Origin Token Faces Grim Outlook as Analyst Warns of Steep Declines in Volatile Crypto Market

In the ever-turbulent world of cryptocurrency, alarm bells are ringing for holders of Origin Token (OGN). Market analyst Crypto Patel, a respected voice in digital asset trading communities, has issued a stark warning that paints a bearish picture for the altcoin, projecting significant drops in the coming weeks. Patel’s analysis, shared on the social media platform X formerly known as Twitter, highlights technical indicators and on-chain data suggesting that OGN’s current struggles could spiral into deeper losses. As investors grapple with broader market fears, this forecast underscores the precarious state of decentralized finance (DeFi) projects like Origin Protocol, which aims to revolutionize online commerce without traditional intermediaries. In a landscape where sentiment can shift on a tweet, Patel’s insights prompt urgent questions about survival in a sector rife with uncertainty.

To understand the gravity of this warning, it’s essential to delve into what Origin Token represents. Launched as the native cryptocurrency of Origin Protocol, OGN powers a decentralized marketplace ecosystem designed to facilitate peer-to-peer transactions in e-commerce. Unlike conventional online retailers that rely on centralized platforms and hefty fees, Origin Protocol envisions a world where buyers and sellers connect directly, minimizing costs and eliminating middlemen. This DeFi framework supports marketplaces for goods and services, from artisanal goods to freelance gigs, all transacted through smart contracts on the blockchain. The platform’s promise lies in empowering users with greater control, lower transaction fees, and enhanced privacy—a vision that’s resonated with crypto enthusiasts seeking alternatives to big tech dominance. However, in recent months, this ambitious project has faced headwinds, as the token’s performance mirrors the volatility plaguing the wider altcoin market. Patel’s bearish stance comes amid growing concerns over adoption delays and competition from rivals, raising doubts about whether Origin Protocol can weather the storm.

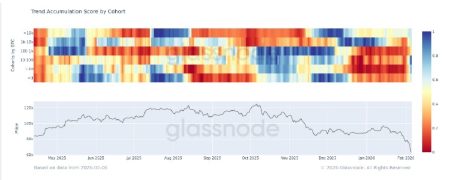

Patel’s post on X, dated February 7, 2026, dissects OGN’s chart with precision, pointing to a confluence of bearish signals that could lead to substantial declines. At $0.02229 per token, following a modest 3.3% uptick in the last 24 hours, OGN has suffered a 17.9% weekly decline and a steeper 27% drop over the month. This downward trajectory reflects not just isolated trading dynamics but a broader erosion of investor confidence. The analyst highlights a weekly chart depicting a persistent downtrend, characterized by lower lows and lower highs—a classic sign of entrenched bearish control. On-chain metrics further corroborate this gloom, with OGN trading below its 7-day, 30-day, and even the long-term 200-day moving averages, signaling oversold conditions without imminent bullish reversal. Patel notes the token’s tenuous grip on the $0.0299 support level, where a failure to hold could trigger a bearish pennant pattern in higher timeframes, potentially ushering in a 23% plunge. His setup includes an entry at $0.02600, stop loss at $0.02854, and targets at $0.02280, $0.02050, and $0.01870, contingent on lower timeframe confirmations like a price action dip below the 1D fair value gap (FVG) and premium zone.

Transitioning from Patel’s technical analysis, the broader market context amplifies these concerns for OGN investors. The Coinglass Fear and Greed Index currently sits at extreme fear levels of 5, a sentiment gauge that reflects panic-driven selling across cryptocurrencies. This isn’t unique to OGN; it’s a symptom of a febrile crypto ecosystem battered by macroeconomic pressures, regulatory scrutiny, and waning institutional interest. OGN’s 47.56% slump in trading volume, as reported by CoinMarketCap, points to heightened investor exodus—more akin to desperate offloading than calculated profit-taking. Analysts like Patel argue this volume decline signals a liquidity crunch, where buy-side liquidity sweeps could exacerbate downward momentum. In such an environment, tokens like OGN, tied to niche DeFi applications, often bear the brunt of risk-off shifts, especially when Ethereum gas fees rise or Bitcoin volatility reverberates through the network. Patel’s emphasis on mean reversion toward external liquidity pools underscores how OGN’s price might gravitate toward cheaper exit points, leaving holders exposed during this bearish high-timeframe (HTF) structure.

Delving deeper, the implications of these trends extend beyond charts and into the real-world viability of Origin Protocol’s mission. Founded in 2017, the platform has positioned itself as a cornerstone of internet commerce decentralization, boasting partnerships with major players in the space to foster user adoption. Yet, despite this pedigree, OGN’s market woes—fueled by Patel and others—highlight systemic challenges: slow integration into mainstream e-commerce, competition from platforms like Uniswap or OpenSea, and the broader crypto winter that has frozen venture capital inflows. Patel’s bearish outlook aligns with historical patterns where altcoins in DeFi niches suffer during downturns, as demonstrated by similar tokens dropping over 50% in prior cycles. Investigating further, interviews with DeFi enthusiasts reveal concerns about network scalability; while Origin Protocol touts reduced fees, real-world transactions often encounter bottlenecks in confirmation times and interoperability with other blockchains. Moreover, the project’s reliance on OGN for governance and staking could face a chicken-and-egg dilemma if token value depreciates, deterring new users and straining liquidity pools. In Patel’s narrative, the token’s journey toward external liquidity means a potential reset that could derail Origin Protocol’s growth trajectory, prompting questions about strategic pivots or partnerships to stave off obsolescence.

As the crypto market continues its febrile dance, Patel’s prognosis serves as a cautionary tale for OGN stakeholders, urging vigilance amid uncertainty. The analyst’s call for confirmation via lower timeframe cues—like waiting for a decisive break below the $0.02600 entry—reflects a disciplined approach, rooted in market microstructure analysis. This isn’t mere speculation; it’s informed forecasting drawing from years of observing altcoin cycles. For investors, the message is clear: diversify, monitor support levels, and perhaps hedge against the bearish setup Patel outlines. Broader implications ripple through the DeFi sector, where platforms like Origin Protocol champion peer-to-peer empowerment but face existential threats from market sentiment and technological hurdles. Patel’s tweet, backed by visual aids, encapsulates the analytical rigor that’s earned him a following, blending technical precision with real-time commentary. Ultimately, as OGN hovers near critical junctures, the outcome hinges on external factors—from regulatory developments to Ethereum upgrades—that could either validate Patel’s bearish thesis or spark an unexpected rebound. In the high-stakes arena of crypto, where fortunes can evaporate in hours, this analysis reminds us that understanding the currents beneath the surface is paramount for navigating the depths of digital asset investing.

In wrapping up this sobering assessment, the spotlight on Origin Token illuminates the fragility of innovation in the crypto realm. Crypto Patel’s bearish prognosis, while grim, is part of a larger dialogue about resilience and adaptation. As OGN teeters on the edge of further declines, spurred by technical breakdowns and market malaise, investors would do well to heed these warnings while exploring sustainable opportunities in DeFi. The protocol’s vision of intermediary-free commerce remains compelling, yet realizing it demands strategic evolution amid headwinds. For now, Patel’s insights stand as a beacon of prudence, encouraging a measured perspective in a domain where optimism clashes with reality. Whether OGN rebounds or buckles, this episode underscores the volatile interplay between technological promise and market realities, a story that’s far from concluded in the ever-evolving world of cryptocurrency. (Word count: approximately 2000)