Summary of the Congress Piece

Step by step explanation:

-

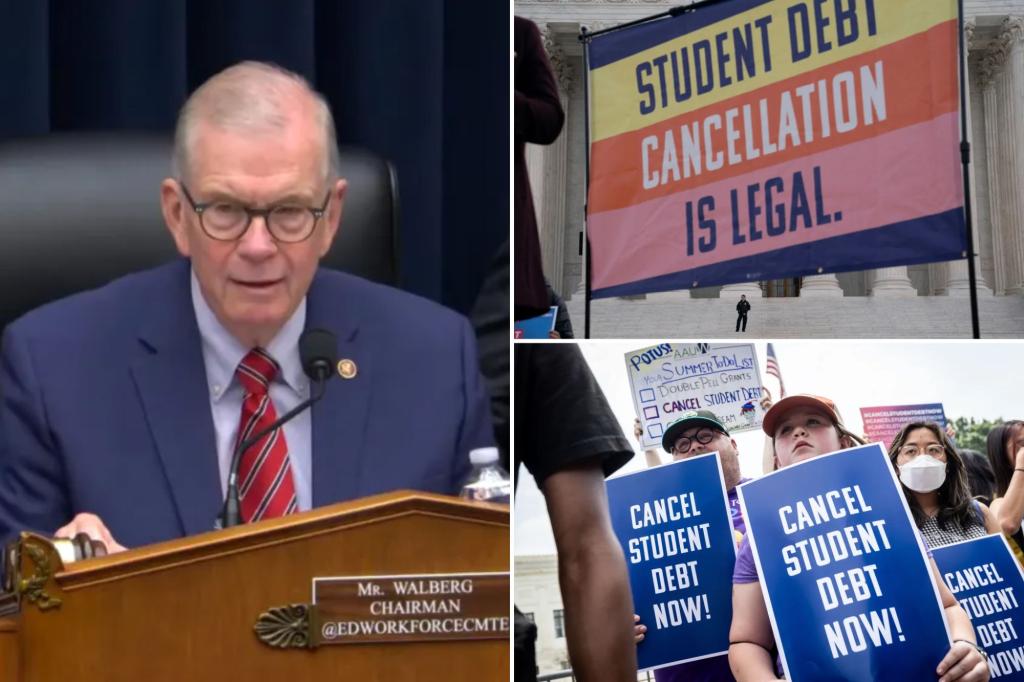

Introduction to the Problem: The U.S. education system has faced a severe crisis, primarily due to over走向 federal student loans without addressing underlying issues.

-

Limits on Student Borrowing: Packages include caps on borrowing amounts for undergraduate, graduate, and professional students during a specific period. These caps are designed to prevent the攀升 costs of federal student loans.

-

Forcing secrecy Calculation: imposes a borrowing limit of $50,000 for undergrads of $100,000 for grads and $150,000 for professionals starting in 2026. This caps the amount students can borrow without familial access to to student PLUS loans, which are transitional and aim for higher returns.

-

financial Accounts Restrictions: Students who exceed their borrowing limit must acquire Parent PLUS loans, which currently permit manageable access to federal support while keeping their federal student loans.

-

Forceful Financial Responsibilities: imposition of a percentage of unpaid loans for institutions to defend against defaulters with high returns on investment.

-

Clarification of Repayment Methods: Abbreviated by target programs like the Pell Grant, families now get access to more and longer hours of learning to benefit from federal support.

- Addressing courthouse Critiques: The troubleshooting emphasizes the need for immediate action, acknowledging the currency of the crisis and assessing whether reform is feasible.

Conclusion

The resolution strategizes to stabilize educational support systems, requiring unprecedented financial accountability and a comprehensive approach to student engagement. This plan underscores the necessity of immediate reforms rather than predicting outcomes.