The U.S. student loan debt landscape presents a complex and evolving challenge, with total debt continuing its upward trajectory despite significant government efforts to provide relief. While the Biden administration achieved a milestone by forgiving nearly $190 billion in student loans for millions of borrowers, the influx of new loans has outpaced the amount forgiven, contributing to a net increase in the overall debt burden. This dynamic underscores the systemic nature of the student loan crisis, highlighting the interplay of rising tuition costs, borrowing trends, and the long-term financial implications for individual borrowers and the broader economy.

A key driver of the increasing debt is the persistently high cost of higher education. With the average cost exceeding $100,000, students are increasingly reliant on loans to finance their education, perpetuating a cycle of debt. This financial burden translates into long-term strain for borrowers, impacting their ability to save, invest, and make major life decisions like purchasing a home or starting a family. The Education Data Initiative reports that total student loan debt reached $1.7 trillion by early 2025, with federal loans comprising the vast majority of this amount. The average federal student loan debt per borrower stands at approximately $38,375, further illustrating the significant financial obligations faced by individuals pursuing higher education.

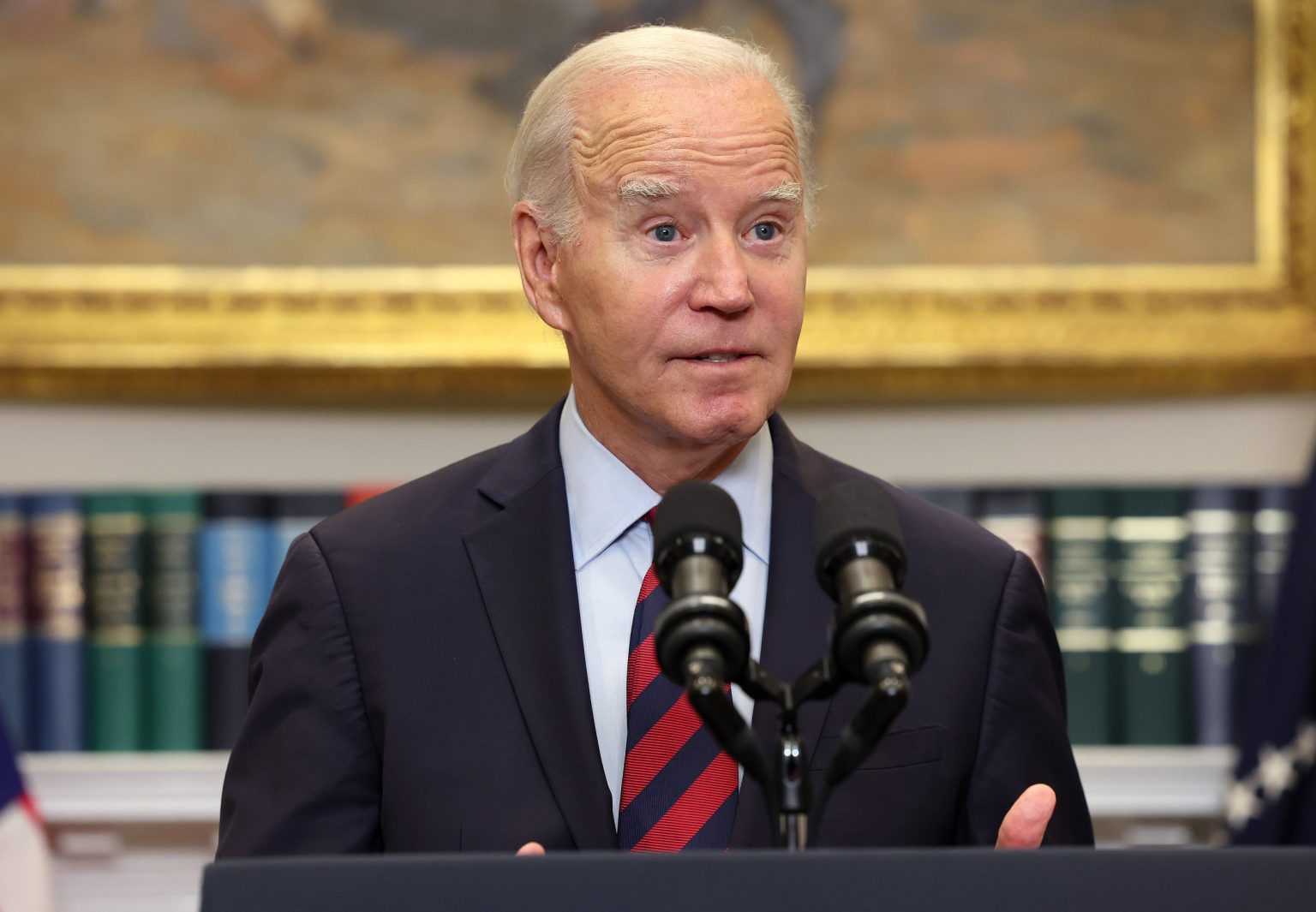

The Biden administration’s efforts to address the student loan crisis included targeted forgiveness programs and the temporary pause on federal student loan payments during the COVID-19 pandemic. While these measures provided immediate relief for millions of borrowers, the long-term impact on the overall debt burden has been less pronounced. The payment pause, while offering temporary respite, also contributed to the accumulation of debt for some borrowers. Furthermore, the resumption of payments, coupled with the ongoing issuance of new loans, has added to the complexity of managing student loan debt.

Expert analysis suggests several factors contribute to the persistent rise in student loan debt. The influx of new borrowers each year, coupled with the extended repayment periods typical of student loans, creates a dynamic where new borrowing often surpasses the amount being repaid. This, combined with rising tuition costs and the limited scope of forgiveness programs relative to the total outstanding debt, explains why the overall debt continues to grow. Higher education expert Mark Kantrowitz emphasizes that while the Biden administration’s forgiveness initiatives were substantial, they were ultimately outpaced by the combined effects of new borrowing, the payment pause, and the complexities of repayment plans.

The ongoing debate surrounding student loan policy reflects the multifaceted nature of the issue. Experts and commentators offer diverse perspectives on the effectiveness of different approaches. Some argue that forgiveness programs, while beneficial for individual borrowers, fail to address the root cause of the problem: the escalating cost of higher education. Others point to the complexity of existing repayment plans and the need for greater flexibility and support for borrowers. Still others suggest that a combination of affordability measures, targeted forgiveness, and comprehensive financial literacy education is necessary to effectively tackle the student loan crisis.

Looking ahead, the future of student loan policy remains uncertain, with potential shifts in repayment plans, forgiveness programs, and overall affordability initiatives. Borrowers are encouraged to stay informed about policy changes and explore available repayment options to effectively manage their debt. The evolving nature of the student loan landscape underscores the need for ongoing dialogue and innovative solutions to address this complex and pervasive financial challenge. Ultimately, finding a sustainable path forward will require a collaborative effort from policymakers, educational institutions, and borrowers themselves.