New IRS Reporting Rules for Third-Party Payment Apps: What Small Businesses Need to Know

The digital age has revolutionized how businesses operate, with online platforms and third-party payment apps becoming increasingly integral to commerce. This shift has spurred the Internal Revenue Service (IRS) to adapt its reporting requirements to ensure accurate income tracking in this evolving landscape. Recent changes to these regulations, specifically regarding 1099-K forms, have significant implications for small business owners who utilize platforms like Venmo, PayPal, eBay, and Etsy. This article delves into the details of these new rules, outlining what businesses need to know to navigate the upcoming tax season successfully.

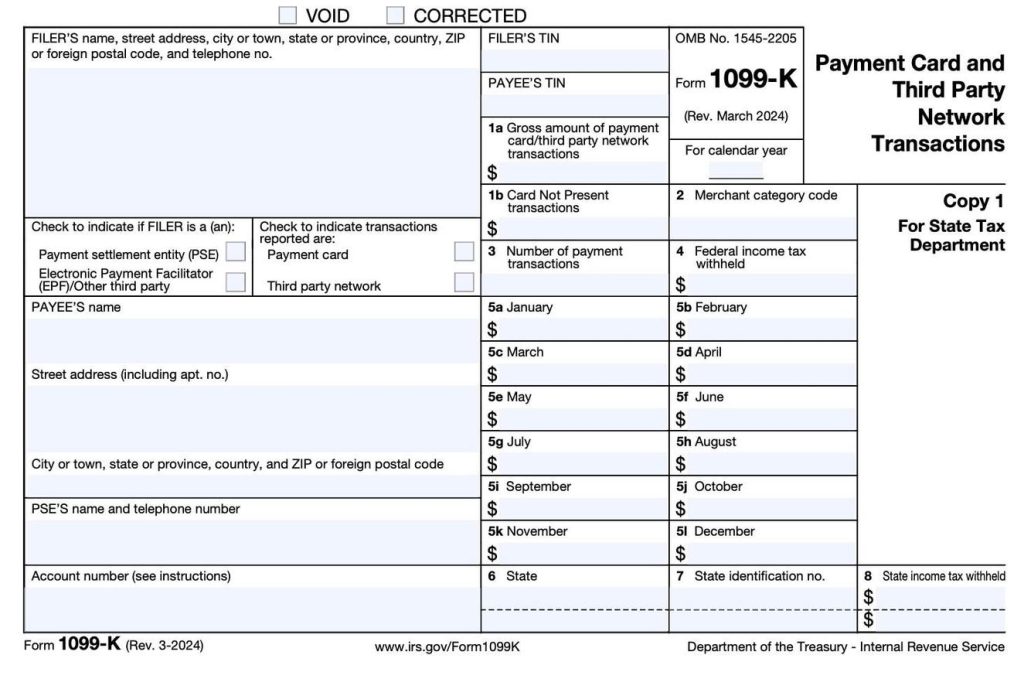

Understanding the 1099-K Form and Its Purpose

1099 forms are crucial tools used by the IRS to track income earned outside traditional employment arrangements. While the 1099-NEC form typically covers payments to independent contractors, the 1099-K specifically addresses income received through third-party payment networks. This distinction is important, as the 1099-K focuses on transactions for goods and services, excluding personal transfers like gifts or reimbursements from friends and family. The rollout of these new regulations aims to address the growing volume of business transactions conducted through these platforms and ensure accurate income reporting for tax purposes.

Phased Rollout and Reporting Thresholds: Navigating the Changing Landscape

The IRS is implementing a phased approach to the new 1099-K reporting requirements. For the 2024 tax year, third-party payment apps are required to issue 1099-K forms to individuals who received over $5,000 in total payments for goods and services. This threshold will decrease to over $2,500 in 2025 and ultimately settle at over $600 in 2026 and beyond. This tiered implementation allows businesses to gradually adjust to the new rules and prepare for the lower reporting threshold in the coming years. It’s crucial for small business owners to be aware of these changes and anticipate the impact on their tax obligations.

Legislative Developments and Potential Future Adjustments

The reporting requirements for 1099-K forms have been subject to legislative adjustments, adding another layer of complexity for businesses to navigate. The American Rescue Plan Act had previously lowered the reporting threshold, but there’s ongoing discussion in Congress about potentially raising it back to $20,000 along with a 200-transaction minimum. This uncertainty underscores the importance for business owners to stay informed about potential legislative changes that could affect their reporting obligations in the future. Monitoring these developments will allow for proactive adaptation and compliance with evolving tax laws.

State-Specific Variations and Resources for Compliance

Adding to the complexity, some states have implemented their own thresholds for 1099-K reporting, independent of the federal guidelines. States like Vermont, Massachusetts, Virginia, and Maryland have set their thresholds at $600, while Illinois requires reporting for amounts exceeding $1,000 across four or more transactions. This variation necessitates careful attention to state-specific rules for businesses operating in multiple jurisdictions. Thankfully, many third-party payment platforms, including eBay, Venmo, Etsy, PayPal, and Cash App, provide resource centers with information to guide users through these complex reporting requirements. The IRS also offers resources to help businesses understand and comply with 1099-K regulations.

Preparing for Tax Season and Seeking Professional Guidance

With the tax filing deadline approaching, business owners who meet the reporting requirements should expect to receive their 1099-K forms soon. Careful review of these forms is crucial to ensure accuracy and avoid potential issues with the IRS. If there are any discrepancies or uncertainties, seeking guidance from an accountant is highly recommended. Professional advice can help navigate the intricacies of these new regulations and ensure accurate tax filing. Proactive preparation is key to mitigating potential penalties and maintaining compliance with evolving tax laws.

Key Takeaways and Future Considerations

The new 1099-K reporting requirements mark a significant shift in how the IRS tracks income generated through third-party payment platforms. Small businesses must understand these changes and adapt their accounting practices accordingly. Staying informed about legislative developments, utilizing available resources, and seeking professional guidance when needed are essential steps to navigate this evolving tax landscape. As the digital economy continues to grow, further adjustments to tax regulations are likely. By staying proactive and informed, businesses can ensure compliance and maintain a healthy financial standing in the face of these ongoing changes.