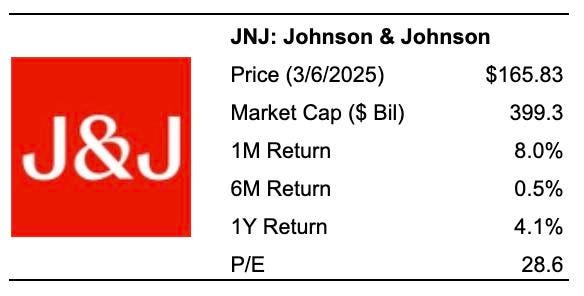

Johnson & Johnson (NYSE: JNJ) stock has experienced significant fluctuations in its stock price over the past year, with the company up 15% compared to the broader S&P 500 index, which remained stable over the same period. This performance gap can be attributed to market volatility, driven by controversial U.S. tariffs and concerns about inflation and economic recovery. Investors typically seek defensive investments during uncertain times, such as pharmaceutical companies like Johnson & Johnson, which serves as a strong dividend yield of nearly 3%. The company occupies a leadership role within its industry, with notable metrics such as a 24.9% operating margin, robust cash flow, and a strong debt-to-equity ratio of 9.2%, ultimately positioning it for resilience against some shocks.

Valuation Analysis of JNJ versus the S&P 500

-

Price-to-Sales (P/S) Ratio: JNJ trades at a slightly elevated price-to-sales ratio of 4.5 compared to 3.2 for the S&P 500. This highlights that JNJ stock is slightly more expensive than the broader market, indicating it might be a better buy considering its lower valuation.

- Price-to-Operating Income (P/EBIT): With an impressive 17.9 times P/EBIT compared to the 24.3 times rate of the S&P 500, JNJ appears to be more expensive relative to the industry’s performance. This suggests that JNJ is trading at a higher cost relative to its operational efficiency.

Johnson & Johnson’s Revenue Growth

-

Over the past three years, JNJ’s revenue has grown by an average of 4.1%, currently reaching $89 billion, marking slightly more growth than the S&P 500, which has increased by 6.9% over the same period.

- In the most recent quarter, JNJ’s revenue growth rate of 5.3% over $23 billion reflects a 4.3% increase from its previous year’s figure of $85 billion. This demonstrates JNJ’s stable growth momentum.

Profitability and Financial Health

-

Johnson & Johnson’s operating income is relatively higher at $22 billion, with a 24.9% operating margin, indicating strong profitability. This margin is notably higher than that of the S&P 500’s 13.0%.

- The company’s operating cash flow of $24 billion, or 27.3% of sales, further underscores its strong profitability. This line of sight suggests superior cash management abilities.

Financial Stability and Resilience

- JNJ’s $37 billion in debt is relatively lower compared to the S&P 500’s $37 billion market capitalization, indicating a strong debt-to-equity ratio of 9.2%. The company maintains a moderate Cash-to-Assets ratio of 13.6%, showing resilience in handling liquidity effectively.

Impact of Externalifs

- JNJ’s stock has unexpectedly shown resilience during market downturns, aligning with its strong financial and resilience metrics. During similar market experiences (e.g., 2008, 2020, and 2022), JNJ demonstrated resilience, notably recovering from losses and appreciate in value.

Sector-Ranked Portfolio (RV Portfolio)

- The stock has been robust during market downturns, with the RV Portfolio (a balanced mix of large-cap, mid-cap, and small-cap stocks) outperforming all-cap benchmarks. This strategy leverages the sectors’ varying performance patterns to capitalize on neutral or growth growth, making the RV Portfolio a strong investment choice.

Overall_emperors Evaluation

- Growth: Neutral

- Profitability: Very Strong

- Financial Stability: Strong

- Downturn Resilience: Very Strong

- Overall: Strong

The high valuation of JNJ reflects a favorable balance among growth, profitability, financial stability, and resilience, supporting its effectiveness as an ambivalent stock that balances risk and return. This position aligns with its strong financial metrics and ample Welfare for potential investors by the RV Portfolio strategy.