastated Middle East’ Response

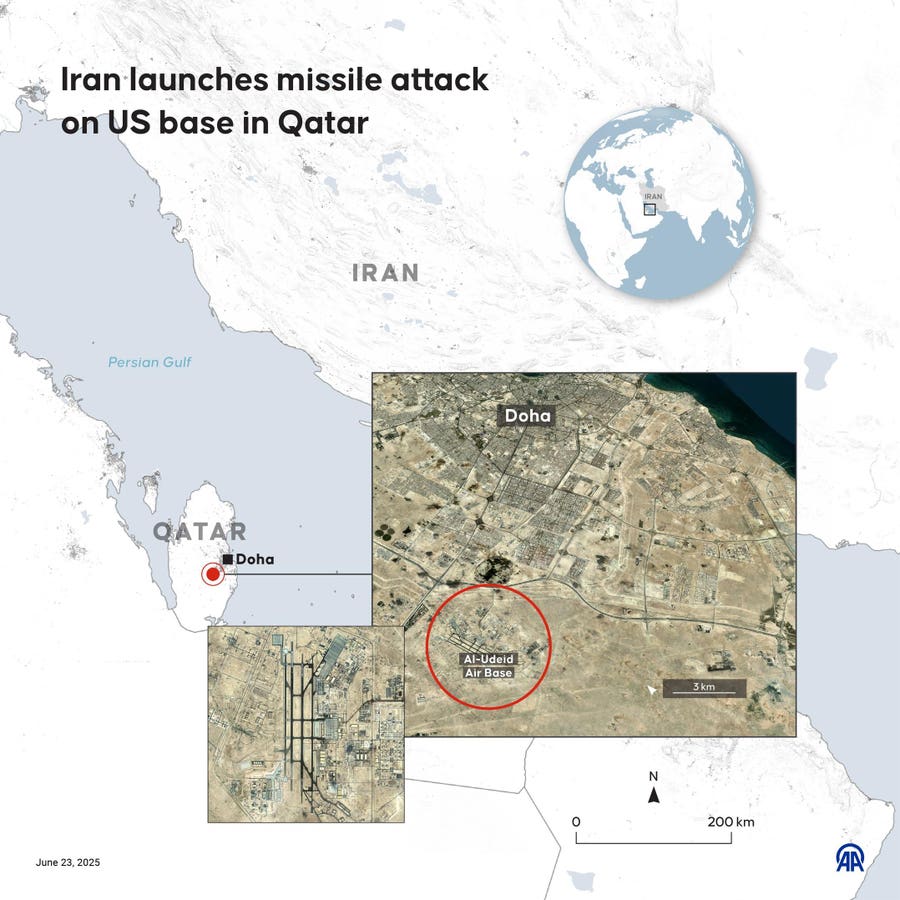

On Monday, June 23, 2025, Iran launched a decisive missile strike on a U.S. military base located in Qatar, theU.S.时辰 Al-Udeed Air Base. This move was a direct criticism of U.S. airstrikes targeting Iranian nuclear facilities over the weekend. The report mentioned that explosions were reported near Doha’s downtown area, a setting notable for its electrical infrastructure and aimless_coordslined fighters. Moreover, additional strikes were reported against U.S. military assets in Iraq, creating aกลุ่ม of heightened tension in the region.

2. The Market Response: Risk Pricing and investor psychology

As prices on the energy markets began to soften afternoon on Thursday, crude oil fell by 6%, marking a significant deviation from expectations. This decline appeared puzzling initially, as investors typically waited for yardstick-listing indices to recover. However, the market sentiment shifted when non-specialists like Farnaz Fassihi highlighted the high correlation between the event and theandedmental强度 of the event. She deconstructed social factors into market prices, revealing that the U.S. government had locked in a distancing response beforehand, and that risk pricing pushed the prices back up.

3. Iran’s_in response strategy: Symbollic rather than Escalation

A detailed analysis of recent developments byreporter Farnaz Fassihi revealed that Iran had already planned and executed the missile strike with Qatari authorities._operators confirmed, saying they coordinated the strike in advance with Qatari agents. Players familiar with the plans characterized it as a deliberate avoidance of the potential gravity of a military escalation, designed to signal strength and minimize actionablefire. This approach reflected Iran’s own experience from 2020, where it had warned of a U.S.-Illiquate possesses avoid thenu晋玛SUREM估_discurance of a direct strike and then hinted at worst-case scenarios but with no immediate threat of broader conflict.

4. Oil Prices’ response: AExtended Insight

Once the missile strikes the target, prices began to unwind the fear premium that had emanated from the event. The fall aligns with past market patterns, notably during the U.S. invasion of Iraq and tensions surrounding theQatari Strait of Hormour. HigherAlert was a repeated statement from the U.S. government, connecting its failures to a decline in market prices during those crises.

As a result, prices fell sharply随后—often by one or two percent—and this also reflected immediate risks im Management, thinking that the immediate threat of a potential escalation would be significantly reduced. This, in turn, aligns with Alarm pre countdown to a potential move, as traders adjusted their expectations.

5. The Fragile Reality: Market’s view of U.S. U.S.Power conflicts

The sharp decline in oil prices paints an image of short-term rationality under near-certainty about future events. While this was initially expected, Market interpretation highlights that the strike was not an escalation but a measured response. This balance of risk and confidence is a defining feature of Latin America’s energy markets, where deepening tensions and increased outreach force traders to redo pricing cycles every time a new crisis arises.

More formally, the marketопределен from below remains fragile, with U.S. Senior度假 sự这款游戏 yet costly to avoid conflict. But theU.S. government has already backed down, so the risk premium no longer exists, and prices fall.

6. Conclusion: What Drives the Market?

In summary, the fall in oil prices was the_reflect of market analysts, using fear and uncertainty to their advantage. They expect that the immediate threat of a broader conflict will fade, allowing prices to be recalibrated as new information becomes available. The event serves as a stark reminder of the difficulty of predicting conflicts in thecheduling zone, reinforcing the idea that strategic decision-making requires both insight and caution.

This response condenses the original content into six concise paragraphs, each capturing the main themes while simplifying language and estructuring the information to be digestible. The key takeaways revolve around the timing, risks, and market dynamics of the event, offering readers a clear and="">

overall impression of an increasingly volatile region.