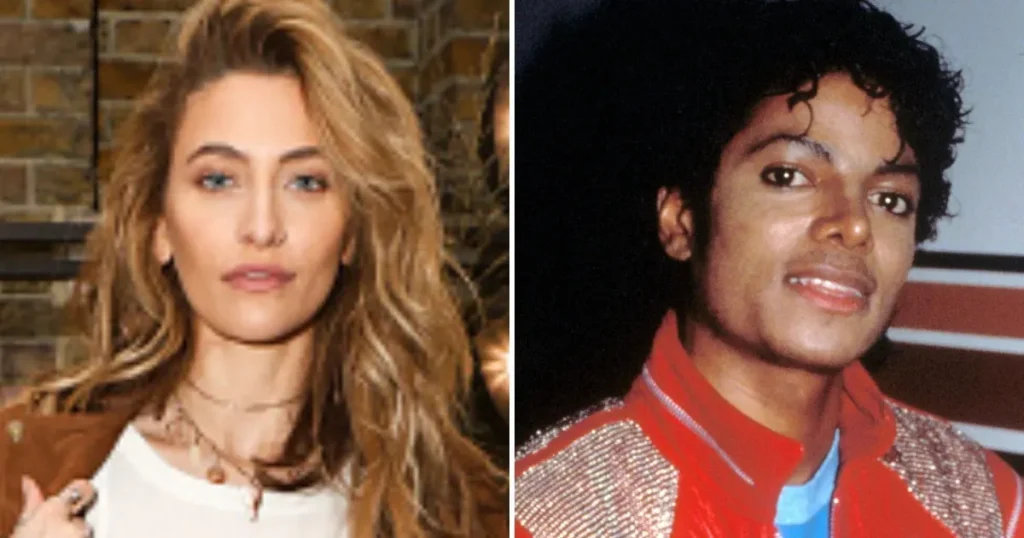

Paris Jackson’s Legal Battle Against Father’s Estate Executors Continues Despite Court Setback

In a determined stance against what she perceives as financial irregularities, Paris Jackson, daughter of the late King of Pop Michael Jackson, has vowed to continue her legal fight against her father’s estate executors despite a recent court setback. The 27-year-old’s petition, which raised concerns about “irregular payments” being made by executors John Branca and John McClain, was largely struck down by Los Angeles Judge Mitchell L. Beckloff on November 10. The dismissal was primarily based on procedural issues, as the court determined that Paris’s claims could not legally target the estate’s own court filings under California’s anti-SLAPP statute, which protects against retaliatory lawsuits. Undeterred by this ruling, Paris’s spokesperson made it clear that she believes significant red flags exist regarding the executors’ behavior and confirmed that an updated filing would be submitted shortly, emphasizing her commitment to ensuring fair treatment for her family.

The heart of Paris’s concerns lies in what she describes as exploitation of her father’s estate by a small group of lawyers who she alleges have been skimming money in “plain view.” Earlier this year, she formally accused the executors of financial misconduct and requested that the court order them to submit detailed documentation of legal fees paid to third-party firms from 2019 to 2023 for her review. Paris also sought a court order that would allow the executors to make only partial payments until invoices receive court approval. As one of the primary beneficiaries along with her brothers Prince and Bigi, Paris stated that her petition was filed “to protect the rights and interests” of all beneficiaries. This represents a significant challenge to Branca and McClain, who as estate executors maintain full control over Michael Jackson’s finances, business deals, and family payments since the pop icon’s tragic death at age 50 in 2009.

The legal documents filed by Paris’s attorney highlight specific concerning practices, particularly what are described as large sums being paid as “gifts to Counsel.” The filing points to a “profound delay in seeking Court approval for extraordinary fees and costs,” and a “lack of oversight with regard to large non-contractual payments Counsel bestowed upon themselves.” Most troubling to Paris and her legal team are alleged payments of $125,000 and $250,000 described as “gifts” to counsel, which her attorney argues “no client would give such gifts to her lawyers out of her own pocket.” The petition further claims that these payments were made despite the beneficiaries having “long ago objected to the practice,” and suggests the counsel was “less than forthcoming in their belated disclosures” about these transactions, which Paris believes constitute “red flags” at minimum.

The dispute comes against the backdrop of Michael Jackson’s enormous legacy and the transformation of his estate from one reportedly burdened with hundreds of millions in debt at the time of his death to what is now described as “a powerhouse and a force in the music business.” The executors have vigorously defended their management, countering Paris’s claims by asserting that their business acumen has vastly benefited the beneficiaries, including Paris herself, who they claim “received roughly $65 million” in benefits. In their filing, the executors suggested that Paris “would have never received that had the Executors followed a typical playbook for an estate like this one in July 2009,” implying that their unconventional management approach has actually increased the estate’s value significantly over what would have otherwise been expected.

This legal battle unfolds fifteen years after the shocking death of Michael Jackson, who succumbed to cardiac arrest associated with a lethal dose of propofol, a powerful sedative administered by his physician Conrad Murray, who was subsequently convicted of involuntary manslaughter. The passage of time has done little to simplify the administration of Jackson’s complex estate, which continues to generate substantial revenue through various business ventures, music royalties, and licensing deals. While Paris acknowledges the estate’s success, her petition suggests that this prosperity may have come with insufficient oversight and accountability, particularly regarding payments to legal representatives who play crucial roles in managing her father’s posthumous business affairs.

The dispute between Paris Jackson and the estate executors highlights the complex challenges that can arise when managing high-value celebrity estates, especially when the beneficiaries reach adulthood and begin to assert their own oversight. While Judge Beckloff’s ruling has temporarily slowed Paris’s legal efforts, her determination to pursue the matter reflects a deep commitment to honoring her father’s legacy by ensuring transparency and proper administration of his estate. As she prepares her updated filing, the case draws attention not only to the specific financial concerns she has raised but also to broader questions about accountability in estate management and the rights of beneficiaries to question the actions of executors, even when those actions have arguably produced favorable financial outcomes. For Paris, this fight appears to be as much about principle as it is about finances – a quest for transparency that she believes would align with her father’s wishes for his children’s financial security and well-being.