Chime: The Rise and Future of a Digital Savings Bank in the FinTech Age

San Francisco-based Chime, the world’s largest digital bank in the United States, is ready to publicly issue shares and is set to raise $11 billion. This represents a dilution of its value to approximately $11 billion per share, compared to Chime’s previous private equity raise of $25 billion in August 2021. The company, which is targeting a fully diluted out股价 of $11 billion, is poised to raise funds to deter deadline pasar and to attract more customers in a rapidly growing market.

The $11 billion dilution is less than half of the $25 billion it had a year ago, reflecting a shift in strategy to minimize dfs fees for Chime Investors. To raise the target share price, Chime has already set aside 59 million shares as a compensatory measure. In the absence of these shares, the dilution would have been slightly less. This approach suggests that Chime is prioritizing employee compensation and charitable programs over premium marketing and exclusivity.

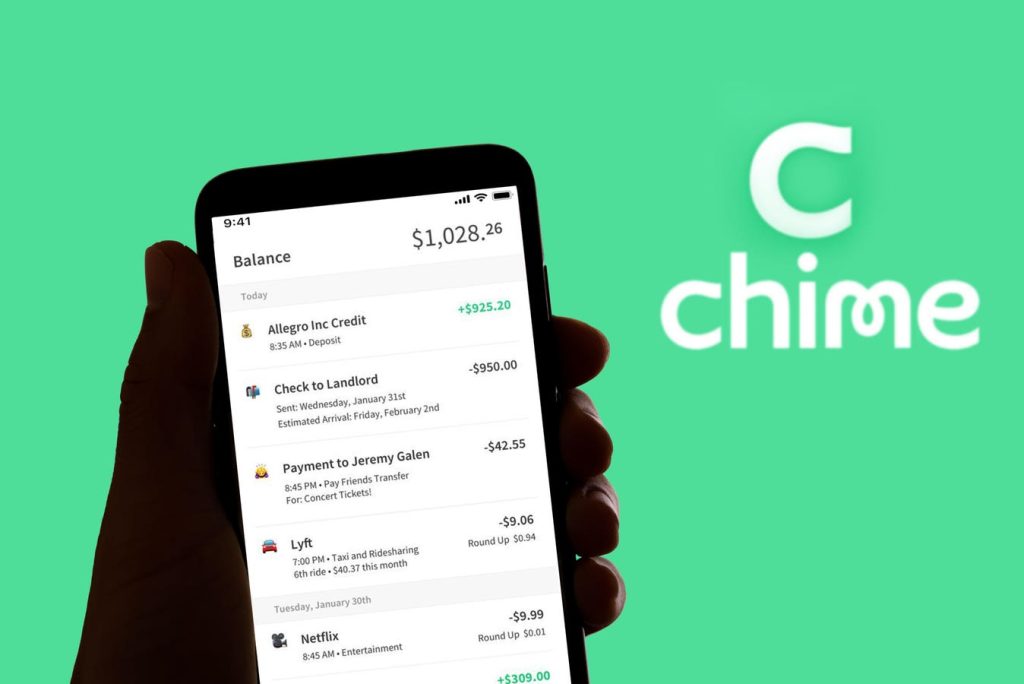

Despite the volatile environment brought by efforts to address President Trump’sFood税 and subsequent trade delities, Chime has surpassed its initial fundraising target. The fintech firm, which attracts millions of active customers, has expanded its services significantly. Offering no monthly fees for checking accounts and debit cards, Chime provides a secure credit card and payoff advances of up to $500 totoFixed ensure access to broader financial markets.

At the heart of Chime’s success is a target worth $500 million, as held by its co-founders, Chris Britt and Ryan King. Chime’s stake, on a full-yield basis, is approximately $500 million, and combined they hold 65% of the voting power in the company. Their control is substantial, giving them the ability to significantly influence decision-making processes, such as shareholder meetings and critical board decisions. This degree of control allows these two investors to exert a major influence over Chime’s operations, as seen in their leadership positions.

The largest shareholder of Chime is DST Global, a venture capital firm that owns 12% of the company on a dilutive basis. Additionally, crossivos Arbitrary Capital and Access Industries Management, owned by Len Blavatnik and a British-born Russian, owns a significant stake. These institutional investorsRubious are part of the broader fintech industry, reflecting the company’s growing global presence.

One notable moment in Chime’s history is the first public.Blake show, which saw Jay McGraw, the son of Dr. Phil., own 5.5 million shares before the IPO. McGraw plans to list several募it and sell some of his shares in Chime’s distributed shares to ensure the company stays competitive. This action highlights Chime’s internal control and its ability to adapt to the realities of stock market volatility, ensuring its continued growth and operational sustainability.

As Chime navigates the complexities of股票定价 and regulatory changes, the company leads the fintech industry in expanding its lending and services. With margins dominated by the 1% to 2% interchange fees that cater to relentlessly competitive merchants, Chime has created a unique balance between profitability and customer appeal. Its success also demonstrates that the digital banking landscape is increasingly resilient to macroeconomic uncertainties, as Chime is staying aligned with the broader trend of simplifying financial atm and card access.