From Ballet to Billions: The Rise of the World’s Youngest Self-Made Female Billionaire

Luana Lopes Lara’s journey from a rigorous ballet school in Brazil to becoming the world’s youngest self-made female billionaire at age 29 reads like an extraordinary tale of perseverance and vision. Alongside co-founder Tarek Mansour, she has built Kalshi, a prediction market platform now valued at an astonishing $11 billion, making them both billionaires almost overnight. The company’s meteoric rise has seen its valuation increase more than fivefold in less than six months, with each founder now worth an estimated $1.3 billion thanks to their respective 12% ownership stakes. This remarkable achievement has placed Lopes Lara ahead of previous record holder Lucy Guo of Scale AI, who had only recently taken the title from Taylor Swift.

Long before she was disrupting financial markets, Lopes Lara was enduring what she calls the “most intense years of her life” at the Bolshoi Theater School in Brazil. The training was brutal—ballet teachers would hold lit cigarettes under her extended leg to test her endurance, while fellow dancers sabotaged each other by hiding glass shards in shoes. Her days were grueling: academic classes from 7 a.m. to noon followed by ballet from 1 p.m. until 9 p.m. Yet despite this demanding schedule, Lopes Lara, inspired by her math teacher mother and electrical engineer father, found time to excel academically, winning gold at the Brazilian Astronomy Olympiad and bronze at the Santa Catarina Mathematics Olympiad. After high school, she performed professionally as a ballerina in Austria for nine months before trading her pointe shoes for a computer science degree at MIT, where her path to entrepreneurship would truly begin.

At MIT, Lopes Lara met her future business partner Tarek Mansour, a Lebanese student who had taught himself English while studying for the SATs. Their friendship blossomed when Mansour began sitting next to her in computer science classes, drawn to her front-row determination and intelligence. The business idea that would change their lives came during walks home from their internships at Five Rings Capital in New York City in 2018. They observed that most trading happens when people have views about future events but lack direct ways to trade on those predictions. “We saw that most trading happens when people have some view about the future, and then try to find a way to put that in the markets,” Lopes Lara explained. This insight led them to create Kalshi, a platform allowing users to bet directly on the outcomes of elections, sports games, and other events, rather than indirectly through traditional markets.

The path from concept to billion-dollar business was fraught with challenges. After being accepted to Y Combinator in 2019, the young founders faced a daunting regulatory landscape. When they realized they needed federal approval, they approached over 40 law firms, all of which declined to help due to the founders’ youth and the company’s small size. “Right out of college, we were taking on an insane amount of risk. It was two years without a single product—nothing launched—and if we didn’t get regulated, the company would just go to zero,” Lopes Lara recalls. The situation was made more challenging by their separation during the pandemic—she was in London while Mansour was in Beirut, where he experienced the devastating port explosion, working on Kalshi by night while helping with recovery efforts by day. Their breakthrough came when former CFTC official Jeff Bandman agreed to help them navigate the regulatory process, leading to Kalshi receiving CFTC approval in November 2020 to operate as a designated contract market—setting them apart from competitors operating without federal regulation.

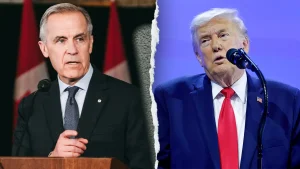

Even with this crucial approval secured, regulatory battles continued. In a bold move that worried investors, Lopes Lara proposed suing the CFTC when the agency rejected Kalshi’s election contracts ahead of the 2024 U.S. presidential election, claiming they resembled gambling. The gamble paid off when a U.S. District Court judge ruled in Kalshi’s favor in September 2024, making history as the first regulated election contracts in the U.S. in over a century. “We really wanted to do things the right way because our vision was to build the biggest financial exchange in the world,” Lopes Lara explained. “Doing it legally was something we couldn’t compromise on.” The platform’s users subsequently bet more than $500 million on the presidential candidates, correctly predicting Donald Trump’s victory a month before election night. This legal victory helped fuel Kalshi’s explosive growth, with crypto-focused venture capital firm Paradigm leading a $1 billion funding round that included heavyweight investors like Sequoia Capital, Andreessen Horowitz, and Y Combinator.

Today, Kalshi is expanding rapidly, with trading volumes exceeding $1 billion weekly and partnerships with major companies including the National Hockey League, Robinhood, Webull, and blockchain platform Solana. The company’s notional trading volume jumped eightfold between July and November 2024, reaching $5.8 billion. While regulatory challenges persist, particularly from states taking legal action against Kalshi’s sports contracts, investors remain confident in the founders’ ability to overcome these hurdles. As Y Combinator partner emeritus Michael Seibel, who has invested in over a thousand companies, puts it: “I don’t know that we have funded a company that has as much potential impact on the world as this one.” For Lopes Lara, whose ballet training taught her “persistence with grace” and the ability to push through adversity, this may be just the beginning of an even more remarkable journey.