Cryptocurrency Market Awaits Recovery as Gold Rally Dominates Investor Attention

Tom Lee Predicts Crypto Rebound After Precious Metals Rally Subsides

In an era of volatile financial markets, cryptocurrency investors have faced significant challenges in recent months as digital assets experience continued price declines. However, amidst the market downturn, influential market analyst Tom Lee, head of Bitmine—the largest Ethereum (ETH) treasury company—maintains a resolutely optimistic outlook on the future of cryptocurrencies. His analysis suggests a compelling correlation between precious metals and digital assets that could signal important market shifts in the coming months.

The Interplay Between Precious Metals and Cryptocurrency Markets

During a recent appearance on CNBC’s Power Lunch program, Lee articulated his theory that cryptocurrencies have temporarily been overshadowed by the historic rally in gold and silver markets. “As long as gold and silver continue to rise, there will be a ‘fear of missing out’ (FOMO) on buying them instead of cryptocurrencies,” Lee explained to viewers. This perspective illuminates the complex psychological dynamics driving current investor behavior, as capital flows toward assets demonstrating momentum rather than those experiencing temporary weakness. The current precious metals boom—with gold reaching unprecedented price levels—has captured the attention of institutional and retail investors alike, diverting attention and investment capital away from the digital asset space.

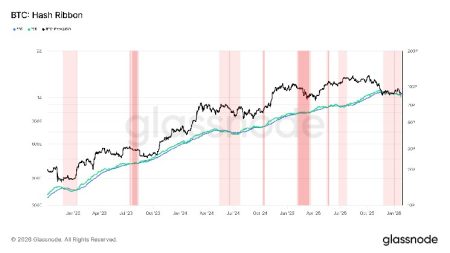

Lee’s analysis draws upon historical market patterns that suggest an important correlation between precious metals and cryptocurrency performance. “Because historically, a decline in the value of gold and silver has led to a subsequent rise in Bitcoin and Ethereum,” he noted during the interview. This observation points to a potential cyclical relationship between traditional safe-haven assets and digital currencies. According to Lee, once the current enthusiasm for gold and silver begins to wane, market participants may redirect their focus toward cryptocurrencies, potentially triggering a significant price recovery. This pattern aligns with previous market cycles where investor capital has rotated between different asset classes as sentiment and momentum shift.

Macroeconomic Factors Driving Cryptocurrency Outlook

Beyond the relationship with precious metals, Lee identified several macroeconomic catalysts that could fuel a cryptocurrency rebound. Specifically, he emphasized that cryptocurrency markets would likely experience upward momentum in scenarios where the U.S. dollar weakens or the Federal Reserve pursues monetary easing policies. These conditions would create a favorable environment for alternative stores of value, including both precious metals and cryptocurrencies. The renowned market bull further suggested that current market conditions are preventing investors from properly evaluating cryptocurrencies based on fundamental factors and technological advancements, implying that digital assets may be significantly undervalued relative to their long-term potential.

The cryptocurrency market has evolved dramatically in recent years, with increased institutional adoption and integration into traditional financial frameworks. Despite this progress, digital assets remain susceptible to market sentiment shifts and macroeconomic conditions. Lee’s analysis suggests that the current focus on precious metals represents a temporary distraction rather than a fundamental rejection of cryptocurrency value propositions. As institutional investors continue developing their approaches to digital asset allocation, the cryptocurrency market stands at an important inflection point where fundamental developments in blockchain technology and financial applications may soon receive renewed attention once the precious metals rally subsides.

Historical Context and Future Implications

Lee’s perspective gains additional credibility when examined within the broader context of cryptocurrency market cycles. Bitcoin and Ethereum have historically demonstrated patterns of significant price corrections followed by substantial recoveries, often coinciding with shifts in macroeconomic conditions and investor sentiment. The current market environment, characterized by high inflation concerns, geopolitical tensions, and monetary policy uncertainty, has created conditions where traditional safe-haven assets like gold and silver have temporarily outperformed. However, this pattern could reverse as market conditions evolve and investors reassess relative valuations across asset classes.

As the head of the largest Ethereum treasury company, Lee maintains a unique vantage point on market dynamics affecting digital assets. His continued bullishness despite recent market challenges reflects a long-term perspective that looks beyond short-term price fluctuations to focus on fundamental value drivers and technological adoption trends. While cautioning that his statements should not be interpreted as investment advice, Lee’s analysis provides a framework for understanding current market conditions and potential catalysts for future cryptocurrency price movements. As precious metals eventually reach price exhaustion and monetary policy continues to evolve, cryptocurrency investors may find themselves positioned for a potential market recovery that reflects the underlying technological and financial innovations driving the digital asset ecosystem forward.