XRP Breaks Critical Support Level as Selling Pressure Mounts in Crypto Market

Market Momentum Shifts as XRP Loses Key $1.93 Support Zone

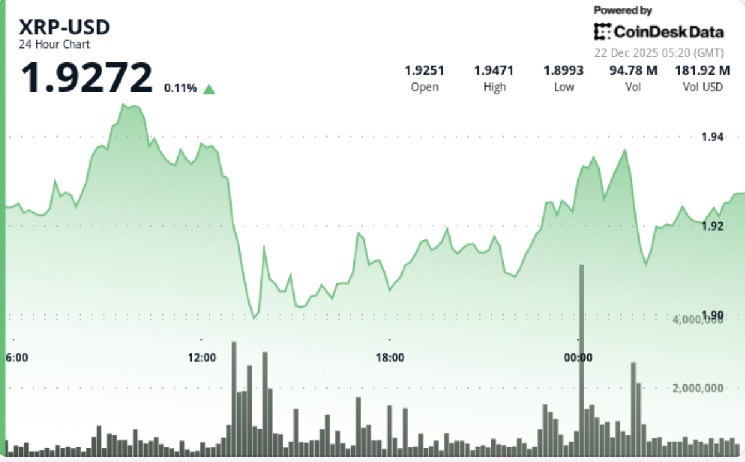

In a significant technical breakdown that has captured the attention of cryptocurrency traders worldwide, XRP broke below its crucial $1.93 support zone late Saturday, signaling a potential shift in market sentiment that could have broader implications for the digital asset. The breakdown occurred with notably elevated trading volume, confirming that sellers have gained the upper hand in what analysts describe as a technically fragile position for the cryptocurrency. This development comes at a time when the broader cryptocurrency market shows mixed performance, with Bitcoin struggling to maintain recent rebounds and large-cap altcoins experiencing selective pressure rather than widespread capitulation.

The movement is particularly noteworthy as it follows a multi-day consolidation period during which XRP traded within a narrow range between $1.90 and $1.95. Market participants had been closely monitoring this consolidation pattern for signs of direction, with the eventual breakdown suggesting that bearish forces have temporarily gained control of price action. “XRP has been vulnerable since losing the psychologically important $2.00 level earlier this month,” noted cryptocurrency analyst Sarah Bergman. “What we’re seeing now is a manifestation of that vulnerability, with repeated rebounds failing to attract the sustained follow-through needed to establish a new uptrend.”

On-Chain Data Reveals Potential Support Vacuum Below Current Levels

Perhaps most concerning for XRP bulls is what on-chain analytics reveal about potential support levels below current prices. Data from blockchain intelligence firm Glassnode indicates that below the $1.77 mark, realized supply—representing the cost basis at which tokens were last moved—thins considerably until approximately the $0.80 area. This $0.80 zone represents a level that previously marked significant accumulation during earlier market cycles, suggesting it could provide substantial support if reached. While such a dramatic decline remains a longer-term scenario rather than an immediate expectation, the loss of intermediate support at $1.93 has increased sensitivity to downside extensions.

The technical breakdown occurred most decisively around 13:00 UTC, when the price slid to $1.897 on volume of approximately 93.8 million tokens—a significant 78% above the 24-hour average trading volume. This surge in selling activity effectively transformed the former support zone into a new resistance level, confirming the failure of the prior consolidation structure that had been forming. Hourly chart analysis reveals XRP trading below its short-term moving averages, with momentum indicators rolling over rather than showing bullish divergence patterns that might signal a potential reversal. The cryptocurrency’s inability to quickly recapture the $1.93 level keeps the near-term bias tilted toward further weakness.

Price Action Details Reveal Active Selling Rather Than Liquidity Issues

A detailed examination of XRP’s price action reveals that over the 24-hour period ending December 22 at 02:00 UTC, the cryptocurrency fell from $1.926 to $1.915. Prior to the breakdown, price had briefly spiked to $1.95 earlier in the session before reversing sharply, with a late-session push lower driving XRP down to $1.907 during the final hour of the period. What particularly concerns technical analysts is that volume accelerated into the breakdown rather than fading, suggesting active selling pressure rather than simply thin market liquidity causing exaggerated price movements. Despite some opportunistic dip-buying emerging near the $1.90 level, subsequent rebounds lacked convincing momentum, and price repeatedly failed to re-enter the prior trading range.

“What we’re seeing isn’t panic selling, but rather a calculated distribution pattern,” explained Marcus Johnson, chief market strategist at Digital Asset Research. “The volume profile during this breakdown suggests institutional positioning rather than retail capitulation, which typically exhibits different characteristics. This methodical selling against resistance is more concerning than a volume spike that quickly reverts.” Johnson’s observation aligns with broader market dynamics, where smart money often positions ahead of retail traders during transitional market phases.

Critical Levels Traders Should Monitor as XRP Enters Technical Uncertainty

For traders navigating this technically challenging environment, several key price levels have emerged as critical markers for potential future movement. The $1.93-$1.95 zone now functions as a resistance band following the breakdown, with any sustainable recovery requiring a decisive move back above this range. Meanwhile, the $1.90 level represents the first defensive position bulls must maintain to prevent accelerated follow-through selling. Should selling pressure continue and push XRP below $1.77, on-chain data suggests a potentially rapid decline could follow, with limited structural support until the approximately $0.80 range where significant historical accumulation occurred.

Market participants should recognize that any credible recovery attempt would require not just a temporary push above resistance, but a fast reclamation of the $1.93 level accompanied by rising volume to neutralize the current bearish technical setup. In the absence of such a recovery, XRP remains in what technical analysts describe as a vulnerable position, with sellers controlling rallies and buyers demonstrating limited conviction at higher levels. As cryptocurrency markets continue to mature and institutional participation increases, such technical breakdowns often provide valuable insights into potential future price direction beyond mere short-term fluctuations. For now, XRP bulls face the challenging task of defending current prices while rebuilding market confidence that was damaged during Saturday’s technical breakdown.

![Standard Chartered Cuts Bitcoin and Ethereum Forecasts, Predicts Bottom by [Date] at $[Price]](https://commstrader.com/wp-content/uploads/2026/02/3f2a2e40b5435ea86ade84c25b7ee76c02e7fe3c-450x300.jpg)