Holiday Scammers Hit New Yorkers Hard During Christmas Season

In the bustling heart of New York City, Toni Campbell’s holiday spirit was crushed when she opened a FedEx package that should have contained $200 Beats by Dre Powerbeats Pro earbuds for her teenage nephew’s Christmas gift. Instead, the 63-year-old Queens native discovered 500 sheets of ordinary printing paper. “I was, like, ‘Wait! My stuff isn’t in here,'” Campbell recalled, describing the moment she realized she’d been scammed. Her colleague, Marife Garcia, confirmed her fears with a devastating response: “Oh my God, they scammed you!” The words sent Campbell into a state of physical distress, joining the growing ranks of New Yorkers victimized by holiday fraudsters. “I work hard for my money, and I don’t have another $200 to buy a second pair of earbuds,” Campbell lamented, expressing a sentiment that resonates with countless Americans struggling to maintain their holiday cheer in the face of increasingly sophisticated scams. Despite reaching out to the third-party vendor 6AVE Electronics (which sold through Walmart.com), as well as Walmart and FedEx, Campbell has yet to receive a refund for her purchase, casting a shadow over her holiday season.

The problem extends far beyond New York’s borders, though the Empire State has become a hotbed for fraudulent activity. According to Federal Trade Commission data, New York recorded 140 quarterly fraud reports per 100,000 residents over the past three years, with a staggering 336,894 fraud claims issued throughout the state since 2021. Victims lost a median of $553.77 per report—6% higher than the national average of $522.55. As Darius Kingsley, head of consumer fraud and scam prevention at JPMorganChase, explains, “Scammers are especially active during the holidays, using tactics like fraudulent travel offers, fake delivery notifications, and deceptive charity appeals to exploit the holiday season and people’s generosity.” The timing couldn’t be worse for victims like Campbell and Garcia’s colleagues, who are simply trying to reward their loved ones during the festive season. “These scammers and thieves don’t think about the lives they’re impacting when they commit fraud,” Garcia told The Post. “It’s inhumane, unethical and a form of disrespect.”

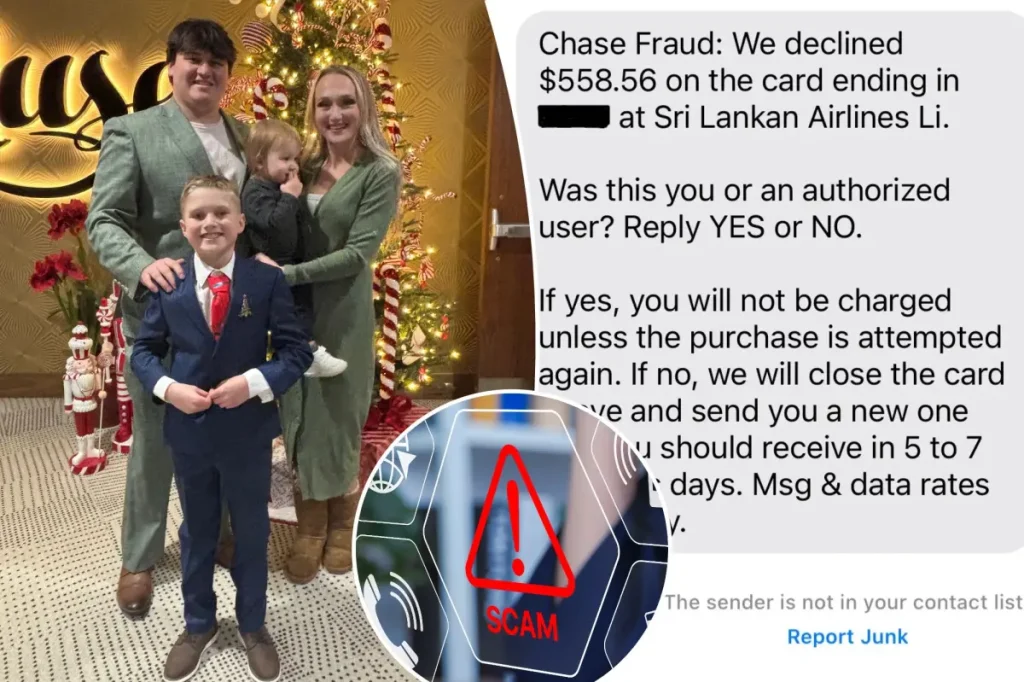

The tactics employed by these holiday Grinches vary widely, as illustrated by Vanessa Tingey’s experience in Orlando, Florida. The 28-year-old mother thought she’d discovered an amazing deal when she found Owala water bottles—typically priced around $40—selling for just $14 online. Excited to purchase one as a Christmas gift for her daughter, Tingey entered her credit card information without realizing she was on a fraudulent website with an extra “a” at the end of the Owala domain name. Days later, she received Chase Bank alerts for a $500 fraudulent purchase with Sri Lanka Airlines. “I was so scared. I was panicking,” Tingey recounted, explaining how she immediately contacted her bank to cancel the card and transaction. Fortunately, she didn’t lose any money, but the experience shook her confidence. “Money is tight. We’re on a budget, and being that it’s the holidays, the budget is already stretched,” she admitted. “I was just a little bit too trusting and too eager for a sale. That’s how they get you.”

Another holiday nightmare unfolded for Rhonda Hadden, a single mother of three from San Antonio, Texas. Despite not having shopped at Walmart in weeks, Hadden received a bank notification alerting her to an in-store purchase of two $150 gift cards made with her debit card in Hollywood, Florida. “A scammer was able to log into my Walmart account and make purchases by scanning a QR code linked to my account and make a $313 transaction,” explained the 33-year-old marketing professional. When she attempted to resolve the issue by contacting the Florida store and Walmart headquarters, Hadden claimed she was given the runaround, with customer support refusing to escalate her case to supervisors. A Walmart spokesperson advised that customers should contact their bank in such situations and update passwords on all online accounts where payment information is stored. Hadden has filed a police report and awaits investigation results, but the financial impact has been significant. “I have three daughters under age 13, one who has severe health issues, and two who still believe in Santa Claus,” she shared. “That $300 may not seem like a lot to some people, but it is a lot of money when you’re living paycheck to paycheck in this economy.”

Travel scams have also marred the holiday season for families like Star Friisval’s, whose 9-year-old son was promised a special Christmas gift: a round-trip flight from Wisconsin to visit family in Arizona. Friisval, a 28-year-old stay-at-home mother of two, discovered what appeared to be a great deal on Trip.com, an online global travel agency she’d learned about through TikTok. She purchased tickets for her family at $1,097.14—considerably less than the $1,400 quoted on airline websites. However, mere seconds after completing the transaction and downloading the company’s app, she received notification that her flight had been canceled. Despite spending hours on the phone with customer service representatives seeking a full refund, Friisval has only received $140.17 back. “With the funds not being issued back before Christmas, we’re unable to buy anything to replace his present now,” she lamented. The emotional toll has been heavy: “My son has grown up knowing that Santa and parents work together on big gifts like this, so he doesn’t understand why Santa’s magic failed.”

As these heartbreaking stories demonstrate, holiday scammers show no mercy in their pursuit of ill-gotten gains. Security experts like JPMorganChase’s Kingsley offer several crucial tips to avoid becoming victims: be wary of online deals that seem too good to be true; verify website URLs (ensuring they begin with “https://”); use credit cards for purchases to enable dispute options; and utilize digital tools like Chase Credit Journey, which offers free credit and identity monitoring. Additionally, consumers should thoroughly research unfamiliar retailers by searching their name alongside terms like “scam” or “complaints,” and remain on trusted platforms when completing transactions. As Friisval advises from her painful experience, “Triple-check the websites you’re patronizing. While it may cost more to book flights, hotels and rent cars directly from a source rather than a third-party site, it’s your safest option to ensure you don’t fall victim to this.” In a season meant for joy and generosity, vigilance has become an essential companion to holiday spirit, as Americans work to protect themselves and their loved ones from those who would exploit the most wonderful time of the year.