The Integration of Madrona Venture Labs into Madrona: A Strategic Shift in the Pacific Northwest Startup Ecosystem

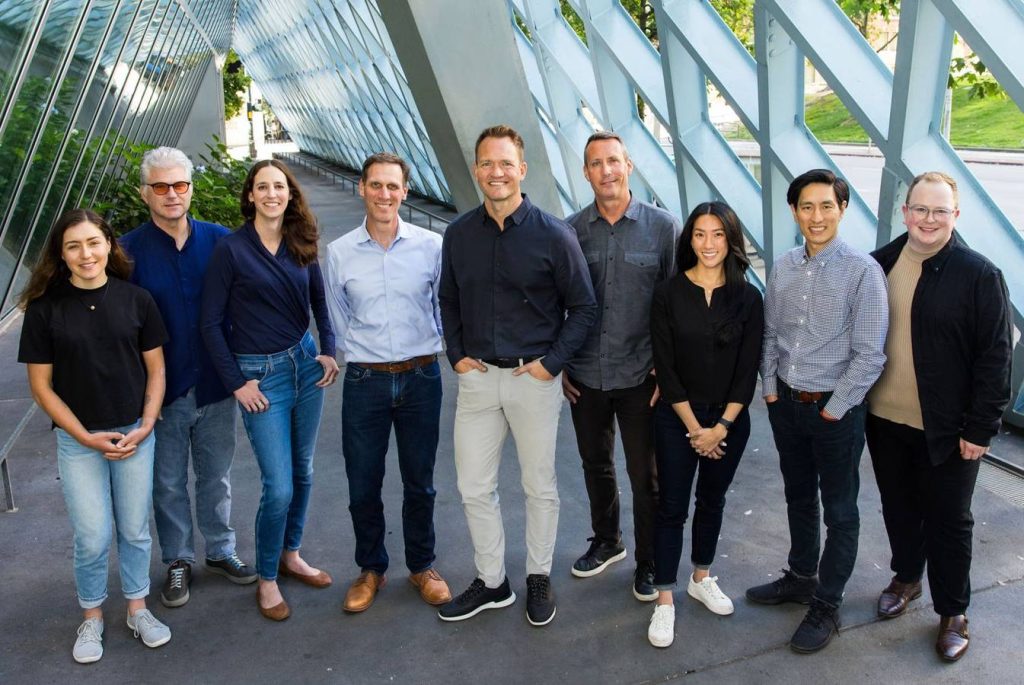

Madrona Venture Labs (MVL), a Seattle-based startup studio affiliated with the venture capital firm Madrona, has concluded its independent operations after a decade of fostering innovation. The studio, which launched in 2014, has been absorbed into its parent company, Madrona, marking a significant shift in the firm’s approach to supporting early-stage companies. This strategic restructuring aims to streamline operations and leverage the resources of Madrona’s recently announced $770 million fund, further solidifying its commitment to the Pacific Northwest startup ecosystem. MVL’s integration reflects the evolution of the Seattle startup scene, which has matured considerably since the studio’s inception.

MVL’s decade-long tenure saw the incubation of 30 startups, contributing significantly to the region’s burgeoning tech landscape. These companies, including notable names like Uplevel, Strike Graph, and OutboundAI, collectively raised hundreds of millions of dollars in funding, validating MVL’s model of providing early-stage support and resources. The studio’s core mission revolved around empowering founders by vetting their ideas, facilitating connections with experienced leaders, collaborating with entrepreneurs-in-residence, and securing crucial initial funding. This comprehensive approach allowed nascent companies to navigate the challenging early stages of development and gain traction in their respective markets.

The decision to integrate MVL into Madrona stems from the evolving dynamics of the Seattle startup ecosystem and the desire for operational efficiency. When MVL was established, the local startup scene was less developed, necessitating a dedicated studio to provide specialized support. However, the region has since witnessed the emergence of numerous incubators, accelerators, and shared workspaces, such as AI2 Incubator, Pioneer Square Labs, and CoMotion Labs, creating a more robust and interconnected environment for startups. This maturation has rendered the separate structure of MVL less essential, prompting Madrona to consolidate its efforts under a single umbrella.

The integration aims to eliminate the inefficiencies inherent in managing MVL as a separate entity. By bringing all startup support activities under the Madrona banner, the firm can leverage its existing resources and expertise more effectively. This streamlined approach will also simplify funding allocation, as previously, a portion of each new Madrona fund was earmarked for MVL’s operations. With the integration, the entire $770 million fund can be deployed across Madrona’s various investment strategies, maximizing its impact on the startup ecosystem.

The timing of the restructuring aligns strategically with the closing of Madrona’s tenth fund. This substantial capital infusion will fuel the firm’s investments across a range of startups, from early-stage ventures to more mature companies. The fund is split between a traditional early-stage fund and an "acceleration fund" designed for later-stage investments, allowing Madrona to support companies at various growth stages. This dual approach reflects the firm’s commitment to nurturing the entire lifecycle of a startup, from initial ideation to scaling and beyond.

The integration has also prompted leadership changes within the organization. Mike Fridgen, MVL’s managing director for nine years, is transitioning to the role of chief operating officer at Rover, a pet-sitting platform and former Madrona portfolio company. Fridgen will also maintain a connection with Madrona as a part-time venture partner, leveraging his extensive experience in the startup ecosystem. Madrona is actively supporting the remaining MVL employees in finding new roles within Madrona-backed companies or elsewhere, ensuring a smooth transition for the team.

Crucially, the closure of MVL as a separate entity does not signify a diminished commitment to early-stage startups or the Pacific Northwest. Madrona remains steadfast in its dedication to supporting emerging companies in the region, as evidenced by its new fund allocation. The firm anticipates investing 75% of its new fund in Pacific Northwest companies, reaffirming its belief in the region’s potential as a hub for innovation. This commitment underscores Madrona’s long-standing role as a key player in the Pacific Northwest startup ecosystem.

The integration of MVL into Madrona marks a significant evolution in the firm’s approach to supporting startups. By consolidating its efforts under a single brand, Madrona aims to streamline operations, maximize resource allocation, and further solidify its commitment to the Pacific Northwest startup community. This strategic move reflects the maturation of the Seattle startup ecosystem and positions Madrona to effectively deploy its substantial new fund, fostering the next generation of innovative companies. The integration is not a retreat but rather a strategic realignment to better serve the evolving needs of the startup ecosystem, ensuring continued support for emerging companies and the vibrant Pacific Northwest tech scene. The transition also highlights the cyclical nature of venture capital and the constant adaptation required to effectively navigate the dynamic landscape of startup development.