The Crypto Crash: Scrambling for Signs of a Bottom in a Freefall Market

In the shadowy underbelly of financial markets, where digital currencies once promised boundless riches, a stark reality has set in. The cryptocurrency sector, battered by a relentless multi-month downturn that has spiraled into what feels like an uncontrollable plummet, has left investors scrambling for any glimmer of hope. Bulls, those perennial optimists who bet big on the stars of the crypto universe, are clutching at thin air—or more precisely, at technical charts, whispered rumors of hedge fund collapses, and any narrative thread that might suggest an impending reversal. This isn’t just a dip; it’s a freefall that has wiped out billions in value, forcing a reevaluation of foundational beliefs about assets built on blockchain and coded promises. Yet, as the market’s temperature drops, some argue that the most telling signals of a turning point aren’t found in bullish rallies or algorithmic predictions, but in the unbridled glee of the skeptics who have long decried the entire movement. For them, the absolute nadir of this bear market might well be marked by the raucous cheers of those who’ve steadfastly warned against the mirage of digital gold.

The landscape of cryptocurrency criticism has traditionally been dominated by established voices, but few have been as consistent or unapologetic as London’s Financial Times. Over the past decade, the venerable publication has positioned itself as a bulwark against the tidal wave of crypto enthusiasm, its team of sharp-witted journalists wielding pens like scalpels to dissect the hype. They’ve never wavered from a stance that views Bitcoin and its ilk as speculative bubbles destined to burst—a perspective rooted in solid journalistic rigor rather than alarmist sensationalism. This week, amidst the chaos of plummeting prices and erased fortunes, the FT seized what seemed like its moment of vindication. Their pages became a battlefield where bearish arguments weren’t just aired but celebrated, offering a counterpoint to the echo chambers of social media traders and blockchain boosters. It’s a reminder that in the sprawling world of finance, skepticism often runs deeper and louder than the buzz of innovation, and the paper’s relentless scrutiny has earned it a reputation as a truth-seeking outlier in an industry prone to grandiose claims.

At the heart of this week’s FT salvo was a Sunday essay by Jemima Kelly, a writer whose name has become synonymous with unflinching crypto critique within the publication. Originally headlined “Bitcoin is still about $69,000 too high,” her piece captured the essence of a view held by many traditionalists: that the cryptocurrency’s journey, which began as a novel experiment and peaked at over $100,000, is now careening toward an inevitable crash. Kelly’s prose painted a vivid picture of futility, likening Bitcoin’s ascent to a flight that would end “splattered on the ground.” She argued that the so-called “greater fools”—those willing to inflate the value based on pure speculation—were finally running dry, exposing the emperor’s clothes of an asset grounded in nothing more tangible than digital ether. As if to punctuate her point, the FT adjusted the headline overnight to reflect the market’s overnight gains, tweaking it to “$70,000 too high.” This minor concession didn’t dilute the essay’s core message; instead, it underscored the FT’s commitment to accuracy in a volatile world. Kelly’s analysis dove into the psychological underpinnings of crypto’s allure, questioning why rational actors continued to pour money into a system perceived as inherently unstable. By highlighting the evaporation of fairy-tale narratives that once buoyed the market—promises of decentralization, untold wealth, and technological utopia—she positioned the recent downturn as a wake-up call. Investors, Kelly suggested, were finally seeing through the illusion, realizing that without intrinsic value, a floor might never exist. Her words resonated in boardrooms and trading desks alike, serving as a sobering mirror for those who’d bought into the hype.

Shifting gears within the same publication, Craig Coben turned his gaze to a corporate giant entrenched in the crypto saga: MicroStrategy, the software company that has gambled its future on Bitcoin holdings. In a piece titled “Strategy’s long road to nowhere,” Coben dissected the fallout from Bitcoin’s slide below the $76,000 mark—the approximate average cost basis for MicroStrategy’s vast treasury of the digital asset, amounting to over $54 billion. By February 2026, with the company’s stock down about 80% from its late 2024 peak, Coben declared the situation dire, likening MicroStrategy’s predicament to “a gigantic mastodon stuck in La Brea tar pits.” He argued that CEO Michael Saylor’s all-in bet on Bitcoin had left management with no palatable options—merely differing avenues to erode shareholder wealth. Over five years, the company’s investments had broken even, but at what cost? Coben’s narrative wove together financial metrics and existential dread, portraying Saylor as a bold visionary whose strategy now resembled a quagmire. The piece delved into the ironies of MicroStrategy’s transformation from a mundane enterprise player to a crypto powerhouse, only to see its narrative crumble under market pressures. Investors, once dazzled by the potential synergy between software and Bitcoin, are now questioning the wisdom of such concentration, with analysts pondering the long-term viability of a business model so tightly tethered to volatile assets. Coben’s analysis didn’t just critique a company; it illuminated broader themes of corporate hubris in the face of speculative manias, blending sharp economic insight with a touch of dramatic flair that echoed the FT’s storytelling prowess.

No commentary on crypto’s woes would be complete without the voice of Peter Schiff, the perennial gold advocate whose critiques have become legendary in investment circles. As gold persists in its enduring bull run, marked by considerable volatility but overall upward momentum, Schiff seized the moment to weigh in on Bitcoin’s travails. In a Tuesday post, he dismantled Michael Saylor’s claims of Bitcoin as “the best-performing asset in the world,” pointing out that MicroStrategy’s massive bullion investment over five years had yielded a meager 3% return—and that worse was likely ahead. Schiff’s rhetoric was laced with wry skepticism, contrasting Bitcoin’s supposed triumphs with tangible realities. He noted that, priced against gold, Bitcoin had tumbled below $76,000, equating to just 15 ounces of the precious metal and marking a 59% drop from its 2021 zenith. Declaring Bitcoin “priced in gold” clarified the long-term bear market’s gravity, Schiff posited that the digital coin was fundamentally unstable compared to gold’s intrinsic worth. This wasn’t mere banter; Schiff’s takedown tapped into decades of criticism, portraying Bitcoin as a fad susceptible to the whims of speculation, while gold stood as a steadfast hedge against fiat currencies and economic uncertainty. His insights added layers to the ongoing debate, inviting readers to consider alternative assets amidst crypto’s chaos, and underscored a divide between those betting on code versus those anchored in commodity-backed security.

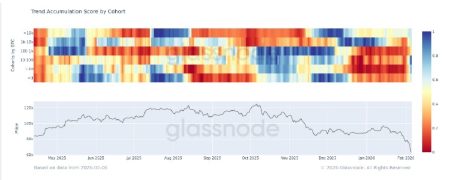

Beyond the op-eds and social media sallies lie subtler indicators that a market bottom might be coalescing, though none as definitive as a sudden uptick. Veteran hedge fund manager Hugh Hendry, known for his candid takes on market cycles, once quipped, “I refuse to pick bottoms—monkeys spend all their time picking bottoms.” His words serve as a prudent caution against mistiming entries based on sensational headlines, such as those from the FT. Yet, Hendry’s commentary acknowledges that some bottoming dynamics are unfolding, even if they’re not orchestrated or predictable. One such sign emerged from the periphery: investor disinterest in Tether, the world’s dominant stablecoin issuer. Late last year, when crypto valuations were soaring, reports suggested Tether was poised to raise $15-20 billion at a staggering $500 billion valuation—a testament to the era’s inflated optimism. But a fresh FT report this week painted a grimmer picture, with investors balking at that price tag. Instead, capital-raising efforts hovered around a скром $5 billion, signaling a shift in sentiment. Tether CEO Paolo Ardoino downplayed the earlier figures as a “misconception,” insisting robust interest persisted at the lofty valuation. Privately, however, concerns bubbled about the firm’s overvaluation, with fluid market conditions hinting that a crypto resurgence could swiftly alter the landscape. These developments—paired with the FT’s onslaught and Schiff’s gold-plated rebuttals—hint at a maturing market, where hype gives way to scrutiny. As history shows, bottoms are often marked by capitulation and fading zeal, setting the stage for recovery. In this crypto crucible, investors are learning the hard way that enduring value demands something more than digital dreams. For now, the bear market grinds on, but whispers of a rebound linger, urging caution and clarity in equal measure. As the dust settles, one thing is clear: the narratives shaping finance are evolving, and critics like Schiff or the FT’s stalwarts may prove prescient guides in navigating the path forward. Whether Bitcoin rebounds to reclaim its highs or fades into obscurity, the conversations sparked this week will echo long after the volatility subsides, reminding us that in the high-stakes arena of finance, skepticism is as vital as innovation. The coming months could redefine cryptocurrencies, purging the excesses and forging a more grounded ecosystem—or they could confirm the skeptics’ bleak predictions. Either way, the drama unfolds, and observers on all sides await the final act with bated breath. Emerging from this turmoil, the crypto space might emerge more resilient, but at a cost measured in trillions lost. Regulatory scrutiny, once an afterthought, now looms large, potentially shaping the industry’s trajectory. Amidst these shifts, individual investors grapple with timeless questions: What truly underpins value in a digital age? As Bitcoin hovers near its lows, with gold shining in contrast, strategies diverge. Schiff’s advocacy for tangible assets resonates, while Saylor’s Bitcoin crusade faces scrutiny. The FT’s essays illuminate these tensions, bridging traditional finance with disruptive innovation. Ultimately, the bear market’s lessons extend beyond price charts, challenging perceptions and probing the psyche of risk. In boardrooms and basements alike, the quest for stability persists, a testament to human ingenuity’s unyielding march.

This week’s developments also spotlight broader economic trends intersecting with crypto’s downturn. As global markets react to inflation lingering from past stimuli and supply chain disruptions, Bitcoin’s volatility exacerbates concerns. Analysts point to the asset’s correlation with tech stocks, which have seen parallel declines, underscoring interconnected risks. Meanwhile, institutional adoption, once hailed as a savior, has faltered with entities like MicroStrategy rethinking exposures. The Ethereum network, too, faces network congestion and energy debates, amplifying calls for sustainable blockchains. Policy discussions in jurisdictions like the U.S. and EU intensify, with lawmakers weighing reforms to curb excesses while fostering innovation. Futures markets, tracking Bitcoin’s derivatives, reveal hedging behaviors that signal enduring pessimism. Against this backdrop, alternative protocols like stablecoins evolve, though Tether’s fundraising hurdles expose vulnerabilities. Venture capital, once crypto’s lifeblood, retracts, favoring traditional tech investments. These dynamics craft a narrative of maturation, where survival depends on utility over hype. As the FT’s critiques echo, investors caution against over-reliance on unproven tech, advocating diversified portfolios. The interplay between digital and traditional assets highlights a pivotal juncture, potentially heralding a more balanced financial ecosystem. Reflections on past cycles, like the 2017-2018 bear market, offer insights, yet unprecedented factors like global events add complexity. Community debates rage on forums and social media, with voices calling for decentralization despite market pressures. Educational initiatives gain traction, as understanding blockchain’s basics becomes crucial. In this crucible of change, the crypto industry’s resilience will be tested, influencing its role in global finance for generations.

Looking ahead, recovery prospects hinge on multiple catalysts, from regulatory clarity to technological breakthroughs. Bitcoin’s halvings, past drivers of bull runs, loom as potential inflection points. Enhanced security protocols and interoperability could broaden appeal, attracting mainstream users wary of volatility. Integration with sectors like gaming and payments signals diversification, evolving beyond speculative trading. Yet, without addressing scalability and environmental critiques, growth remains stunted. The FT’s bearish stance, while influential, contrasts with advocates touting crypto’s democratizing potential in underdeveloped economies. Schiff’s gold-centric view persists, framing Bitcoin as a liability amid currency instability. As markets stabilize, MicroStrategy’s strategy may inspire imitations or serve as a cautionary tale. Tether’s valuation saga underscores the need for transparency in finance. Collectively, these elements weave a tapestry of uncertainty and opportunity, compelling stakeholders to adapt. The bear market’s depths, though painful, catalyze innovations, shaping a future where crypto complements rather than competes with established systems. Observers anticipate a bottom forming through sustained capitulation, paving the path for rediscovery. In journalism’s lens, figures like Kelly and Coben epitomize critical discourse, fostering informed decisions in a speculative arena. As the narrative unfolds, one theme prevails: resilience stems from learning, not repetition of past excesses. The coming inflection may redefine wealth, blending digital prowess with timeless prudence. For now, the crypto saga continues, a testament to finance’s dynamic evolution. Emerging narratives prioritize sustainability, equity, and real-world applications, distancing from fleeting booms. Economic indicators, such as derivative volumes, signal waning fervor, aligning with skepticism’s rise. Gold’s ascent parallels, offering hedges against uncertainty. MicroStrategy’s plight typifies corporate bets on trends, urging diverse approaches. Investors, scarred yet sage, eye horizons beyond headlines. The FT’s essays ignite dialogues, probing value’s essence in virtual realms. Ultimately, the bear market’s crucible forges strength, challenging conventions and inspiring progress.

In retrospect, this week’s crypto recap encapsulates broader societal reckonings with technology’s frontiers. As prices tumble and critiques mount, questions about societal trust in digital systems intensify. Films and literature echo themes of speculative bubbles, humanizing the narrative beyond charts. Community responses vary, from denial to acceptance, reflecting psychology’s role in markets. Educational outreach, from universities to online platforms, equips novices, mitigating risks of future manias. Policy evolutions, spurred by crises, aim for balance, protecting consumers while nurturing innovation. Environmental debates intersect, questioning crypto’s carbon footprint against professed efficiencies. Amid volatility, art and culture interpret the phenomenon, celebrating or critiquing its disruptive allure. Social implications loom large, as crypto enables financial inclusion yet exacerbates inequalities. Reflections draw parallels to historical depressions, where asset collapses spurred reforms. The Tether episode, for instance, prompts scrutiny of stable mechanisms, essential for wider adoption. Schiff’s contrasts evoke Kommendant’s critiques, timeless in their resonance. As cycles turn, adaptability defines winners, with liquidity and strategy as linchpins. The FT’s persistence in objectivity sets a standard, amid echo chambers. In essence, the bear market serves as a mirror, revealing fragilities in untested models. Forward gaze anticipates harmonious integrations, where crypto enhances stability rather than amplifying risks. Professional dialogues bridge divides, fostering collaborative futures. Challenges persist, but so does ingenuity’s spark. Through education and regulation, a paradigm shift emerges, elevating finance towards equity. Tales of resilience, like BitBucket’s legacy, inspire amid slumps. Economists prognosticate recoveries tied to global recoveries, blending macro trends. As bottom signals proliferate, optimism quietly stirs, tempered by wisdom. The journey continues, with lessons etched in screens and strategies.

Concluding this exploration, the crypto downt spiral reveals lessons transcending markets. From FT essays to Schiff’s proclamations, critiques underscore volatility’s perils. MicroStrategy’s missteps exemplify hubris, while Tether’s hurdles highlight valuation controversies. Hendry’s wisdom promotes prudence, avoiding impulsive gambles. Broader themes of sustainability, equity, and integration foreground future discourses. As prices oscillate, underlying narratives shift towards maturity. Regulatory frameworks evolve, guided by precedents and public input. Technological advancements promise efficiencies, yet accountability remains paramount. Cultural reflections enrich understandings, humanizing digital abstractions. In boardrooms and beyond, dialogues prioritize holistic views, balancing innovation with ethics. The bear market, though arduous, catalyzes refinement, heralding resilient ecosystems. Schiff’s gold advocacy contrasts digital fervor, inviting diversified visions. MicroStrategy’s trajectory offers cautionary tales, influencing corporate strategies. Tether’s reevaluation signals market sobriety, amidst speculative halcyon. Collective learning from downturns paves equitable paths forward. Journalism’s role, exemplified by FT’s rigor, ensures informed narratives in tumultuous times. As cycles recur, humanity navigates, blending caution with curiosity. Emerging paradigms envision compromise, where crypto complements realities. Insights from experts foster dialogues, bridging speculative divides. Ultimately, the ongoing saga reminds: true value endures scrutiny, emerging stronger from tempests. In finance’s grand theater, actors learns, evolving towards sustainable symphonies. The bottom, elusive yet inevitable, awaits revelation through time’s lens.