Zhao Sets Record Straight: Binance Founder Addresses Rumors Following Dubai Conference

Cryptocurrency Leader Clarifies Personal Boundaries in Era of Social Media Scrutiny

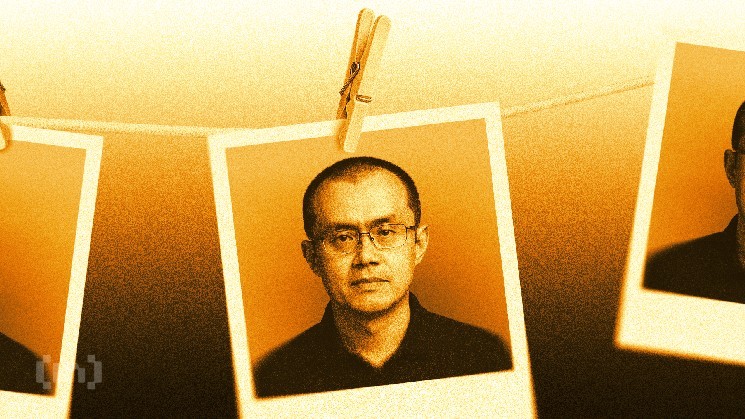

In the fast-moving world of cryptocurrency, where market fluctuations can happen in seconds, information—and misinformation—travels just as quickly. Binance co-founder Changpeng “CZ” Zhao recently found himself addressing not market volatility or regulatory challenges, but personal rumors that spread rapidly through the crypto community following his appearance at Binance Blockchain Week in Dubai.

The speculation began on December 4th during a high-profile debate where Zhao squared off against proponents of gold as an investment vehicle. What should have been a discussion focused on financial theory and cryptocurrency’s place in modern investment portfolios quickly gave way to social media buzz when observers noted a brief interaction between Zhao and a female Key Opinion Leader (KOL) attending the conference. Within hours, crypto Twitter and various social media channels lit up with unsubstantiated claims about a potential romance between the industry titan and the influencer.

“It’s unfortunate that we live in a time where professional interactions are so easily mischaracterized,” said an industry analyst who requested anonymity due to professional relationships with Binance. “The cryptocurrency space already faces enough challenges regarding misinformation about the technology itself. When personal rumors enter the equation, it further distracts from the important innovations and developments happening in blockchain.”

Leadership in the Public Eye: The Challenges of Cryptocurrency Fame

The incident highlights the unique position cryptocurrency leaders occupy in today’s digital economy. Unlike traditional finance executives who often maintain low public profiles, blockchain pioneers like Zhao frequently engage directly with their communities through social media, public conferences, and informal gatherings. This accessibility, while valuable for building trust in a relatively new industry, comes with the downside of intense personal scrutiny.

“Cryptocurrency founders face a level of public exposure that’s unprecedented in financial history,” explains Dr. Miranda Collins, who studies leadership and public perception at Georgetown University. “Before social media, banking executives weren’t expected to be constantly accessible to their customers. Today’s blockchain leaders are not just business executives but cultural figures who must navigate both professional responsibilities and public curiosity about their personal lives.”

The rumors surrounding Zhao are particularly notable given his reputation for maintaining professional boundaries and focusing relentlessly on business objectives. Throughout Binance’s meteoric rise to become one of the world’s largest cryptocurrency exchanges, Zhao has generally kept discussions centered on technology, market developments, and regulatory compliance rather than personal matters. His quick move to address and dismiss the recent speculation aligns with this pattern of maintaining clarity and focus.

Dubai’s Growing Role in Global Cryptocurrency Conversations

The setting of this incident—Dubai’s Binance Blockchain Week—is itself significant in understanding the evolving cryptocurrency landscape. The United Arab Emirates has positioned itself as a forward-thinking hub for blockchain technology and digital asset businesses, with Dubai particularly aggressive in courting industry leaders and innovative companies. The conference represented not just a gathering of enthusiasts but a strategic business forum in a region increasingly central to cryptocurrency’s global development.

“Dubai has created a regulatory framework that offers clarity many cryptocurrency businesses find attractive,” notes financial technology consultant Samira Al-Jabri. “Events like Binance Blockchain Week aren’t just conferences—they’re statements about where power and influence in this industry are consolidating. The UAE understands that early regulatory clarity can translate to economic advantage as blockchain technology matures.”

The debate that sparked the rumors—focused on cryptocurrency versus gold as a store of value—represents one of the fundamental conversations within financial circles today. Traditional investors often point to gold’s millennia-long history as a stable asset, while cryptocurrency advocates highlight digital assets’ portability, divisibility, and independence from physical storage requirements. That substantive economic discussion was temporarily overshadowed by personal speculation underscores how the cryptocurrency community sometimes struggles to separate personalities from the technologies they represent.

Social Media’s Double-Edged Sword for Blockchain Pioneers

For figures like Zhao, social media presents both opportunity and risk. Platforms like Twitter (now X) allow direct communication with users, investors, and developers—a significant advantage when building trust in new financial technologies. However, these same platforms accelerate the spread of rumors and can quickly transform innocent interactions into supposed scandals.

“We’ve observed how cryptocurrency leaders use social media differently than traditional executives,” says Dr. Collins. “There’s an expectation of authenticity and accessibility that’s unique to this space. But that accessibility comes with risk—every comment, like, or interaction becomes potential fodder for speculation. The line between professional and personal becomes incredibly blurred.”

Zhao’s quick response to quash the rumors demonstrates an awareness of how damaging unchecked speculation can be in an industry where trust and reputation are paramount. Cryptocurrency exchanges like Binance depend on user confidence—not just in their technology but in their leadership. Allowing rumors to proliferate unchecked could potentially undermine that trust at a time when regulatory scrutiny of the industry is already intense.

Moving Forward: The Evolution of Cryptocurrency Leadership

As the cryptocurrency industry continues its march toward mainstream adoption, its leaders face evolving challenges. The pioneers who built blockchain businesses from nothing must now navigate the responsibilities that come with managing multibillion-dollar enterprises under regulatory spotlights. Personal conduct, professional relationships, and public perception matter in ways that weren’t considerations in the industry’s early days.

“What we’re witnessing is the maturation of not just a technology but a leadership culture,” explains financial historian Dr. Jonathan Weber. “The cryptocurrency world began as a somewhat counterculture movement, resistant to traditional financial norms. As it integrates with the broader economy, its leaders are experiencing the same scrutiny that executives in banking, technology, and other public-facing industries have long dealt with.”

For Zhao and other cryptocurrency founders, this evolution means balancing transparency and accessibility with appropriate personal boundaries. It means recognizing that their actions—even innocuous ones like conversing with colleagues at conferences—may be scrutinized and potentially misinterpreted. Most importantly, it means understanding that leadership in this space is about more than technical innovation or business acumen—it’s about modeling the values that will shape how digital assets integrate into the global economy.

As the dust settles on this brief controversy, the cryptocurrency community returns its focus to the substantive questions that drove the Dubai conference: the role of digital assets in modern portfolios, regulatory developments across global markets, and technological innovations that continue to reshape how value moves around the world. These substantive discussions, rather than personal rumors, represent the true heartbeat of an industry still defining its place in the financial landscape.