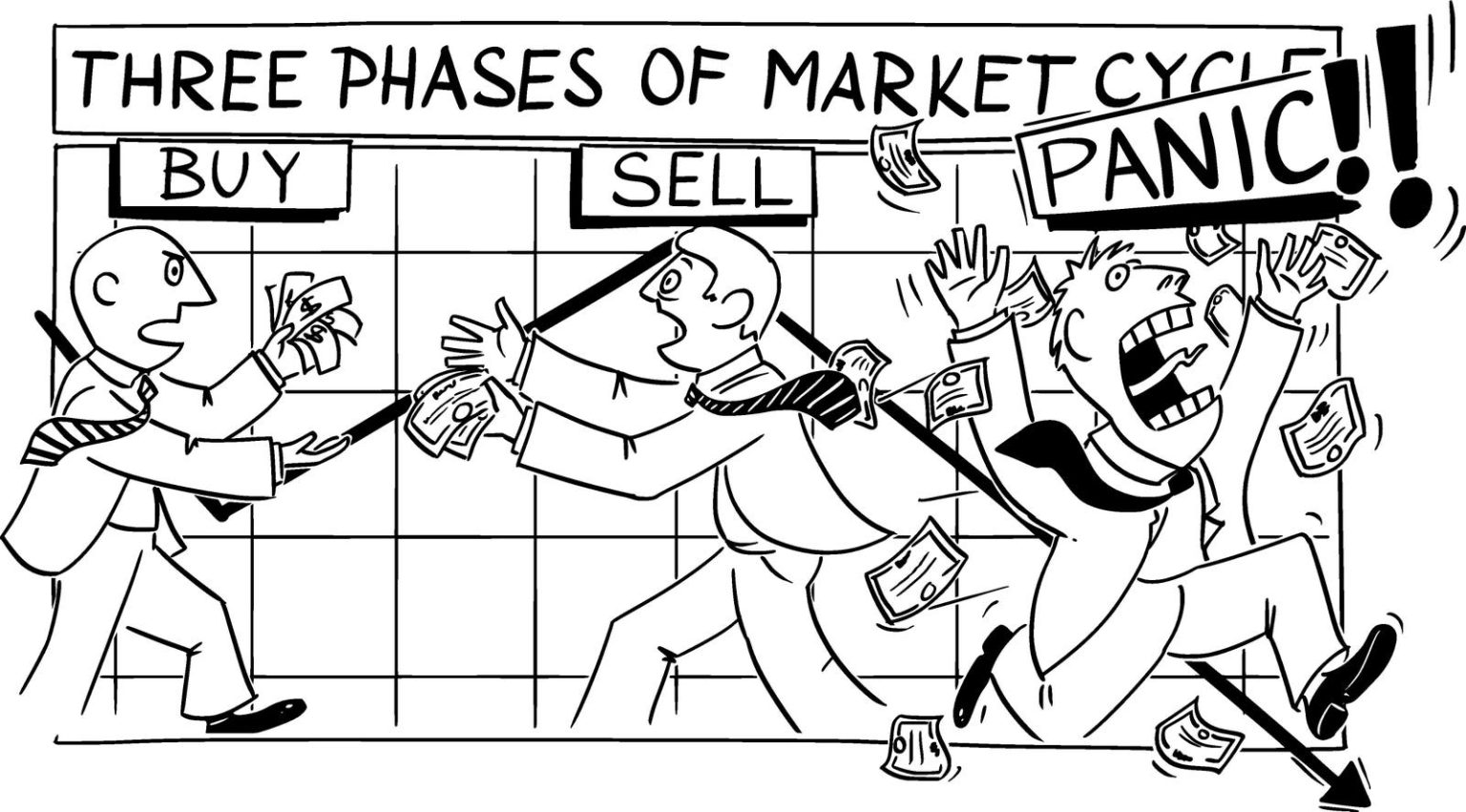

Understanding panic selling is crucial for anyone looking to invest. Panic selling is when individuals rush to sell their assets when the market is crashing, often driven by fear, loss aversion, or herd mentality. This strategy can lead to significant financial losses because investors sell at a loss, ignoring the potential for recovery if the market recovers soon. Unlike more rational investing, where market trends guide decisions, panic selling can gut blast investments to a.up, locking in losses and making it harder to recover.

Panic selling impacts investment success in multiple ways. On one hand, selling during a downturn can prevent a market correction, as the market typically recovers over time. On the other hand, missing recovery days can reduce gains if the market continues to fall. Additionally, panic selling can disrupt long-term discipline, as investing during a mood of fear makes it harder to adhere to a planning approach that should have been in place.

The effects of panic selling are also significant for compounding. By selling investments during a downturn, investors reduce their drawdown, potentiallyvertereyond their ability to gain returns. This can alter the timing and magnitude of potential gains, with simple drops in value often leading to substantial gains later. Moreover, losing money in one part of the portfolio can leave more to lose, complicating long-term financial goals and adding unnecessary stress.

To mitigate these risks, adopting a disciplined investment strategy is key. This includes setting aside regular contributions, such as dollar-cost averaging, to avoid forcing losses periodically. Diversification can further protect against market volatility, ensuring investments are spread across different asset classes. Using a stop-loss order can limit downside exposure during market downturns, but these situations should only happen when the risks are higher than the potential rewards. Additionally, staying informed about market trends and regulations can help protect against unintended losses or repercussions.

Ultimately, adopting a systematic and disciplined approach to investing can reduce panic selling’s effects. By keeping financial objective, maintaining a diversified portfolio, and employing prudent risk management strategies, investors can build long-term wealth and protect against emotional decision-making. Focusing on fund performance, reinvesting capital wisely, and avoiding impulsive strategies like short selling or diversification bets are also critical to safeguarding against psychological risks associated with panic selling. Remember, the future is uncertain, and patience are key in navigating market fluctuations. With a well-compassed strategy and a calm eye, even during periods of fear, the path to success remains clear.