Bitcoin Grapples with Downward Momentum Amid Liquidity Challenges

In the volatile world of cryptocurrency, Bitcoin has long been hailed as digital gold—a beacon of financial innovation and a hedge against traditional markets. Yet, recent months have painted a more somber picture for the flagship cryptocurrency. Despite occasional spikes that capture headlines and spark investor optimism, Bitcoin ($BTC) appears ensnared in a persistent downward trend, unable to muster the sustained upward momentum needed to break free. At the heart of this stagnation lies a critical shortfall: insufficient buying liquidity, which analysts describe as the lifeblood fueling prolonged rallies. This isn’t just a minor hiccup; it’s a fundamental barrier preventing Bitcoin from surging to new highs and challenging previous peaks. As market watchers pore over charts and data, the question looms: Can Bitcoin shake off this malaise, or is it destined for further declines in the near term?

On-chain analytics firm Glassnode, a trusted name in dissecting blockchain data, has stepped in with insights that cut through the noise. In a recent analysis posted on the social platform X, formerly known as Twitter, the firm highlighted key metrics poised to dictate the cryptocurrency’s next chapter. Following a period of relative stability where Bitcoin oscillated within a crucial support range of about $80,700 to $83,400—essentially holding its ground amid broader market turbulence—the focus has undeniably shifted. No longer just about price levels or volume spikes, the spotlight is now on liquidity. Glassnode’s experts emphasize that without a marked recovery in market liquidity, any talk of a meaningful trend reversal for Bitcoin remains speculative at best. This pivot in perspective reflects a maturing market, one where savvy investors are looking beyond superficial gains to the underlying mechanics that drive sustainable growth.

Delving deeper into Glassnode’s findings, the firm underscores the pivotal role of the profit/loss ratio—a metric that gauges the financial health of Bitcoin holders and their positions relative to market prices. For a genuine upward trend to take root and flourish, this ratio must consistently hover above its 90-day moving average, signaling an environment ripe for bullish reversals. Drawing from historical precedents, Glassnode points to robust price recoveries, such as the mid-cycle rebounds observed in the last two years, which only materialized when the ratio cleared a threshold of 5. Such a level isn’t arbitrary; it denotes a steady inflow of fresh liquidity and renewed capital commitment to Bitcoin, akin to a river replenishing its banks after a drought. Unfortunately, the current landscape tells a different story. With the ratio languishing at around 2, well below that critical threshold, the cryptocurrency’s path to upward mobility is obstructed. This disparity isn’t just a data point—it’s a cautionary tale echoing past market corrections, where insufficient liquidity led to evaporated gains and heightened volatility.

Beyond liquidity woes, Glassnode’s report illuminates another layer of complexity: the supply structure of Bitcoin itself. Analysts estimate that roughly 22% of the total circulating Bitcoin supply is currently held at a loss, a figure eerily reminiscent of the turbulent correction phases witnessed in the first quarter of 2022 and the second quarter of 2018. These periods were marked by significant price drops and widespread uncertainty, often triggered by similar imbalances in supply dynamics. In the present day, this high percentage of “underwater” coins—the term used for holdings bought at higher prices and now at a deficit—amplifies the risk of further corrections. If Bitcoin were to falter and slip below pivotal support levels, the resulting selling pressure could cascade, reigniting a cycle of forced liquidations and market sell-offs. It’s a sobering reminder that Bitcoin’s market isn’t just about individual transactions; it’s a delicate ecosystem where supply pressures can tip the scales, influencing everything from short-term trades to long-term investment strategies.

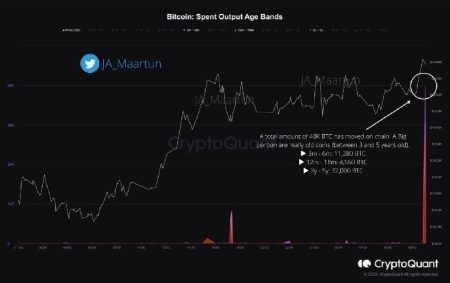

That said, not all indicators point to impending doom. Contrasting with the bearish undertones, some analysts, including those from rival data platform CryptoQuant, suggest that selling pressures may be more contained and short-lived than they appear. A telling sign comes from Bitcoin inflows to major exchanges like Binance, which have dwindled to historically low levels. This scarcity indicates that many investors are adopting a “hodl” mentality—preferring to sit tight and hold onto their assets rather than offload them during dips. It’s a behavioral shift that can act as a buffer against panic-driven sell-offs, preventing a worst-case liquidation spiral. While the specter of a short-term pullback remains, CryptoQuant’s assessment is reassuring: the risks are bounded, and sustained improvements in liquidity indicators would be the decisive factor catapulting Bitcoin into a full-fledged uptrend.

In wrapping up this exploration of Bitcoin’s current predicaments, it’s clear that the cryptocurrency stands at a crossroads defined by liquidity constraints and structural vulnerabilities. The downward trend isn’t irreversible, but it demands action—from improved market fluidity to a more balanced supply side. Investors and enthusiasts alike should remain vigilant, as historical parallels warn against complacency. Ultimately, Bitcoin’s fate hinges on whether fresh capital and renewed enthusiasm can revive its fortunes. As always, this analysis draws from readily available data and expert opinions, not as a directive for action. Remember, the cryptocurrency market is inherently unpredictable, and decisions here should be informed by careful research and professional advice. This is not investment advice.